Over the past month, Ethereum (ETH) has surged from $2,100 to $3,000, during which US stock companies and mining companies have announced purchasing ETH as their "strategic reserve", with some mining companies even selling all their BTC to buy ETH with cash.

According to statistics, Ethereum strategic reserve companies have purchased over 545,000 ETH in the past month, with a total value exceeding $1.6 billion.

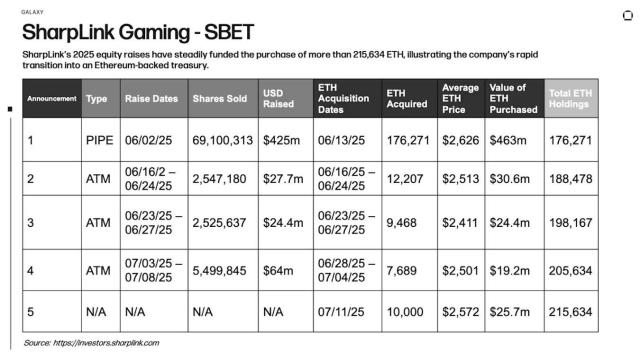

SharpLink (SBET), as the first company to use ETH as a strategic reserve, saw its stock price skyrocket from $3 to over $100 after announcing ETH purchase, then drop to single digits, and is currently back above $20.

Recently, SBET has purchased nearly 50,000 ETH in just 5 days, with its total ETH holdings now exceeding the Ethereum Foundation.

Additionally, SBET has staked some of its ETH on-chain to earn staking rewards, with its staking position earning 322 ETH as of July 8.

Currently, the US stock companies using ETH as a "strategic reserve" are primarily 5 companies:

· SharpLink Gaming (SBET)

· BitMine Immersion Technologies (BMNR)

· Bit Digital (BTBT)

· Blockchain Technology Consensus Solutions (BTCS)

· GameSquare (GAME)

ETH holdings for each company are as follows:

mNAV is the ratio of market capitalization to net asset value, calculated by the formula:

The mNAV of ETH strategic reserve companies is primarily estimated by "stock market capitalization" / "total ETH value held".

Is the Market FOMO-ing?

This mNAV data represents the disconnection between company market value and assets, also reflecting market sentiment and emotional premium for a concept or stock. A higher mNAV often indicates stronger market speculation, while a lower mNAV suggests a more rational investor approach.

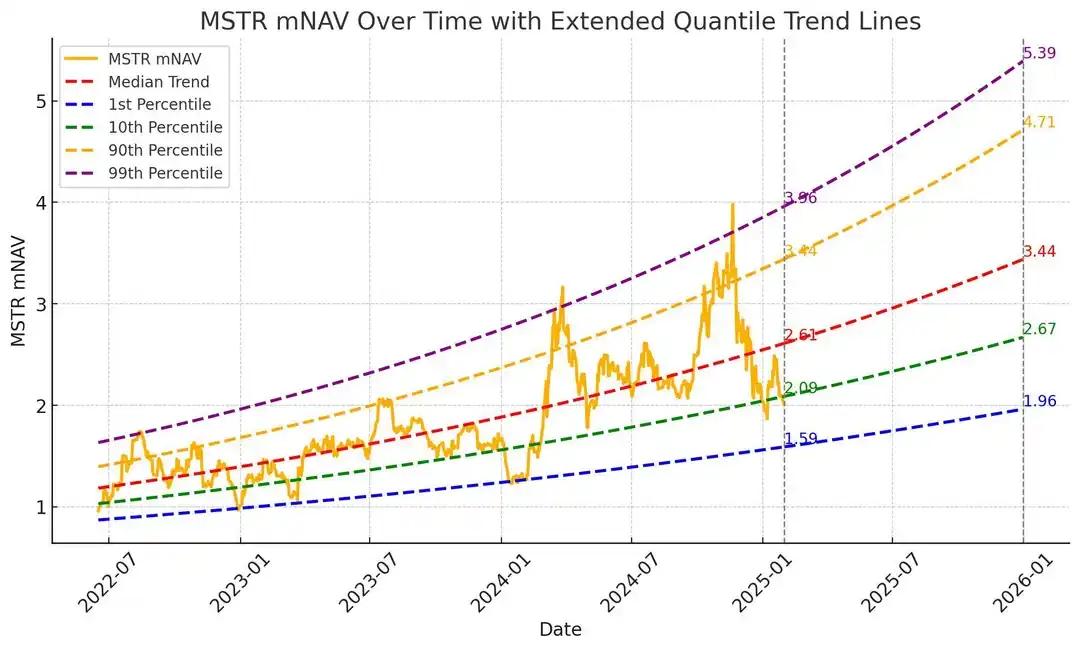

Looking at BTC strategic reserve companies, as of May 2025, MicroStrategy's (MSTR) market value is about 1.78 times its Bitcoin net asset value (mNAV), with fluctuations between 1 to 4.5 times between August 2022 and August 2024.

MSTR's mNAV curve reflects how crypto market sentiment drives the valuation of such companies.

Its peak of 4.5 times typically occurs during BTC bull markets and massive BTC accumulation periods, showing strong investor enthusiasm. The low point of 1 times corresponds to crypto market bear markets and consolidation periods, indicating investors' unwillingness to pay emotional premiums.

An mNAV between 2-2.5 represents a relatively neutral investment sentiment and premium.

By this standard, SBET and BTCS are currently in this range, while BMNR and BTBT's mNAV are slightly high.

It's worth noting that BMNR and BTBT were originally mining companies and may hold other assets besides ETH, which have not yet been calculated.

Overall, the current Ethereum strategic reserve stocks are still in a relatively rational valuation range, and market enthusiasm has not reached FOMO.

If Ethereum Rises to $5,000, How Much Could These Companies Multiply?

If ETH price continues to rise to $5,000 in the coming months, assuming these companies' total ETH holdings remain unchanged and no additional fundraising occurs, with a rational premium (mNAV = 2), the potential stock prices and gains would be:

Investors should note that mNAV = 2 is a relatively neutral premium rate. If ETH truly rises to $5,000, the market might be willing to pay a higher emotional premium for these ETH strategic reserve companies.

Additionally, during this period, the ETH these companies have staked will generate returns, potentially increasing their ETH holdings.

Ethereum's Value Discovery: Why Suddenly Attractive to Institutions?

When these Ethereum strategic reserve companies discuss why they chose ETH, the main reasons are:

· Success of BTC reserve companies like MSTR

· ETH staking rewards

· ETH's potential in stablecoin and RWA narratives

Bit Digital's CEO Sam Tabar is very optimistic about replicating MSTR's model with ETH and confident about ETH reaching $10,000:

"(Establishing Ethereum reserves) We're just getting started. This is just a warm-up. Think about how Saylor continuously issues stocks to buy BTC, and then BTC keeps rising, enabling him to repeat the entire process."

Primitive Ventures, in betting on SBET, emphasized ETH's staking reward potential:

"ETH has a natural earning capacity through staking and DeFi ecosystems, making it a truly productive asset, which Bitcoin lacks. SBET can potentially directly leverage ETH's on-chain mechanisms for compound growth, creating real and quantifiable returns for shareholders."

Bitmine Immersion Technologies' CEO is more optimistic about ETH's potential in RWA and TradFi narratives, stating in an interview:

"In my view, Ethereum is attractive because it's the first-layer blockchain for tokenizing real-world assets. As more things in the financial and real worlds become tokenized, financial institutions like Goldman Sachs, JP Morgan, Amazon, and Walmart will want to stake Ethereum itself, just as they do with stablecoins. We're doing what these companies will do in the future."