The pendulum of the cryptocurrency market seems to be swinging once again. After experiencing a historic Bitcoin rally driven by spot ETFs, the market's spotlight is quietly shifting. Bitcoin's market dominance (BTC.D) has begun to decline after reaching its highest point since early 2021, a subtle yet critical change that has left countless traders and investors holding their breath, repeatedly asking the same question: Is the long-awaited Altcoin Season finally coming?

Bull Market Prelude: A Familiar Capital Rotation Melody

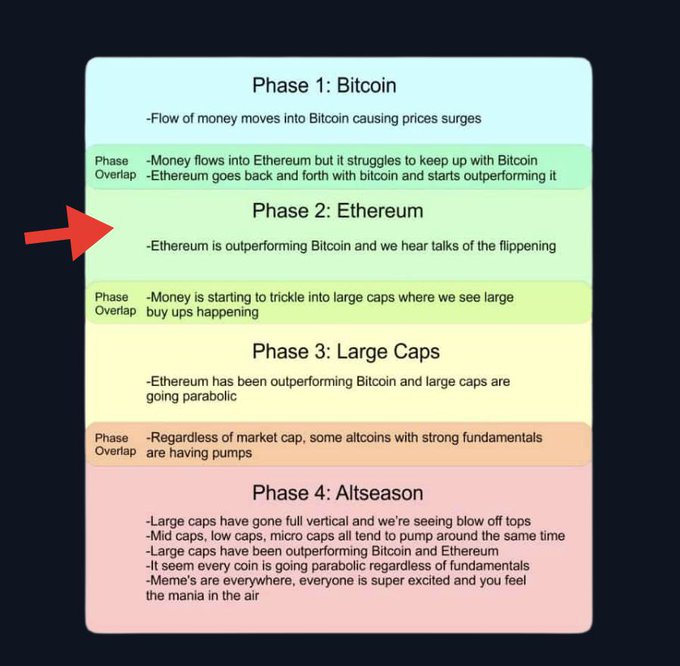

The evolution of a crypto bull market is not chaotic but often follows a clear capital rotation trajectory, providing a key perspective for interpreting the current market. This is not mysticism but a logical script based on changes in market participants' risk appetite. A typical cycle usually involves several stages: first, capital, especially new liquidity from traditional financial sectors, will primarily flow into the most liquid and consensus-strong assets - Bitcoin, driving a significant price increase.

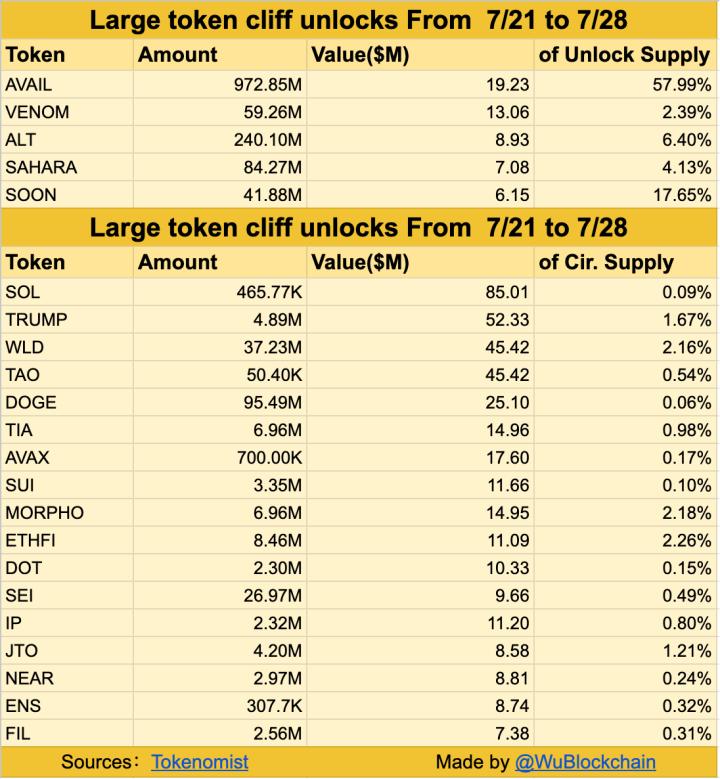

The market perfectly enacted this scene from late 2024 to early 2025. The approval of Bitcoin spot ETFs brought unprecedented institutional capital inflow, pushing its price to new historical highs. However, when Bitcoin's price begins to consolidate at a new high plateau, with relatively limited space for exponential growth, the capital's profit-seeking nature begins to manifest. Early profitable investors and funds seeking higher returns (beta) start looking towards the next point on the risk curve.

Therefore, the current decline in Bitcoin's market dominance is not a diminishment of its own value, but more like a natural prelude to the bull market entering its next movement. Historical data clearly shows that whether in the 2017 or 2021 bull markets, the significant drop in Bitcoin's market dominance after reaching a staged price high is a classic harbinger of a comprehensive Altcoin market explosion. This downward trend itself is a signal that deserves high market attention.

Transition Period of "Optimism" Under Multiple Indicator Resonance

If we view various market indicators as a dashboard, all pointers are currently pointing in one direction: the market is in a critical transition period from a "Bitcoin moment" to an "Altcoin moment".

[The translation continues in the same manner, maintaining the specified translations for specific terms]Secondly, the integration of AI and Crypto. As the two most eye-catching trends in the current technology field, their combination is viewed as a core issue by top research institutions like a16z, Messari, and Delphi Digital. The logic is that future AI Agents will need to use crypto networks for permissionless payments and verifiable computing, thereby giving birth to an entirely new on-chain intelligent economic ecosystem.

Thirdly, Decentralized Physical Infrastructure Networks (DePIN). By using token incentive models to crowdsource the construction of real-world infrastructure (such as wireless networks, computing power, energy storage, etc.), DePIN has formed a market worth billions of dollars by early 2025 and has been listed as a core track by multiple research institutions.

These new narratives provide solid fundamental support for the market, while macro liquidity may become the spark that ignites everything. BitMEX founder Arthur Hayes repeatedly emphasized that global central banks, especially the potential easing policies of the Federal Reserve, will inject massive liquidity into the market, becoming the "rocket fuel" for risk assets. Macro analyst Raoul Pal describes the potential parabolic exponential growth stage of crypto assets after these liquidity inflows as the "Banana Zone". Macro liquidity is the conductor of the symphony, while these new narratives are the instruments of each section.

Summary

So, has the Altcoin season truly arrived? All signs indicate that the stage is set, and the overture has been played. The decline in BTC market dominance, generally optimistic market sentiment, and the strong launch of Ethereum as the core engine all align with the classic characteristics preceding an Altcoin season.

However, we cannot simply apply past experiences. The melody of this cycle is destined to be different. The institutional power brought by the Ethereum ETF is both a catalyst and potentially a cause of unprecedented market divergence, creating a "two-speed" market with a few blue-chip projects performing vastly differently from the majority of small and medium-market-cap projects.

Ultimately, the scale and breadth of this feast will depend on whether new narratives like RWA, AI, and DePIN can truly capture and convert the upcoming macro liquidity. This Altcoin season will no longer be a chaotic celebration where everything rises, but more like a strict review of project quality, narrative intensity, and real-world integration capabilities. The curtain is rising, and what smart investors need to do is not just feel the volume of the entire symphony, but carefully listen and discern which are the true main melodies.