Our era lacks consensus, with only two macro propositions and personal choices:

- 1. Interaction between technology and society, successful internet industry, failed metaverse attempts, and Web3/blockchain proving itself;

- 2. Personal choices in the cycle, LABUBU is a high-end cultural symbol of industrial systematization, BTC holders are long-term beneficiaries of massive liquidity.

Image description: Dormant address activation image source: @whale_alert

In the LABUBU trend, even if everyone rejects its cultural and economic value, crypto enthusiasts must keep up with the times and actively embrace the new organism.

It's not because LABUBU and Non-Fungible Token are similar, which is like seeing everything as a nail when you have a hammer. We should accept this is a diverse world, an objective economic development law where niche products are reproduced in a mass way, and scale effects will make wealth grow exponentially.

Until reaching the true hard top, this industry will produce a real leader, such as Binance, USDT, BTC, or LABUBU. LABUBU's 1.08 million auction price is a psychological stabilizer, telling everyone this is the top, and there's still significant room for growth in what they hold, encouraging continued holding.

Searching for the Next Generation's Attention

$110,000 Bitcoin repels ordinary people, 1.08 million LABUBU uses tiered marketing.

Before Bitcoin's price breaks through $100,000, we've prepared for a long time, just like the anxiety and anticipation before Ethereum's Cancun upgrade. But we all know it will come, and when the psychological price is broken, when will 110,000 arrive, it won't be so attention-grabbing.

LABUBU's trend in crypto is gradually fading, and analyzing without chasing hot spots becomes more composed. LABUBU hasn't gone far away; everyone will return to their niche spaces, expecting to be noticed by the masses again next time.

In my view, LABUBU is the first time small-town youth learned to face the world through IP design, landing, and startup process, though I'm unsure how to close it, looking forward to a perfect finale.

This is more important for the crypto world deeply affected by Binance's listing effect disappearing, and Altcoins becoming more lost in the market tide. LABUBU is like a launch pad with many evergreen assets, MOLLY/LABUBU, etc., with its own secondary market Qiandao and Idle Fish, and even its own Pinduoduo-like platform.

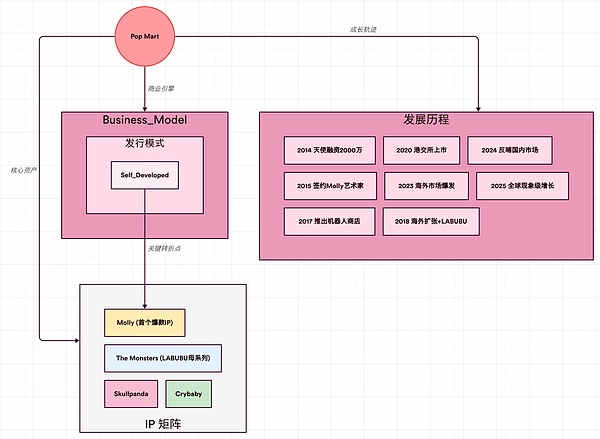

Reviewing Pop Mart's development, you'll find LABUBU isn't particularly important. In MOLLY's development cultivation, early blind box mode exercise, a nationwide hit like LABUBU was inevitable.

In more familiar terms, LABUBU is an asset, blind box is the asset issuance method, refined after 10+ years of crafting, an industrial thinking's complete victory over manual labor.

Image description: Pop Mart structure image source: @zuoyeweb3

If we go back to 2013, the popular phrase was "everything can be done again with mobile internet", in 2017 it was "everything can be done again with blockchain", so Pop Mart investor Mai Gang would understand Bitcoin.

Trends are different each time, but transformation always exists.

Mai Gang's guide in American venture capital is Tim Draper, who is one of Mentougou's largest creditors, a Coinbase investor, and an investor in almost all of Musk's projects: Tesla/SpaceX/SolarCity, and the toy platform Robinhood.

Whether Mai Gang or Draper, it doesn't matter if they understand Bitcoin's technical principles or the intrinsic relationship between rubber toys and grain stores. Catching the next generation's trend is key - don't try to educate young people, try to understand and respect them.

Although Bitcoin holders might think they're more high-end than LABUBU buyers, and LABUBU buyers might think they understand trends better than Bitcoin buyers.

So let's sell together, there's always one that suits you.

Positioning Ordinary People's Purchasing Power

Chain IP repeatedly fails, while Pop Mart becomes stronger with each setback.

I propose a counterintuitive point: the on-chain activity population isn't large enough, and funds are easily over-concentrated. Onekey's boss and a few friends can gather 1/5 of Resupply TVL, but LABUBU's price, no matter how high, will have hundreds or thousands of times more holders.

In other words, LABUBU doesn't want luxury, but ordinary people's purchasing power.

Bitcoin's spiritual core is highly similar. Although $110,000 Bitcoin isn't ordinary people's primary financial choice, in the past decade, each dip was a good entry opportunity. If you believe continuous massive liquidity will continue, then $1 million Bitcoin isn't impossible.

Fundamentally, Bitcoin hasn't let down any holder. 21 million quantity creates moderate scarcity, and high premium has real support.

LABUBU and Pop Mart understand this well. Wang Ning once said "seven-tenths full", which you can understand as moderate shortage maintaining heat, or as the economic basis for 20 times premium of its products.

In the secondary market, for Maotai, luxury goods, and Pop Mart, this is an existence that can't be officially acknowledged, but human speculative nature never sleeps, seemingly reaching a business tacit understanding naturally.

The premise is a ten-year layout, unlike the quickly born and dying Bing Dwen Dwen. Pop Mart's MOLLY still contributes profits, and Wang Ning believes IP cultivation requires continuous investment. Disney's legal department meme itself is an extreme representation of the company's IP importance.

Bitcoin is similar. I once found it hard to understand why a purely open-source, unmanaged, and even unprofitable Bitcoin community would exist. Today's crypto community is synonymous with distribution channels, but Linux and BTC communities are global proof of 10+ years of survival.

Even Linux has accompanied several generations, and Disney spans a century. So can Bitcoin become the next Linux, and Pop Mart the next Disney?

At least, their spiritual cores are highly similar: allowing more ordinary people to participate, encouraging generational updates, and keeping pace with new-era humans. Such examples are numerous: Disney's Lina Bell, Pop Mart's Crybaby, Linux's Rust transformation.

Bitcoin is most special, adopting founder invisibility and an unchanged strategy facing all changes, creating immense spiritual identity. People who participated in Bitcoin ten years ago still exist, and new humans twenty years later can still participate.

Conclusion

Even if the whole world doesn't understand LABUBU, crypto enthusiasts shouldn't deny its enormous value. We should even learn, imitate, and even surpass it.

Pop Mart has four IPs with annual sales over 1 billion yuan. Initial IP Molly already accounts for less than 30% of total revenue. Current Bitcoin still occupies over 50% of crypto total market value, showing our new product ability is inferior to grain stores. We should work harder.

Telling crypto stories doesn't necessarily mean telling crypto's stories. The next proposition is: LABUBU entering a financial cycle. Cursing, rejoicing, or regretting is meaningless. We only have one question: Where is the next one? How to participate?