Bernstein predicts that the cryptocurrency market will continue to grow strongly until early 2026, with Bitcoin potentially reaching $200,000 by the end of 2025 or early 2026.

This price increase cycle is primarily led by financial institutions, with the asset management scale of Bitcoin ETF exceeding $150 billion, which is distinctly different from previous cycles dominated by retail investors.

- Bitcoin is likely to reach $200,000 by the end of 2025 or early 2026 according to Bernstein's forecast.

- The cryptocurrency market is currently led by institutions with Bitcoin ETF assets exceeding $150 billion.

- US laws such as the GENIUS Act and Clarity Act will promote compliance and development of regulatory platforms.

How long will the cryptocurrency market continue to grow according to Bernstein?

Bernstein, a reputable financial analysis organization, predicts that the cryptocurrency market will continue to grow until early 2026. They emphasize that Bitcoin could break the $200,000 mark in the late 2025 or early 2026 period, based on recent trend analysis and market data.

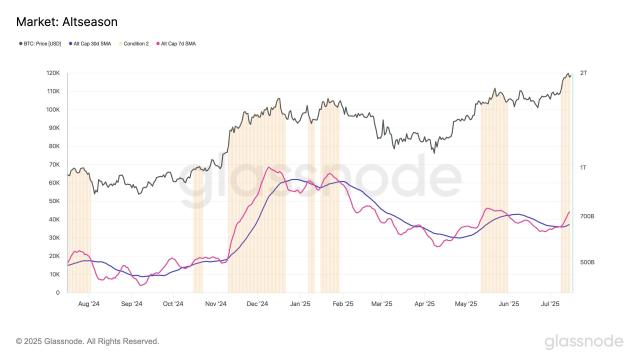

On 14/7/2024, Bitcoin surpassed $123,000, setting a new record. Unlike previous periods, the current price increase cycle is driven by large financial institutions instead of individual investors.

"The modern market growth race is supported by a large-scale digital asset management landscape, with Bitcoin ETF exceeding $150 billion."

Edwin Smith, Bernstein CEO, 14/7/2024

What is the role of institutions and Bitcoin ETF in this trend?

Financial institutions play a central role in the current cryptocurrency price increase cycle, demonstrated by the total assets of Bitcoin ETF exceeding $150 billion. Among these, BlackRock IBIT accounts for $84 billion, showing strong confidence in Bitcoin.

This is an important difference from previous cycles mainly led by retail investors, helping the market become more systematic and sustainable, reducing volatility caused by FOMO or FUD from small user groups.

How do US laws affect the cryptocurrency market?

GENIUS Act and Clarity Act - two laws expected to promote compliance for the cryptocurrency market in the US.

Regulated platforms like Circle, Coinbase and Robinhood are expected to benefit greatly from these policies, thereby contributing to creating a more transparent and safe market environment for investors.

"Completing the legal framework will help the cryptocurrency market grow stably, minimize risks, and attract more institutional investors."

Jessica Anderson, financial law expert, 2024

How are Ethereum, Solana networks and stablecoins developing?

Besides Bitcoin, networks like Ethereum and Solana are recording positive growth from the asset Tokenization trend, increasing the utility of Blockchain in many fields.

The stablecoin market size has reached nearly $250 billion, supporting liquidity and stability for the broader cryptocurrency ecosystem, contributing to building a new financial system based on an Internet platform.

In-depth analysis: How does Blockchain contribute to building an Internet-native financial system?

According to Bernstein analysts, Blockchain represents a solid step forward for the new generation financial system. However, market expansion is still predicted to be long and challenging.

This requires persistence and long-term vision from investors and blockchain platforms to contain volatility and develop sustainably.

| Data & Characteristics | Bitcoin ETF | Ethereum | Stablecoin |

|---|---|---|---|

| Total managed assets (billion USD) | 150 | Not officially determined | 250 |

| Notable large funds | BlackRock IBIT ($84 billion) | Asset Tokenization, DeFi | Used to support price stability, liquidity |

| Main trend | Led by institutions, ETF development | Tokenization, expanding applications | Market growth, expanding liquidity |

Frequently Asked Questions

How much could Bitcoin reach by the end of 2025?

According to Bernstein, Bitcoin could reach around $200,000 in the period of late 2025 or early 2026 based on current trends and market data.

What makes this cryptocurrency market different?

This price increase cycle is primarily led by large financial institutions instead of retail investors, helping the market become more stable and larger in scale.

How do GENIUS Act and Clarity Act affect cryptocurrency?

These two laws promote compliance and legal processes for the cryptocurrency market in the US, helping create a safer environment for investors and trading platforms.

Why are stablecoins important in the cryptocurrency ecosystem?

Stablecoins provide price stability and liquidity mechanisms in the ecosystem, playing a central role in the broader development of DeFi.

How are Ethereum and Solana networks developing?

Ethereum and Solana are growing strongly thanks to the asset Tokenization trend and the explosion of DeFi applications, expanding Blockchain utility.