Written by: Max Wong @IOSG

TL;DR

Infrastructure has become saturated; consumer applications are the next frontier. After years of pouring funds into new L1s, Roll-ups, and development tools, the marginal technological returns are minimal, and users do not automatically flood in just because the technology is "good enough". Now, attention creates value, not architecture.

Liquidity is stagnant, and retail investors are absent. The total market value of stablecoins is only about 25% higher than the 2021 historical peak, with recent increments mainly coming from institutions purchasing BTC/ETH for their balance sheets, rather than speculative capital circulating within the ecosystem.

Core Arguments

Friendly regulatory policies will unlock the "second wave" of development. More clear US policies (Trump administration, stablecoin bill) will expand TAM and attract Web2 users who only care about touchable applications, not underlying technical architectures.

The narrative market rewards real usage. Projects with significant revenue and PMF—such as Hyperliquid (around $900 million ARR), Pump.fun (around $500 million ARR), Polymarket (around $12 billion trading volume)—far outperform infrastructure projects with high financing but lacking users (Berachain, Sei, Story Protocol).

Web2 is essentially an attention economy (distribution > technology); as Web3 deeply integrates with Web2, the market will follow—B2C applications will expand the pie.

Currently Achieved PMF Consumer Tracks (Crypto-Native):

Trading/Perpetual Contracts (Hyperliquid, Axiom)

Launchpad/Meme Coin Factory (Pump.fun, BelieveApp)

InfoFi and Prediction Markets (Polymarket, Kaito)

Next Wave Ascending Tracks (Web2 Encoded):

One-stop deposit/withdrawal + DeFi super app—integrating wallet, bank, yield, and trading (Robinhood-style experience without ads).

Entertainment/Social platforms, replacing ads with on-chain monetization (exchange, staking, prize pools, creator tokens), optimizing UX and improving creator earnings.

AI and gaming are still in the pre-PMF stage. Consumer AI needs safer account abstraction and infrastructure; Web3 games are troubled by the "wool party" economy. A breakthrough will only come after a game that focuses on gameplay rather than crypto elements emerges.

Superchain Theory. Activity is concentrating towards chains friendly to consumer applications (Solana, Hyperliquid, Monad, MegaETH). One should select killer applications from these ecosystems and infrastructure directly supporting them.

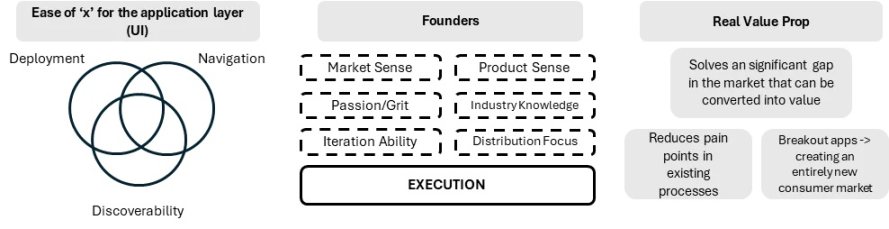

Perspective on Investing in Consumer Applications:

Distribution and execution > pure technology (network effects, viral cycles, brand).

UX, speed, liquidity, and narrative alignment determine victory.

Assess as an "enterprise" rather than a "protocol": real income, scalable model, clear industry dominance path.

Bottom line: Pure infrastructure trading can no longer replicate 2021-style valuation multiplication. Excess returns in the next 5 years will come from consumer applications that transform crypto infrastructure into daily experiences for millions of Web2 users.

Here's the English translation:Web2 has always been about the attention economy (distribution > technology); After deep integration with Web3, it will remain the same - B2C applications will expand the overall market

Viral spread and attention are the key to success → Consumer applications are the easiest to achieve

Because network effects are easily embedded in consumer applications → Such as binding Twitter and receiving protocol rewards for posting (Loudio, Kaito)

Therefore, consumer application content is easily generated → Easy to go viral and occupy mindshare

B2C applications can easily create topics through user behavior, incentives, or community (Pump.fun vs Hyperliquid)

Viral spread brings attention, attention brings users → Viral applications will attract new retail investors and expand the market

Web2 Native: First, applications that attract Web2 users, unlocking new behaviors using cryptographic paradigms - focusing on backend seamless integration of crypto without boasting as a "crypto application" (such as Polymarket).

Web3 Native: The verified decisive factors are better UX + ultra-fast interface + sufficient liquidity + one-stop solution (breaking fragmentation). The new generation of Web3 users care more about UX > returns or technology, only caring about the latter two after crossing a certain threshold. Teams and applications that understand this principle should be valued at a premium.

Generally, the following elements are still needed:

Conclusion

Consumer investment targets do not necessarily rely entirely on differentiated value propositions (although they can). Snapchat was not a technological revolution, but rather a recombination of existing technologies (chat modules, all-in-one camera), creating a new unlock. Therefore, evaluating consumer targets from a traditional infrastructure perspective is biased; institutions should consider: Can this project become a good business and ultimately create returns for the fund?

To this end, they should assess:

Distribution capability trumps the product itself - can they reach users?

Can they effectively reorganize existing modules to create an entirely new experience?

Funds can no longer drive returns through pure infrastructure. This is not to say infrastructure is unimportant, but that in a narrative-driven market, they must possess genuine attractiveness and use cases, not value propositions that no one cares about. Overall, for consumer targets, most investors are overly "right-leaning" - too literally adhering to "first principles", while true winners often prevail through better branding and UX - these qualities are implicit yet critical.