Deng Tong, Jinse Finance

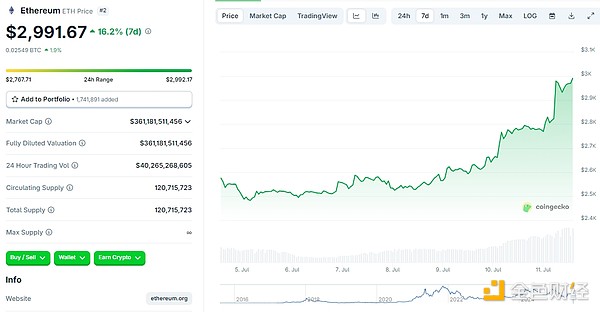

This morning, ETH briefly rose above $3,000 for the first time since early February this year. In recent days, ETH's market performance has reversed its previous downturn, rising from around $2,500 to $3,000, with a 7-day increase of 16.2% as of the time of writing.

According to 8marketcap data, Ethereum's market value has risen to $36.168 billion, surpassing SAP and rising to 35th place in global asset market value. Although ETH's rise is linked to BTC, what other factors are influencing ETH's market? What do industry insiders say? Is Ethereum leading the Altcoin season?

I. What factors are driving ETH's market rise?

1. Stablecoin Ecosystem Drive

On the Ethereum network, stablecoin issuance has remained consistently active, serving as an on-chain cash engine, driving continuous demand for ETH block space, and ensuring liquidity in the Ethereum ecosystem. On June 26, the adoption rate of Ethereum-based stablecoins reached a historical high, with over 750,000 unique users per week. USDT and USDC together occupy most of the $13.4 billion stablecoin market on the network.

On March 25, the stablecoin USD1, launched by the Trump family project World Liberty Financial, was issued on Ethereum and Binance Smart Chain.

On June 10, Société Générale-Forge, the crypto subsidiary of Société Générale, announced the launch of a USD-pegged stablecoin USDCV, issued on Ethereum and Solana blockchains.

On May 22, Circle increased the issuance of 100 million USDC on the Ethereum network.

On June 18, Tether minted 1 billion USDT on the Ethereum network.

On July 4, Tether increased the issuance of 1 billion USDT on the Ethereum network.

Additionally, stablecoins play a crucial role in trading and lending. They are not only important assets in the DeFi field but can also drive Ethereum transaction volume and asset liquidity. According to Token Terminal data, the active loan amount on Ethereum's lending protocols reached $22.6 billion, a historical high. Key players in this market include Aave, Spark, Morpho, Maple, Fluid, Compound, Euler, and others.

2. Increasing Ethereum Treasury Enterprises

More and more companies are using ETH as treasury assets, which undoubtedly strengthens Ethereum's "digital gold" status in asset allocation and proves that companies are optimistic about Ethereum's development prospects and future market trends.

- [Rest of the text continues in the same translation style]

Ethereum co-founder Vitalik Buterin and Ethereum researcher Toni Wahrstätter have jointly written a proposal EIP-7983, aiming to set the Gas limit for a single Ethereum transaction at 16.77 million. The proposal aims to reduce the risk of Denial of Service (DoS) attacks, optimize Zero-Knowledge Virtual Machine (zkVM) performance, and balance overall gas usage efficiency.

5. US Crypto Policy Shift

On July 5th, Grayscale posted on X platform: "We believe Ethereum may benefit from a US-friendly cryptocurrency policy shift, with new legislation like the Genius Act potentially clarifying stablecoin rules, driving investment, and accelerating smart contract adoption. With strong development activities and expansion plans, Ethereum is prepared to benefit from this."

Recently, the US GENIUS Act and CLARITY Act have attracted attention. The US crypto policy shift provides a more favorable development environment for various projects in the Ethereum ecosystem, attracting more developers to participate in Ethereum ecosystem construction and promoting innovation in DeFi, Non-Fungible Token, and other applications, further consolidating Ethereum's position in the blockchain field. Additionally, as a demonstration zone for crypto regulation, the US policy orientation will also influence the global cryptocurrency regulatory landscape. If US regulatory policies are favorable to ETH price, future global regulatory policy clarity will further drive ETH price increases. US regulatory policies are bringing medium to long-term policy benefits to Ethereum in terms of compliance pathways and institutional participation.

6. Continuous Net Inflow of Ethereum ETF

Recently, the Ethereum ETF has been in a state of continuous fund net inflow, especially in the past two days: On July 10th, the US spot Ethereum ETF had a net inflow of $383.1 million, which is the second-highest net inflow in the fund's history; on July 9th, the net inflow was $211.3 million; on July 8th, the net inflow was $29.5 million; on July 7th, the net inflow was $62.1 million...

Bitwise's Chief Investment Officer Matt Hougan believes that fund inflows into Ethereum exchange-traded funds will significantly accelerate in the second half of the year, as more stablecoins and stocks will begin trading on the Ethereum chain, which is easily understandable for traditional investors. In June this year, Ethereum ETF fund inflows have reached $1.17 billion, and if this trend continues, Ethereum ETF fund inflows in the second half of the year are expected to reach $10 billion.

The continuous net inflow of Ethereum ETF means more funds are entering the market to purchase ETH-related assets, directly increasing demand for ETH. With Ethereum's supply relatively stable for a certain period, according to the principle of supply and demand, increased demand will inevitably drive ETH price up.

(Translation continues in the same manner for the rest of the text)