A Bitcoin whale has decided to liquidate all 131 BTC they had accumulated nearly three years ago, generating over $15 million in profits.

This whale began buying when Bitcoin's price was around $17,300 and recently transferred the BTC from Binance to OKX, earning over $13 million in profits, approximately 5.8 times their initial capital.

- Bitcoin whale accumulated 131 BTC from the lowest price nearly 3 years ago.

Who are Bitcoin Whales and What is Their Role in the Cryptocurrency Market?

According to a report from on-chain analyst Ember, Bitcoin whales are investors who own large amounts of Bitcoin and have a significant influence on market price fluctuations. Their accumulation and liquidation often create large waves in the cryptocurrency market.

For example, the whale with 131 BTC held for nearly three years, who decided to sell recently, created a significant impact on liquidation and market sentiment on the exchange.

Why is the Recent Liquidation of Bitcoin Whales Receiving Special Attention?

Industry analysts note that this event demonstrates an effective long-term investment strategy by buying at the historical dip and selling when the market strongly recovers. The whale's profit of 5.8 times the capital shows the power of maintaining a long-term position in a volatile market.

"The whale's consideration of liquidation at this time shows a shift in market psychology from accumulation to profit-taking, which is a crucial turning point for predicting the next trend."

Nguyen Van Dat, Strategy Director at Crypto Insights, July 2024

How Did This Whale's Transaction History Unfold?

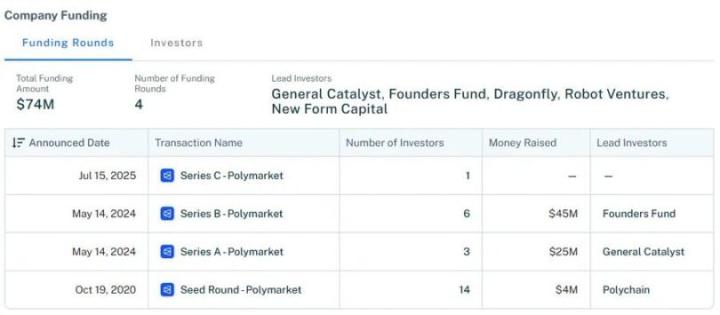

Data shows the whale transferred 131 BTC from Binance to OKX in November 2022, when BTC's price was equivalent to $17,300. This is considered a period when Bitcoin's price touched a dip after several deep drops in the global cryptocurrency market.

Recently, the whale decided to sell the entire Bitcoin lot, generating over $15 million, earning more than $13 million compared to the initial investment cost.

"Moving assets from one exchange to another not only helps whales be flexible in trading but is also a signal for investors to pay attention to market indicators."

Tran Minh Hoang, On-chain Analyst, 2024

What Does This Liquidation Mean for the Current Bitcoin Market?

Whales liquidating large amounts of Bitcoin can strongly impact prices and investor sentiment. However, this is also a signal showing the market is reversing or taking profits from large investors, contributing to balancing liquidity and supporting a more sustainable market development.

Frequently Asked Questions

What are Bitcoin Whales?

Bitcoin whales are investors who own large amounts of Bitcoin and can create significant market influence due to their superior buying and selling power.

Why Do Whales Often Accumulate Bitcoin Long-Term?

Holding Bitcoin long-term helps leverage price fluctuations and long-term growth opportunities, minimizing risks of selling during weak market periods.

What Does Transferring Bitcoin Between Exchanges Mean?

Transferring Bitcoin between exchanges is usually aimed at finding better trading opportunities or signaling preparation for large asset liquidation.

How Does Large Bitcoin Liquidation Affect Prices?

Large liquidation can cause short-term price volatility, affecting investor sentiment and market liquidity.

Is the Whale's Recent Profit Noteworthy?

A profit of 5.8 times after nearly three years is evidence of a long-term investment strategy and choosing a reasonable liquidation timing.