TL;DR

Infrastructure has become saturated; consumer applications are the next frontier. After years of pouring funds into new L1s, Roll-ups, and development tools, technical marginal returns have become minimal, and users do not automatically flood in just because the technology is "good enough". Now, attention creates value, not architecture.

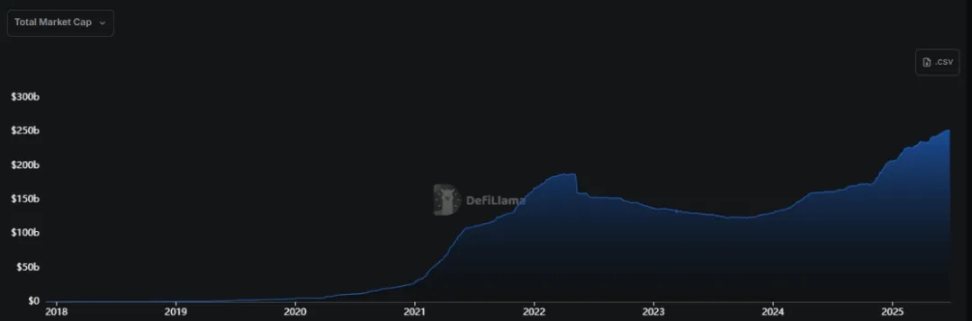

Liquidity is stagnant, and retail investors are absent. The total market value of stablecoins is only about 25% higher than the 2021 historical peak, with recent increments mainly coming from institutions purchasing BTC/ETH for their balance sheets, rather than speculative capital circulating within the ecosystem.

Core Arguments

- Friendly regulatory policies will unlock the "second wave" of development. More clear US policies (Trump administration, stablecoin bill) will expand TAM and attract Web2 users who only care about touchable applications, not underlying technical architectures.

- The narrative market rewards real usage. Projects with significant revenue and PMF—such as Hyperliquid (around $900 million ARR), Pump.fun (around $500 million ARR), Polymarket (around $12 billion trading volume)—far outperform infrastructure projects with high financing but lacking users (Berachain, Sei, Story Protocol).

- Web2 is essentially an attention economy (distribution > technology); as Web3 deeply integrates with Web2, the market will follow—B2C applications will expand the pie.

Current Consumer Tracks with PMF (Crypto-Native):

- Trading/Perpetual Contracts (Hyperliquid, Axiom)

- Launchpad/Meme Coin Factory (Pump.fun, BelieveApp)

- InfoFi and Prediction Markets (Polymarket, Kaito)

Next Upward Tracks (Web2 Coded):

- One-stop deposit/withdrawal + DeFi super app—integrating wallet, banking, yield, and trading (Robinhood-like experience but without ads).

- Entertainment/Social platforms, replacing ads with on-chain monetization (exchange, staking, prize pools, creator tokens), optimizing UX and improving creator earnings.

AI and gaming are still pre-PMF. Consumer AI needs safer account abstraction and infrastructure; Web3 games are troubled by "wool party" economics. A breakthrough will only occur after a game that focuses on gameplay, not crypto elements, emerges.

Superchain theory. Activity is concentrating towards chains friendly to consumer applications (Solana, Hyperliquid, Monad, MegaETH). One should select killer apps from these ecosystems and infrastructure directly supporting them.

Perspective on investing in consumer applications:

- Distribution and execution > pure technology (network effects, viral cycles, brand).

- UX, speed, liquidity, and narrative fit determine success.

- Assess as an "enterprise" not a "protocol": real revenue, scalable model, clear industry dominance path.

Bottom line: Pure infrastructure trading can no longer replicate 2021-style valuation multiplication. Excess returns in the next 5 years will come from consumer applications that transform crypto infrastructure into daily experiences for millions of Web2 users.

Introduction

Previously, the industry was highly focused on technology/infrastructure, concentrating on building "tracks"—new Layer-1s, scaling layers, developer tools, and security primitives. The driving force was the industry's belief that "technology is king": as long as the technology is good and innovative enough, users will naturally come. However, this is not the case. Look at projects like Berachain, Sei, and Story Protocol, with financing valuations that are outrageous yet hyped as the "next big thing".

In this cycle, as consumer application projects take the spotlight, discussions have clearly shifted to "what are these tracks actually for". As core infrastructure reaches a "sufficient" maturity and marginal improvements decrease, talent and capital begin to chase consumer-facing applications/products—social, gaming, creator, business scenarios—demonstrating blockchain's value to retail and daily users. The consumer application market is essentially an attention economy, which makes the entire crypto market a battlefield of narratives and attention.

This insight report will explore:

1. Overall market context

2. Types of consumer applications in the market

a. Tracks with existing PMF

b. Tracks that can be upgraded via crypto tracks and ultimately achieve PMF

3. Framework and investment thesis for consumer applications—how can institutions identify winners?

Narrative—Why Now?

This cycle lacks the retail FOMO and NFT/Altcoin speculation of 2021, and the tightened macro environment has restricted VC and institutional capital input, causing new liquidity growth to fall into a "stagflation" situation.

▲ Stablecoin Market Value Trend

As shown in the chart, the total stablecoin market value grew about 5 times from 2021-2022, while this round (late 2023-2025) has only grown 2 times. At first glance, it seems organic and healthy steady growth, but it's actually misleading: the current market value is only about 25% higher than the 2021 peak, which is low-speed for any industry over a 4-year dimension. This is even under the background of the most clear regulatory tailwind for stablecoins and a strong coin-supporting president.

Capital inflow growth has significantly slowed, mainly starting from January 2025 after Trump's election. So far, new capital is not speculative or truly "flowing water", but more institutions incorporating BTC/ETH into their balance sheets and government and enterprise expansion of stablecoin payments. Liquidity is not due to market interest in new products/solutions, but regulatory benefits; these funds are non-speculative and won't directly inject into secondary markets. This is not free capital, nor retail-driven, so even with price highs, the industry has not reproduced the 2021 frenzy.

Overall, it can be compared to after the 2001 .com bubble, when the market sought the next growth direction—this time, it will be consumer applications. Past growth was also driven by consumer applications, just with products like NFTs and Altcoins, not applications.

Core Argument

In the next 5 years, the crypto market will see a second wave of growth driven by Web2/Retail Investors

- Trump administration's clearer crypto policy gives green light to founders

- Stablecoin legislation significantly expands TAM for all crypto applications

- Past liquidity bottlenecks were due to lack of clear framework and market island effect; now favorable to liquidity due to stablecoin regulations

- Strong positive political sentiment has greater impact on consumer applications than infrastructure, as consumer applications can attract massive Web2 users

- Web2 users only care about directly interactive application layers and products that bring value - they want Web3's "Robinhood", not "crypto AWS"

- Robinhood

- Google/YouTube

- Snapchat

- ChatGPT

User Layer Unlocking

- Ad removal brings better UX

- Benefit through prize pools and airdrops by supporting/watching favorite creators

- Token dividends

Creator Layer Unlocking

- Contribution-based revenue model; more transparent and fair

- Exchange fee sharing

- Event fee sharing

- Creator tokens enable direct value flow from fans to creators

- Ad removal improves user retention

- Platform model inherently drives user growth, benefiting creators

Why Not AI or Gaming?

Currently, AI consumer applications are still premature. We need to wait for applications that can truly achieve "one-click DeFi/account management" before experiencing a breakthrough; the current infrastructure for safety and feasibility is still insufficient.

In gaming, blockchain games struggle to break through because core users are mostly "Farmers" chasing money rather than game enjoyment, resulting in low retention. However, future games might implicitly use cryptographic paradigms at the underlying level (such as economic and item systems), while players/developers still focus on playability—if CSGO had used on-chain economics, it might have been very successful.

In this regard, small games utilizing cryptographic mechanisms have already had some successful cases (Freysa, DFK, Axie).

Arguments and Framework

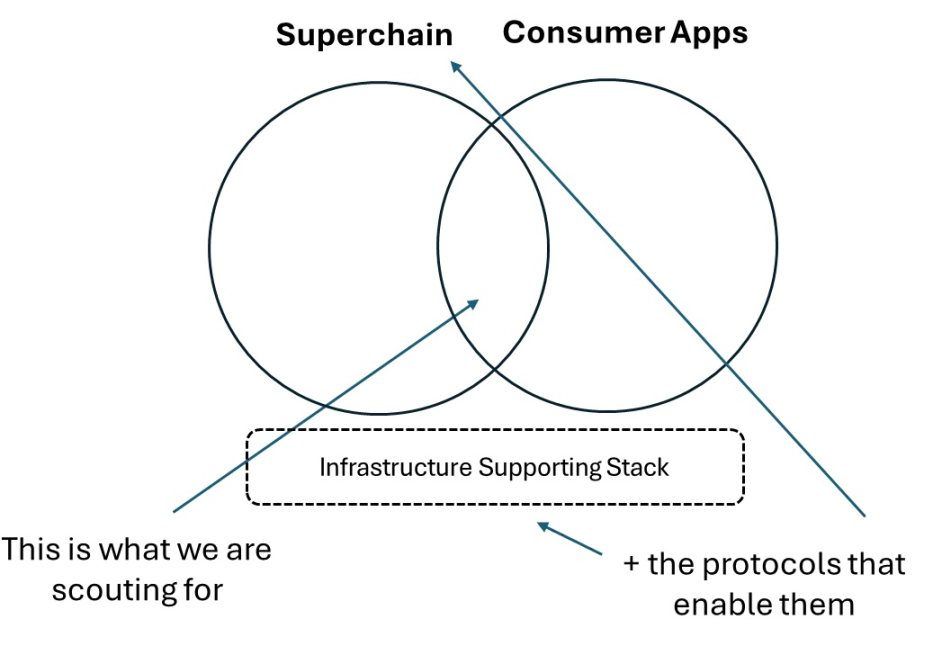

Overall perspective: Market maturity → Reduced inter-chain fragmentation → A few "Super Chains" will prevail → Institutions should bet on next-generation consumer applications and supporting infrastructure on these super chains.

This trend is already happening, with activity concentrating on a few chains, rather than being dispersed across over 100 L2s.

Here, "Super Chains" refer to consumer-centric chains optimizing speed and experience, such as Solana, Hyperliquid, Monad, MegaETH.

Analogy:

- Super Chains: iOS, Android

- Applications: Instagram, Cash App, Robinhood

- Supporting Stack: AWS, Azure, Google Cloud

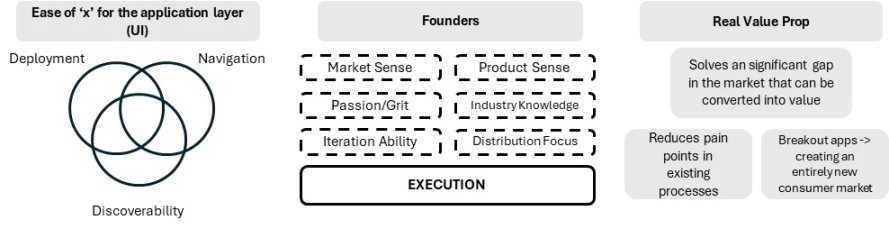

As mentioned earlier, consumer applications can be divided into two key categories:

- Web2 Native: Applications first attracting Web2 users, unlocking new behaviors using cryptographic paradigms—focus on products with seamless backend crypto integration without claiming to be "crypto applications" (like Polymarket).

- Web3 Native: Verified decisive factors are better UX + ultra-fast interface + sufficient liquidity + one-stop solution (breaking fragmentation). Next-generation Web3 users care more about UX > earnings or technology, only considering the latter two after crossing a certain threshold. Teams and applications understanding this deserve premium valuation.

They generally need to possess the following elements:

Conclusion

Consumer investment targets need not completely rely on differentiated value propositions (though they can). Snapchat was not a technological revolution, but rather a recombination of existing technologies (chat modules, AIO camera), creating a new unlock. Therefore, evaluating consumer targets from a traditional infrastructure perspective is biased; institutions should consider: Can this project become a good business and ultimately create returns for the fund?

To this end, assess:

- Distribution capability trumps the product itself—can they reach users?

- Can they effectively reorganize existing modules to create an entirely new experience?

Funds can no longer drive returns through pure infrastructure. This doesn't mean infrastructure isn't important, but that in a narrative-driven market, they must possess genuine attractiveness and use cases, not value propositions no one cares about. Overall, for consumer targets, most investors are overly "right-leaning"—too literally adhering to "first principles", while true winners often prevail through superior branding and UX—qualities that are implicit yet crucial.