Written by: Blockchain Knight

In 2011, a16z founder Marc Andreessen published an article titled "Software is Eating the World" in The Wall Street Journal, with the core argument that software is changing the world at an unprecedented speed and scale.

In the past decade, we have witnessed the rapid development of the internet, giving birth to numerous companies with market capitalizations exceeding $100 billion. Even now, this statement remains valid, as AI is beginning to change the world in new ways, with some even suggesting that AI is devouring software. However, everything seems to have started in 2011, as platforms like Weibo and WeChat experienced their breakthrough that year.

Now, more than a decade after the birth of blockchain technology, we are finally witnessing the beginning of "blockchain devouring the world" - and this beginning is the implementation of US stock tokenization.

Although US stock tokenization is not a novel concept and was partially realized even in the now-defunct FTX, the players entering the market now are no longer purely crypto companies, but well-known internet enterprises like Robinhood.

Last week, Robinhood announced the launch of stock token trading services in Europe based on the Arbitrum network, tokenizing shares of unlisted companies including OpenAI and SpaceX. This news caused a huge wave in the financial circle and helped push Robinhood's stock price to a historic high.

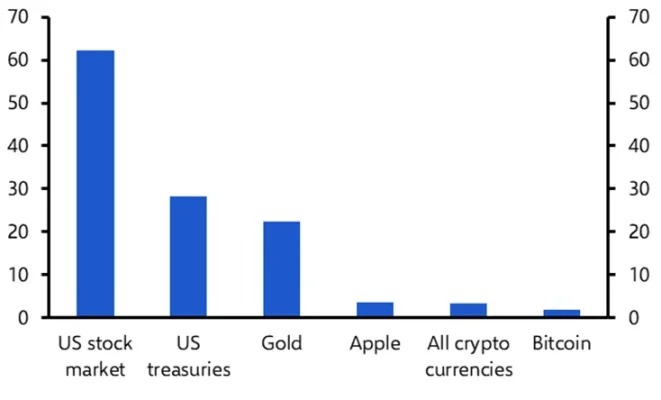

Currently, the total market capitalization of the entire crypto market is approximately $3.4 trillion, while the total market capitalization of global stock markets is around $135 trillion, a difference of nearly 40 times.

Conversely, the ultimate ceiling market for stock tokenization is $135 trillion, and this ceiling will continue to expand as the market value grows.

However, the market share is currently less than 0.1%, and the industry will only be considered to have truly achieved explosive growth when it breaks through 3%.

This is the future these emerging trading companies are targeting, and the true growth point of blockchain.

If this logic is established and realized, the impact of blockchain and cryptocurrencies will be no less significant than "software eating the world".

It can be anticipated that the next 1-2 years will be a period of wild growth in this field, with more companies entering the market and forcing traditional stock service companies (TradFi) to transform. The door to this trend has already been opened.

But is stock tokenization the endpoint of blockchain? The author believes this is just an important step.

At the end of last year, MicroStrategy CEO Michael Saylor released a proposal titled "US Digital Asset Framework, Principles, and Opportunities". Regarding future prospects, Saylor predicted that the global digital capital market could grow from $2 trillion to $280 trillion, while the digital asset market (excluding Bitcoin) could grow from $1 trillion to $590 trillion.

We currently have three important turning points: first, the global enthusiasm for stablecoins, both in the West and the East; second, the continuous growth of on-chain scale for government bonds and money market funds, widely referred to as RWA; and third, the beginning of stock tokenization.

The ultimate scale Michael Saylor mentioned is the market after all these assets are on-chain, and the possible arrival of truly "everything on-chain" - a phrase that has been mentioned for years, from the bustling STO in 2018 to the current RWA and stock tokenization. We have finally reached the critical point, though the journey remains long and challenging, but it is underway.

Although these figures seem far-fetched now, it's similar to saying Bitcoin would reach $10,000 ten years ago, which seemed dramatic and absurd, but now it has reached $110,000 and continues to set new historical highs.

In the foreseeable future, we can see that blockchain is reshaping the form of asset presentation and value transfer, and whether it will reshape information transmission remains to be seen. Meanwhile, AI is reshaping information capture methods and bringing productivity transformation. Now, the technology tree is on the eve of explosion.

Coincidentally, both technologies have been dormant for over 10 years, from being ignored to being filled with bubbles, and then to value reconstruction. Perhaps it's time to release that "monster".

So, who will be the next big player to enter stock tokenization? We await with anticipation.