Author: 1912212.eth, Foresight News

Original Title: Is Online Lending for Crypto Trading Inherently Sinful?

In the crypto world, the days of turning small investments into massive gains with hundredfold opportunities are long gone. Missing the wealth creation opportunities in 2017 and 2021 means that small capital turning fortunes is nothing more than a pipe dream. Of course, Twitter is filled with stories of turning thousands into millions through contracts and becoming famous overnight with a MEME, but these are rare exceptions. Most people either didn't make money or lost money, and their stories remain unheard. For some crypto traders, the "consensus" became borrowing money when their principal is insufficient.

Recently, the OKX account freezing wave has brought the topic of borrowing money for crypto trading to the forefront of public discourse. According to reports, some user accounts were frozen due to fund source issues, with OKX demanding detailed proof of funds, including ten-year income records, and explicitly stating they do not support using online loans for cryptocurrency trading. This incident has not only raised questions about OKX's compliance policies but also sparked heated debates within the crypto community about "online lending for crypto trading".

Open-Minded Approach: Farming, Arbitrage, Buying Mainstream Crypto Spot

Hongyi, chief economist of Thoughtful Group, once said, "When your capital is too small, even multiplying it several times won't significantly impact your life." Most crypto traders harboring wealth dreams likely share this perspective.

Twitter user 0x Enlightened expressed complex feelings about online lending, noting that he borrowed 200,000 last July through Borrowing Treasure at a low interest rate of around 3%, with a one-year interest-only repayment of just over 10,000. "Such a low-risk leverage would be a waste not to use."

He revealed that his returns doubled, and he has since repaid the 200,000 loan.

Trader Crypto Monkey disclosed borrowing 180,000 from Wan Yong Gold, 100,000 from Netbank Loan, 70,000 from Micro Loan, and 20,000 from Zhaolink Good Period Loan, totaling about 600,000 yuan to buy the dips.

"After going All In with loans, life became incredibly challenging. That period was volatile, with fluctuations of tens of thousands. The most painful part was repaying several thousand each month. Pressure turned into anxiety, and each day felt like a year. I repeatedly contemplated the consequences of potentially losing everything."

Eventually, he waited for the bull market and received substantial returns.

Clever individuals use borrowed funds to buy the dips during challenging bear markets, awaiting returns in bull market cycles. Or they use loans for farming, token launches, and arbitrage, avoiding high-leverage trades hoping for overnight riches, which might be a key way to avoid risks.

Crypto player Xiao Su (pseudonym) told Foresight News, "As long as borrowing costs are low, you can even make some money buying Bitcoin spot. It depends on individual risk appetite. I use borrowed funds to buy mainstream crypto spot and hold, planning to sell in the second half of the year if there's market movement. But I only borrow what I can repay, and even if I lose this money, it's not the end of the world."

Opponents: Essentially Adding Leverage

While some are open-minded, many strongly oppose borrowing for crypto trading. Famous KOL Bitcoin directly stated, "Borrowing for crypto trading is essentially adding leverage, a game designed for very few. Most people trying to change their fate actually accelerate its backlash. Believing you can win is self-deception! Truly changing one's fate isn't about 'borrowing to gamble', but about time, patience, and continuous value accumulation."

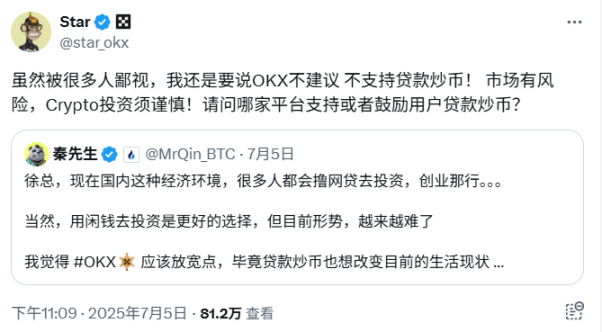

As the borrowing for crypto trading topic intensifies, OKX founder Star explicitly stated he doesn't recommend or support borrowing for crypto trading, challenging which platform supports or encourages such practices.

Trader Paulwei also explained on Twitter why he doesn't recommend borrowing for crypto trading, especially for contracts.

He explained that even with little money, he would never borrow externally for trading. Liquidation means the current method is wrong, skill is insufficient, and immediately using more money would likely repeat the same mistakes, falling into a deeper abyss. Daring to start over with small funds is the spiral growth of method and capital. In such a volatile market, if method and skill improve, even small capital will naturally grow, possibly faster than expected; conversely, if method and skill haven't improved sufficiently, external capital injection only increases unnecessary "tuition fees".

Profit from trading is never about crazy leverage. Once burdened with massive debt, it often significantly impacts subsequent life. Some contract-trading users, eager to recover, hope for a final big win, only to fail again and fall deeper.

Paulwei believes, "The key to surviving low periods is making an extremely unnatural decision: with even less principal, dare to slowly explore with lower leverage."

Summary

Some Web3 professionals, facing high bank lending barriers due to provident fund and social security issues and limited principal, coupled with a get-rich-quick mentality, choose online lending. However, market conditions are unpredictable, leverage is a devil, and dancing with risk can lead to total loss. Controlling risk and not leaving the table might be the true survival strategy in the crypto world.