A Contradictory Symphony

In the summer of 2025, the financial markets are staging a dazzling duet. On one side, there is a feast of risk assets. Bitcoin broke through $112,000 on July 9, reaching a new high since May. Meanwhile, on the other side of the ocean, the Nasdaq Composite Index, led by tech giants like NVIDIA, has repeatedly set new historical highs, with market sentiment soaring. This triumphant movement seems to herald the arrival of an "Everything Rally" era.

However, on the B-side of this prosperity, a completely opposite low-key requiem is lurking. The alarm of the US national debt is ringing louder, with the total amount already exceeding $36 trillion. The Congressional Budget Office (CBO)'s forecast is even more disturbing: by 2035, federal debt will rise to 118% of GDP, with an annual fiscal deficit of $1.9 trillion. At the same time, the US trade deficit continues to expand, reaching $71.5 billion in May 2025 alone, highlighting its serious dependence on external capital.

This seemingly contradictory picture makes the market's clamor sound somewhat jarring. Jamie Dimon, CEO of JPMorgan Chase, has repeatedly warned that due to excessive government spending, the US bond market "will experience a crisis" - it's not a question of whether it will happen, but when.

So, how should we understand this grand dance on the edge of a cliff? Is the market's revelry an irrational bubble that ignores risks, or is there a deeper logic? The answer may be hidden in the contradiction itself. This magnificent rise is not a result of market ignorance about the debt crisis, but precisely its most profound and forward-looking response. Capital is voting with its feet, staging a massive "hedging" migration - fleeing assets destined to be diluted and rushing towards "Noah's Arks" believed to withstand the storm. This is not a paradox, but the inevitable prelude to market logic reconstruction during the transition between old and new orders.

The Anatomy of Rise: A Story of Double Revelry

The essence of this rise is not a simple coincidence, but the result of deep resonance between capital, narrative, and technological trends. The underlying driving force behind Bitcoin and tech stocks' synchronized strength reveals profound structural changes in the market.

The Symbiosis of Technology and Crypto

In recent years, Bitcoin and tech stocks, especially the Nasdaq 100 Index, have shown an unprecedented symbiotic relationship. According to research by CME Group, since 2020, Bitcoin's correlation with US stocks has transformed from "uncorrelated" to significantly positively correlated, especially during market pressure periods, with this linkage becoming increasingly apparent, indicating that Bitcoin is exhibiting "equity-like" behavioral characteristics.

... (rest of the text continues in the same manner)A widely discussed concept is the so-called "Mar-a-Lago Accord". Proposed by strategist Zoltan Pozsar and elaborated by the current White House Council of Economic Advisers Chairman Stephen Miran, this plan is seen as a modern unilateral version of the 1985 Plaza Accord. Its core objective is to force other countries to accept US dollar depreciation by imposing high tariffs and threatening to withdraw security protection, thereby revitalizing US manufacturing. More radically, the plan even envisions forcibly converting foreign-held US Treasury bonds into century-long ultra-long bonds, which is tantamount to a "soft default" against foreign creditors.

If the "Mar-a-Lago Accord" primarily targets the external world, then the "Pennsylvania Plan" proposed by Deutsche Bank strategist George Saravelos turns its focus inward. The core idea of this plan is to "onshore" US debt, reducing dependence on foreign buyers and instead having domestic entities absorb new government bonds. Its implementation methods are quite innovative: first, relaxing leverage ratio regulations for large banks to enable them to hold more Treasury bonds; second, supporting the development of US dollar stablecoins through legislation. Since regulated stablecoins are primarily backed by short-term US Treasury bonds, a thriving stablecoin market would create a massive and stable new source of demand for the US government.

Whether exerting external pressure or "digesting" internally, both scenarios send a clear signal: the foundational status of US Treasury bonds as the global "risk-free asset" is being shaken. When ideas of debt restructuring, forced conversion, and using cryptocurrency infrastructure for deficit financing have moved from the margins into policy advisors' view, it signifies a decisive drift in the global financial "Overton Window". Things once unimaginable are now being put on the table. This compels global capital to reassess risks and seek a true value haven not controlled by a single sovereign will.

Bit's Role in the Grand Game

In this grand game of global capital restructuring, Bit is playing an unprecedented key role. It is both a "digital lifeboat" for capital fleeing the old system and might inadvertently become the "Trojan horse" for the old system's self-rescue.

Digital Lifeboat

When the world's primary reserve currency and its sovereign debt face credibility erosion risks, Bit's core attributes—absolute scarcity (total 21 million), non-sovereign decentralized network, and global liquidity—make it a logical choice for institutional capital.

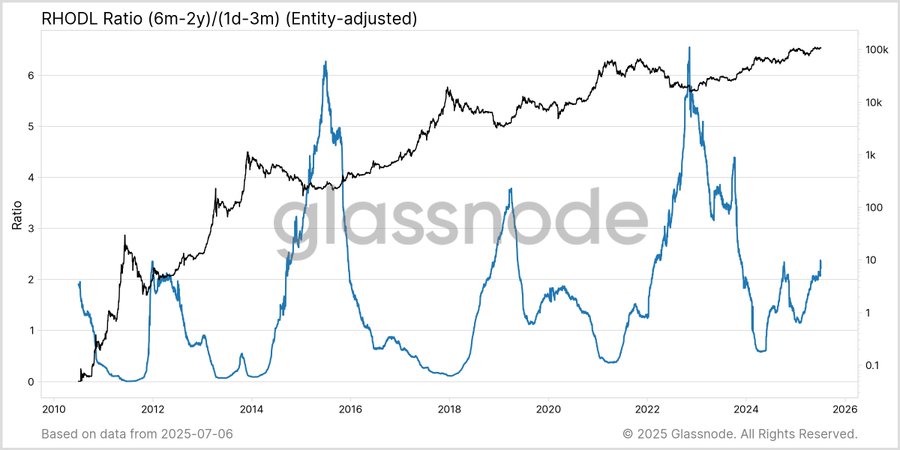

On-chain data provides strong evidence for this "hedging" logic. glassnode's data shows that the "Realized HODL Ratio" measuring long-term holder wealth concentration has risen to the highest point in this cycle. This indicates a maturing market with reduced short-term speculative behavior and wealth increasingly concentrated in long-term investors with conviction—a structure often forming a healthy basis for sustained market growth. Meanwhile, the MVRV ratio, though rising to 2.26, is still far from the historical bull market peak of over 7.5, suggesting significant upside potential in this cycle remains untapped.

Market maturity is accompanied by a "de-risking" regulatory environment. Washington plans to hold "Crypto Week" around July 14, 2025, during which the CLARITY Act and other key legislation will be reviewed. The act aims to provide a clear regulatory framework for digital assets, such as placing certain crypto assets under CFTC supervision, which would significantly reduce compliance uncertainties for institutional investors.

A clear feedback loop is forming: regulated ETF products solve institutional access and custody issues; clear legislative frameworks eliminate compliance gray areas; and a solid on-chain holder structure enhances the asset's intrinsic resilience. Together, these are transforming Bit from a marginal, high-risk alternative investment into an "institutional-grade" macro hedging tool that can be incorporated into mainstream investment portfolios.

Trojan Horse

However, there's another side to the story. In the "Pennsylvania Plan" concept, stablecoins play a subtle yet critical role. This reveals a possibility: the US government might have discovered that the crypto ecosystem could become a new tool for addressing debt issues.

The logic chain is clear: the global stablecoin market of hundreds of billions of dollars is predominantly composed of US dollar stablecoins, with issuance reserves primarily consisting of highly liquid short-term US Treasury bonds. This means that every transaction and flow in the crypto world indirectly finances the US fiscal deficit. As the global crypto economy of tens of trillions of dollars increasingly depends on stablecoins as its core trading medium, a massive, structural, and price-insensitive demand pool for US Treasury bonds is formed.

This could lead to an ironically symbiotic relationship: a crypto world brandishing "decentralization" becomes one of the most important funding sources for the world's largest sovereign debt nation. In this scenario, the US government's motivation might shift from suppressing or containing cryptocurrencies to actively incorporating them into regulation and "nurturing" their development to more effectively utilize this new financing channel. The upcoming "Crypto Week" and related legislation may not only be about consumer protection but also about laying compliant "water channels" for this massive new funding pool.

A New Era's Script

We stand at a historical crossroads. The simultaneous new highs of Bit and US stocks are not irrational bubbles but the market pricing a profound macro transformation. This "everything rising" duet is a massive reconfiguration by global capital as the old sovereign debt supercycle approaches its end.

The future script can no longer be summarized simply as a "bull" or "bear" market. It will be a financially transitional period filled with uncertainty, high volatility, but also structural opportunities. In this new script:

First, the actual value of fiat currencies represented by the US dollar and their sovereign debt will face continuous erosion pressure. This provides a long-term and powerful tailwind for assets with absolute scarcity like Bit.

Second, capital will continue flowing in two directions: one towards "hard assets" like Bit with value storage and non-sovereign attributes; the other towards "productive assets" like top tech companies with strong moats that can create growth beyond inflation rates.

Finally, we will witness increasingly complex and deep entanglements between nations and the crypto ecosystem. Nations will attempt to use crypto technology to solve traditional framework challenges, while the crypto world will seek its positioning and development path in its contest with sovereign states.

The old financial map is becoming invalid, and a completely new era with not-yet-fully-written rules has begun. In this grand global financial architecture reshaping, Bit is no longer a marginal spectator but is being pushed to center stage, playing an unprecedented core role. And this grand play has only just begun.