The wave of institutionalization reached a new height in June, with the global crypto ETF scale breaking through the milestone of 1.1 trillion dollars, with BlackRock's BTC ETF alone attracting 4.9 billion dollars in net inflows in a single month. More notably, the degree of participation from traditional financial institutions is undergoing a qualitative change. For example, Goldman Sachs has started to provide Bitcoin-backed loan services with CoinBase, a depth of participation far beyond Wall Street's tentative layout during the 2021 bull market. Meanwhile, the expected shift in the Federal Reserve's monetary policy has injected new variables into the market, with historical data indicating that the Fed's interest rate cut cycle is usually accompanied by a significant rise in BTC.

In terms of regulation, as mentioned earlier, the passage of the GENIUS Act in the United States and the establishment of Hong Kong's stablecoin licensing system mark that major financial centers have built a preliminary compliance framework for digital assets. This policy certainty is attracting more traditional capital to enter the market.

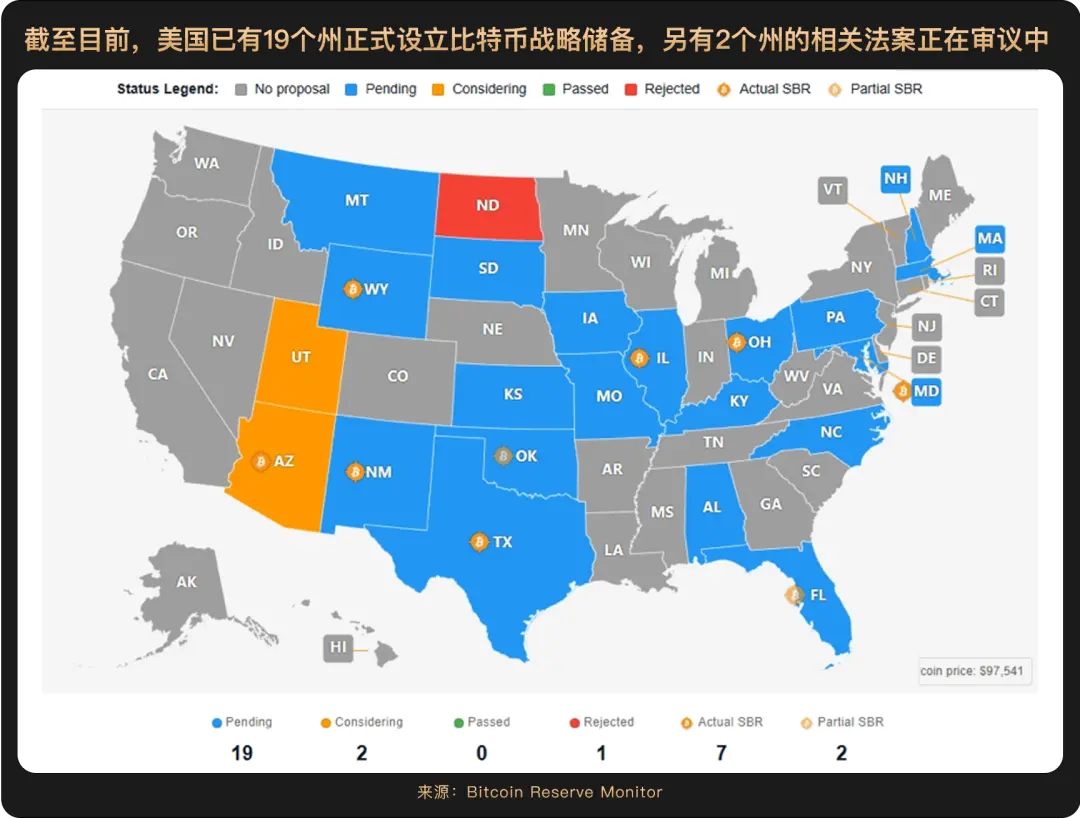

Additionally, the White House's digital asset policy advisor revealed that the United States is working to build a strategic BTC reserve infrastructure. The executive order issued by Trump in March did not mandate the Treasury Department to disclose the government's BTC holdings, but we can expect proactive disclosure of related information in the second half of the year. The advisor also added that the U.S. government is "highly inclined" to increase BTC holdings in a budget-neutral manner. This means that the U.S. government will provide funding support for BTC purchases through internal fund restructuring or cost savings, without increasing fiscal deficits or taxpayer burdens.

In short, looking back from the midpoint of 2025, the development trajectory of the crypto market has fundamentally differed from the early stage driven purely by speculation.

Geoffrey Kendrick, the digital asset research head at Standard Chartered Bank, once predicted that BTC's target price would be $200,000 by the end of 2025. The dominant narrative behind this market trend has shifted from being linked to risk assets to being driven by capital flows, with funds pouring in through multiple forms. BTC is becoming an allocation tool for funds withdrawing from U.S. assets, showing that this rise is not just a price fluctuation, but a reflection of global capital allocation and macroeconomic trends. In this sense, the second half of 2025 is likely to be a historical turning point for deep coupling between the traditional financial system and the digital currency ecosystem.

Currently, BTC price is maintaining a high range of $10-12,000, and looking forward to the second half of the year, under multiple favorable conditions such as a possible Federal Reserve interest rate cut, continued growth in enterprise crypto adoption, and clarification of regulatory policies, it is expected to usher in a new period of steady development.