Author: SoSo Value

The market has become unpredictable again.

On one hand, ETH price has neither significantly risen nor fallen, leaving investors restless; on the other hand, worrying news headlines keep appearing - "23 billion dollars worth of ETH is queuing for redemption, this is the largest selling pressure in history!" Panic spreads quickly. It's like being in a theater where lights start flickering and audience members in the front rows begin to leave. You start wondering: "Is this performance about to collapse? Should I exit too?"

But don't rush. Before impulsively pressing the "sell" button, let's calmly and carefully investigate, returning to the most basic questions: Who exactly is selling? More importantly, who is buying? Once you see both sides' cards, you'll realize this isn't a panic-driven sell-off - but a potential reshuffling of a game that might determine the future.

Step 1: Sellers - Who is Selling ETH?

Recent massive ETH selling pressure comes from three aspects:

- Early investors cashing out profits: As ETH hit new highs, many long-term holders decided to cash in gains and reduce positions.

- Large-scale redemption by on-chain stakers: Since the Shapella upgrade allowed more flexible ETH withdrawals, large amounts of previously locked tokens have entered circulation, with some being sold.

- Institutional and whale portfolio rebalancing at high points: Some institutions and large accounts sold at recent highs, moving to other assets or speculative arbitrage.

- Largest sales and primary addresses

- In July 2025, a significant sell-off occurred at the renowned institution Trend Research: Within 24 hours, they sold 69,946 ETH (approximately $218 million), including a block sale of 21,000 ETH (around $67 million). Even after the sell-off, the Trend Research wallet still held 115,187 ETH, indicating this was a portfolio rebalancing or staged profit-taking, not a "complete sell-off".

- Another major seller was a whale account (selling 40,000 ETH worth approximately $127 million, sent to Kraken exchange). In July, institutional and whale account total sales exceeded $374 million.

- The Ethereum Foundation was also suspected of selling, but they clarified that part of the sale was actually conducted by the non-profit organization Argot Collective supporting Ethereum infrastructure, who sold 1,210 ETH as development funding.

- Selling characteristics and process

- Most sales come from institutions and whales, typical "one-time settlement" profit-taking, not blind panic selling.

- Most sold ETH flows to CEXs (like Kraken, Binance), with some quickly absorbed by new capital and ETF demand.

- The actual situation is that whales and institutional investors buy and sell at high and low points simultaneously, taking profits on one side and building long-term positions on the other. Key insight: This redemption wave is a normal phenomenon in the mid-bull market, essentially optimizing and consolidating investor structure.

Step 2: Who is Buying? Wall Street's New "Pipeline" Inflow

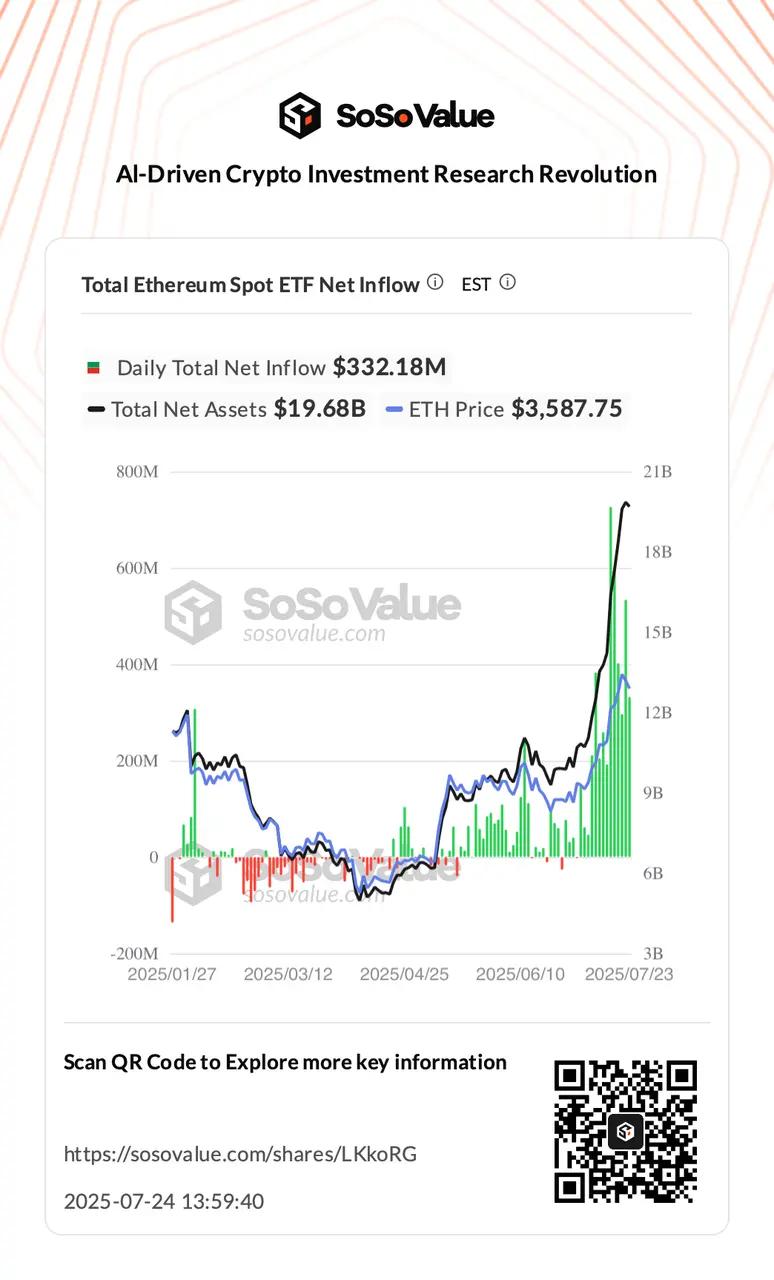

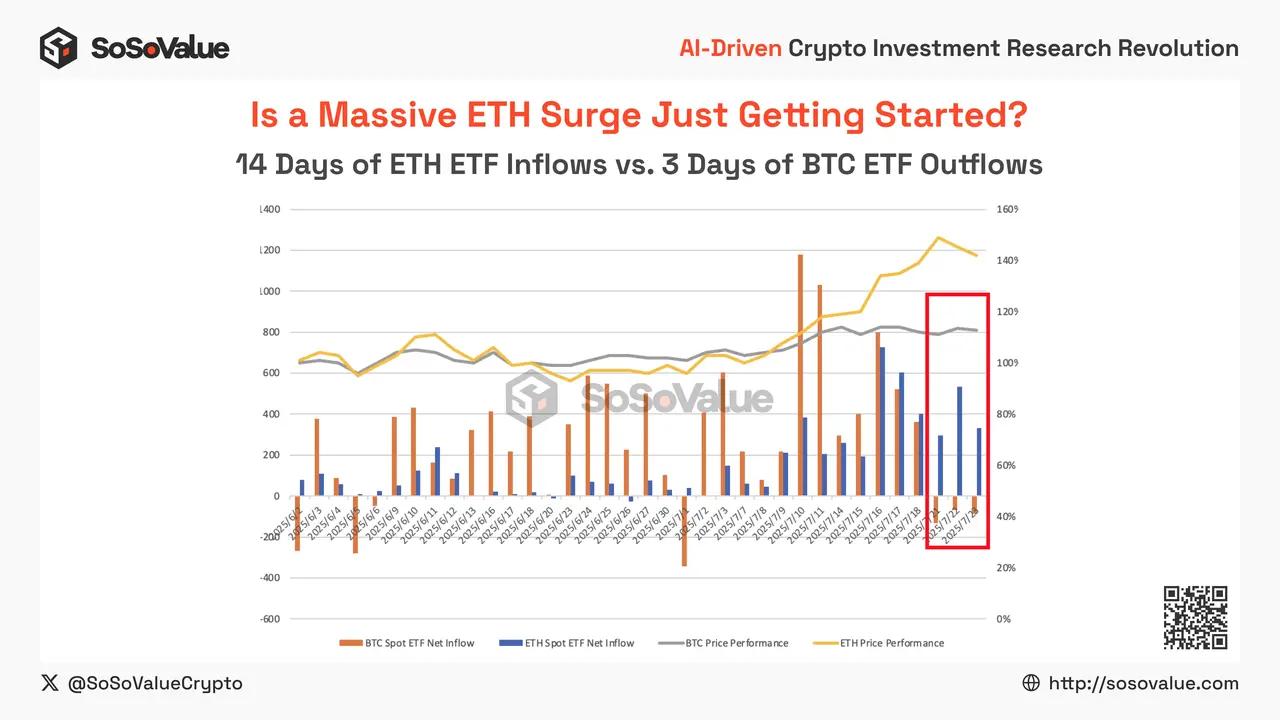

As "old money" exits, who will become the new major buyers? The answer is: Wall Street - specifically, Ethereum spot ETFs.

If the cryptocurrency market is a pond, Ethereum spot ETFs are like a newly built massive pipeline directly connecting it to the global capital (traditional finance) ocean. Since launch, US spot Ethereum ETFs have attracted $8.32 billion in net inflows, currently holding over 4.4% of ETH circulation. BlackRock's iShares Ethereum ETF (ETHA) alone holds over 2.2% of total ETH supply.

Statistical data shows ETH ETF fund flows have high independence: even during market turbulence when Bitcoin ETFs experience outflows, ETH ETFs continue steadily attracting funds like a magnet.

This divergence sends a strong signal: ETH investments are not passive or trend-driven, but strategically allocated after careful consideration.

Just like stock investors selectively buy the second-largest blue-chip stock (Ethereum) when the index leader (Bitcoin) fluctuates, institutions are acknowledging ETH's unique value as "digital oil" and a decentralized platform.

Another major purchasing power driving ETH's rise comes from savvy listed companies and institutional "whales". These investors no longer view ETH as a speculative trading tool, but as a productive asset generating returns and incorporated into balance sheets. Corporate finance directors now ask: "How much stable revenue can ETH bring me?" instead of "How high can the price go?" - marking a clear shift towards value investing.

When companies start converting part of their balance sheets to ETH, it signifies ultimate industry recognition of ETH's value. This is more meaningful than short-term speculation.

Key Insight: Wall Street's "smart money" is establishing structural long positions through ETFs and capital firms. This fund inflow is stable, independent, and strong, forming robust value support for ETH.

Step 3: Validator Exit Interpretation - Changing of "Major Shareholders"

The next clue lies in Ethereum's network core: validator dynamics. Recently, a record number of validators joined the exit queue, raising concerns about massive core participant departures. But is this truly a sign of "everyone running"?

Let's look from another perspective. Imagine the most popular restaurant in town is always packed, with people queuing outside. When early diners finish and leave, freeing up tables, does this mean the restaurant is failing? Of course not; it just means others finally have a chance to enter! Current validator changes are like this popular restaurant's "table turnover rate".

- As of July 23rd, about 519,000 ETH (approximately $1.92 billion) is queued to exit the network (the largest queue since January 2024), with withdrawals facing over 9 days delay.

- Andy Cronk (co-founder of staking provider Figment) says: "When prices rise, people unstake and sell to lock in profits. We've seen retail and institutional investors repeat this in multiple cycles." He further notes that large institutions changing custodians or wallet technologies might also trigger unstaking.

- Despite this, market pressure isn't significant - new validator demand is also strong, with 357,000 ETH (around $1.3 billion) waiting to join, with validator entry queue reaching the longest wait time since April 2024 (6 days).

- Some new demand might come from ETH treasury funds; SEC clarification that staking is not illegal has further sparked institutional interest.

- Since late May, active validator numbers increased by 54,000, reaching nearly 1.1 million record.

"Exit" (validators in withdrawal queue): Mainly early investors or venture capitalists locking profits after years of investment - planned "investment returns", not panic selling.

"Entry" (validators in activation queue): 357,000 ETH queued to join - new, determined long-term capital wanting to "take the relay baton", optimistic about Ethereum's future.

Key Insights: This is not a one-way "run", but a benign shareholder transfer. Short-term speculators are transferring chips to long-term value investors, thereby optimizing network participation and laying a more solid foundation for Ethereum's next phase of growth.

In-Depth Analysis: The Three Engines of ETH Value

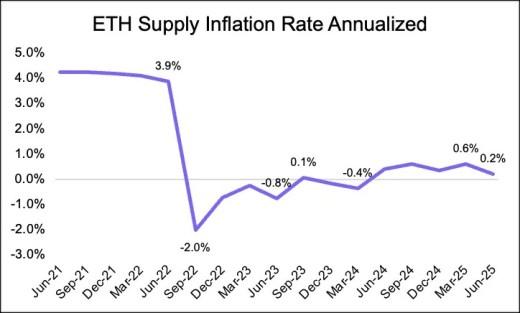

Engine One: The Value Magic of Deflationary Mechanism

Since the EIP-1559 upgrade, a portion of the base fee for each transaction is automatically burned. With the surge in network activity, the amount of ETH burned exceeds the issuance, leading to ETH deflation and continuous reduction in supply. Unlike fiat currency (with easily uncontrolled issuance) and Bitcoin (with a fixed cap), ETH's deflation creates a stronger value anchor. The community jokingly calls it "ultrasound money": ETH's scarcity is increasingly enhanced, and the purchasing power and value storage capacity of each ETH are growing.

Engine Two: On-Chain Staking - The Economy's "Long-Term Bond"

Each staked ETH is like a long-term government bond - locked to secure the network and paid generous "interest" (staking rewards). Currently, over 34 million ETH are staked (about 29% of total supply), meaning nearly one-third of ETH forms the backbone of the Ethereum economy.

- Since the Shapella upgrade enabled flexible withdrawals, net staking has increased by over 12 million ETH, showing strong long-term confidence.

- Staked ETH not only earns rewards but also reduces circulating supply and sets a price floor for ETH.

Engine Three: Regulatory Tailwinds Attracting Stablecoin Flow and On-Chain Growth

The introduction of the US Stablecoin Regulation Act (GENIUS Act) has prompted many financial and tech giants to announce new stablecoin plans, triggering a "stablecoin race". The total stablecoin market cap has recently reached $244 billion, with the Ethereum ecosystem accounting for 54%.

When stablecoins flow into Ethereum, it's like massive "new ships" bringing real-world cash into the blockchain economy. This will drive the on-chain DeFi market, increase gas fee consumption, and create continuous demand for ETH (used for fees and staking).

Risk Assessment: Not Entirely Smooth Sailing

Despite the bright prospects, we must realistically assess risks and challenges:

*ETH itself is classified as a commodity; some staking/derivative products remain controversial, but the regulatory environment is becoming clearer.

Conclusion: Addressing Uncertainty

Beneath the surface "ice layer" (price volatility, exit), Ethereum's "flame" - structural purchases and fund reallocation from ETFs - is burning brightly. This "major reorganization" is not a sign of decay, but a revival of a healthier, stronger ecosystem.

The conclusion is clear: For investors who can see through the fog and identify structural trends, today's market volatility is not a "flee" situation, but a strategic buying opportunity. For the long-term bull market in the secondary market, only through meaningful trading volume and consolidation can price and value truly align.

The real question for investors is: How much time, confidence, and patience are you prepared to invest in this investment journey?