On July 4, 2025, a major event occurred in the Bitcoin network that shook the entire cryptocurrency market - 8 "ancient" Bitcoin addresses that had been dormant for 14 years were suddenly activated, and a total of 80,009 BTC (worth about $8.69 billion) were transferred to 8 new addresses. This event quickly became the focus of the crypto community, not only because of its huge amount of funds that could have a huge impact on the market, but also because the mysterious background of these "dormant" Bitcoins triggered various speculations about the identity of the holders. This article will comprehensively analyze the ins and outs of this event, deeply explore its potential market impact, and objectively evaluate various theories about the identity of the holders.

Event Overview: The Bitcoin whale that had been sleeping for 14 years suddenly woke up

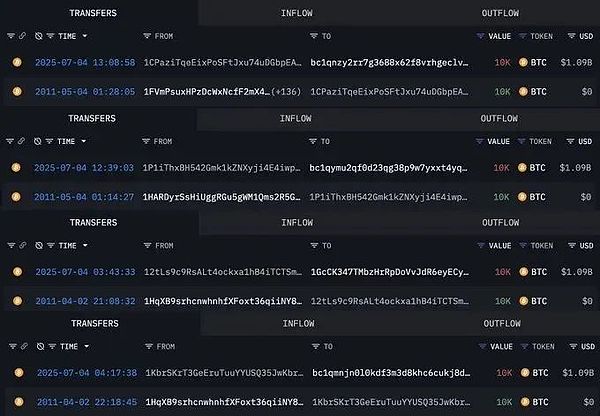

Starting at noon on July 4, 2025, on-chain data monitoring tools (including Arkham, Lookonchain, etc.) have successively captured a series of abnormal large-scale Bitcoin transfer activities. Eight "dormant" Bitcoin addresses that have never had any transaction records since 2011 were suddenly activated, and a total of 80,009 Bitcoins held by them were transferred in batches to eight new receiving addresses. Calculated at the current Bitcoin price, the total value of this batch of transferred assets is as high as 8.69 billion US dollars, becoming one of the largest "ancient" Bitcoin movement events in recent years.

These activated original addresses can be divided into two groups:

Group 1: 2 addresses, each received 10,000 BTC (20,000 in total) on April 2, 2011, when the price of Bitcoin was only $0.78;

The second group: 6 addresses received a total of 60,009 BTC (an average of about 10,000 per address) on May 4, 2011, when the Bitcoin price was $3.37.

This means that the holders of this batch of Bitcoins have never touched these assets in more than 14 years. During this period, the price of Bitcoin soared from less than $4 to nearly $110,000, achieving a value increase of more than 100,000 times.

Transfer details and technical features

This large transfer operation showed a high degree of planning and technical proficiency. All the transferred bitcoins were not sent directly to any known exchange address, but were dispersed into 8 new SegWit (Bech32) format addresses, each of which received about 10,000 BTC. The choice of this receiving address is quite meaningful:

1. SegWit technology adoption: The new address uses the Bech32 format, a more modern and efficient Bitcoin address format that supports Segregated Witness technology, which can reduce transaction fees and enhance scalability. This shows that the operator has a good understanding of the latest developments in the Bitcoin network, rather than being a technical "laggard" who has been out of touch with the community for a long time.

2. Fund diversification strategy: The original funds are evenly distributed to multiple new addresses, each of which holds about 10,000 BTC (worth about $1.09 billion). In the view of chain analysis experts, this layout may indicate a subsequent batch disposal plan - whether it is a gradual sale, further mixing of coins, or simply for asset management optimization.

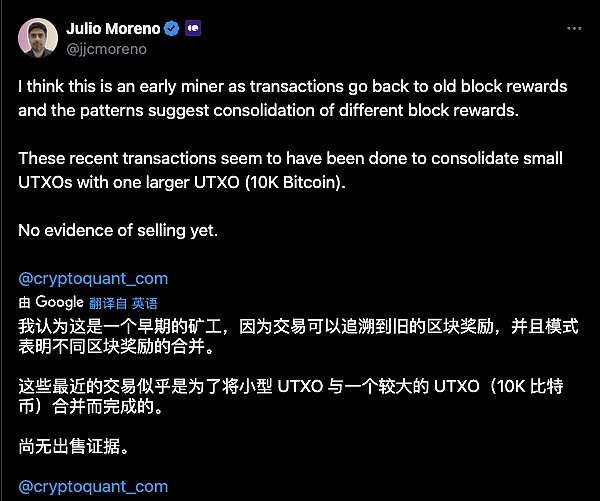

3. Transaction structure characteristics: According to the analysis of CryptoQuant analyst Julio Moreno, the UTXO (unspent transaction output) source of these transactions is shown to be early block rewards, and its transfer structure shows the typical miner "clearance and reconstruction" characteristics, that is, the process of integrating multiple smaller UTXOs into a larger output.

As of July 5, 2025, these transferred bitcoins are still quietly stored in the new address without any further action. However, major cryptocurrency exchanges and analysis platforms around the world have marked these addresses as "high-risk" monitoring targets and track their fund movements at any time.

On-chain data analysis: Tracing the transfer path of ancient Bitcoin

The transparency of blockchain data provides researchers with a unique opportunity to deeply analyze the transfer trajectory of these 80,009 bitcoins. By interpreting these on-chain features, we can infer the possible intentions and technical proficiency of the operators and provide a basis for predicting future behavior.

Historical background of the original address

This batch of activated "ancient" addresses has several distinct common features, which provide important clues for inferring the identity of the holders. All eight original addresses remained completely silent for 14 years before activation, without any transfer records in or out. This extreme "dormant" state is not uncommon among early Bitcoin holders, but such large-scale and synchronous activation is unusual.

It is worth noting that the time when these addresses received Bitcoins - April and May 2011 - was in the early development stage of Bitcoin. At that time, the Bitcoin network had just started, and the main participants were limited to cryptography enthusiasts, libertarians, and technology pioneers. In April 2011, the price of Bitcoin was less than $1, and it slowly climbed to around $3 in May. Individuals who could accumulate such a large amount of Bitcoin at this time are very likely directly related to the core development or early mining activities of Bitcoin.

Technical details of the transfer transaction

From a technical perspective, this batch of transfer transactions shows that the operator has deep knowledge and rich experience in blockchain operations. The transferred bitcoins were eventually evenly distributed to 8 new addresses, with each address receiving about 10,000 BTC. This even distribution pattern shows a high degree of planning and precision.

Of particular note are the technical features of the new addresses. Unlike the traditional address format (P2PKH) common in 2011, the new addresses for receiving this batch of "ancient" bitcoins all use the Bech32 format, which is the Segregated Witness (SegWit) address defined in the Bitcoin Improvement Proposal BIP 0173. SegWit was activated in 2017 and effectively solved the transaction scalability problem faced by Bitcoin by optimizing the storage method of transaction signature data. The use of this modern address format shows that the operator has not only been paying close attention to the development of the Bitcoin protocol, but also actively adopting the latest technical improvements to optimize its asset management.

Interpretation of transaction purpose from multiple angles

On-chain analysts have proposed several possible explanations for the purpose of this massive transfer:

1. Asset reorganization and management optimization: The most optimistic interpretation is that this is just a routine asset management operation. After 14 years of holding, the original wallet may have become outdated, and the holder may upgrade the wallet for security reasons or to facilitate inheritance by future generations. Spreading funds to multiple new SegWit addresses can improve privacy and management flexibility.

2. Preparations before selling: A more pessimistic view is that this may be a prelude to a large-scale sell-off. By spreading funds to multiple addresses, holders may be prepared to adopt a "batch shipment" strategy and gradually cash out on exchanges to reduce the impact on the market. Historically, similar large-scale "dormant" Bitcoin movements often foreshadow market fluctuations.

3. Private key leakage or change of ownership: Another possibility is that the private keys of these bitcoins have been leaked recently or are controlled by new owners. Considering the 14-year time span, the original holders may have passed away, and these assets may be discovered and taken over by heirs. In addition, the possibility of hacker attacks cannot be completely ruled out, although this is less likely for long-term cold storage of bitcoins.

Table: Overview of key data of Bitcoin whale transfer events

Potential market impact: $8.69 billion "black swan" mystery

The 80,009 bitcoins that were suddenly activated are like a sword of Damocles hanging over our heads in the current market environment, and their potential market influence cannot be underestimated. Based on the current price, the total value of this fund is as high as 8.69 billion US dollars, which is large enough to shake the fund balance of the entire cryptocurrency market. Market analysts generally believe that this may be the biggest potential source of selling pressure facing the Bitcoin market since the Mt.Gox Bitcoin unlocking incident.

Analysis of the market share of whale holdings

To fully understand the relative size of this money, we can compare it to other major holders in the Bitcoin market:

MicroStrategy: This listed company, known for its large holdings of Bitcoin, currently holds approximately 597,000 BTC. The 80,009 BTC activated this time is equivalent to 13.4% of its total holdings.

Satoshi Nakamoto's holdings: Satoshi Nakamoto, the anonymous founder of Bitcoin, is believed to hold approximately 1.26 million BTC (mainly from early block rewards). This batch of transferred funds is equivalent to 6.35% of Satoshi Nakamoto's known address holdings.

Bitcoin ETF: The net absorption of global Bitcoin ETFs in the second quarter of 2025 was 111,000 BTC, which means that if this whale decides to sell all of them, its selling pressure will be equivalent to 72% of the entire ETF market's absorption in one quarter.

Holdings of listed companies: In Q2 2025, the total net increase in Bitcoin holdings by global listed companies was 131,000 BTC, and the holdings of whale accounted for 61% of this figure.

These comparisons clearly show that the size of this fund has reached a level sufficient to affect the liquidity of the entire Bitcoin market, and any selling decision by its holders will have a substantial impact on the price.

Market acceptance capacity assessment

Can the current daily liquidity of the Bitcoin market digest such a large-scale potential sell-off? Data shows that although the spot trading volume of major exchanges has increased significantly, it is still facing pressure to take over:

As the world's largest cryptocurrency exchange, Binance's Bitcoin spot trading volume in the past 24 hours was about US$1 billion, which means that the sell-off of US$8.69 billion is equivalent to the total spot trading volume of the entire platform for 8.69 full trading days.

More importantly, it is impossible for a sell-off of this scale to be absorbed by the market in a short period of time without causing a sharp drop in prices. Trading depth data shows that even on the deepest exchanges, a market order of more than 1,000 BTC will cause a price slippage of 1-2%. If tens of thousands of bitcoins are sold at the same time, the price drop may be extremely significant.

Market impact under different sell-off scenarios

Depending on the models constructed by market analysts, different treatments of this money could lead to very different market outcomes:

1. One-time concentrated selling: The most pessimistic scenario is that holders choose to sell all of their holdings in a short period of time. In this case, the price of Bitcoin may suffer a "halved drop", with a drop of more than 50% in the short term, triggering a chain reaction, including forced liquidation of leveraged positions, sharp fluctuations in the derivatives market, and a rapid deterioration of market sentiment.

2. Slow shipment in batches: If holders choose to sell gradually in batches over a longer period of time (such as 6-12 months), the market impact will be relatively mild. Assuming that no more than 5,000 BTC are sold per month (about 2-3% of the monthly trading volume of global exchanges), the market price may be subject to 10-20% periodic pressure, but it will not lead to a systemic collapse.

3. Continue to hold: In the optimistic scenario, if this is just a routine wallet management operation and Bitcoin continues to remain in cold storage, the direct impact on the market will be very limited. However, the subsequent activities of these addresses will continue to be watched by the market, forming a "pending" psychological impact.

Table: Estimated market impact of potential sell-off of 80,009 BTC

Immediate market reaction and institutional warning

Although these bitcoins have not yet flowed into exchanges as of July 5, 2025, the market has already reacted nervously. After the news came out, the price of Bitcoin fell back by about 3% in a short period of time, and the volume of short orders on mainstream exchanges increased significantly. Several trading platforms, including Binance and OKX, have included these new addresses in special monitoring lists to track fund movements in real time.

Institutional investors also responded quickly. Data shows that the net inflow rate of Bitcoin ETFs has slowed down after the incident was exposed, and the premium rate of Grayscale GBTC has narrowed slightly, indicating that some institutional investors have adopted a wait-and-see attitude. Many analysis agencies have issued risk warnings, advising customers to be cautious in chasing high prices at the current price to prevent potential whale selling risks.

"A move of 'dormant' Bitcoin of this magnitude will always cause market nervousness," said the chief strategist at cryptocurrency hedge fund XYZ Capital. "While we don't yet know the ultimate intentions of the holders, from a risk management perspective, investors should consider hedging downside risk, or at least reducing leverage exposure."

The mystery of the owner's identity: three main speculations and an assessment of the evidence

The sudden transfer of 80,009 bitcoins naturally sparked heated speculation about the identity of the holder. After cross-analyzing the characteristics of on-chain data, the early history of Bitcoin, and public information, the crypto community has gradually formed three main speculation directions. Each speculation has its supporting evidence and doubts. We will analyze the rationality of these theories one by one.

Hypothesis 1: Early Bitcoin miners (most accepted hypothesis)

The most accepted explanation in the industry is that these bitcoins belong to an independent miner or a small group of miners in the early Bitcoin network. Coinbase executive Conor Grogan pointed out on the X platform that this batch of funds most likely came from a single miner in 2011, who integrated 180 mining reward blocks at the time and had a wallet address containing 200,000 bitcoins in 2011.

The on-chain evidence supporting this theory is quite strong:

Source of block rewards: Julio Moreno, head of research at CryptoQuant, analyzed that the UTXO (unspent transaction output) of the transaction can be traced back to the early block rewards, and its transfer structure shows the typical characteristics of miners' "clearance and reconstruction".

Characteristics of the mining era: In 2011, Bitcoin mining was extremely easy and could be done with a normal CPU. Each block was rewarded with 50 BTC and there was almost no competition. Early miners could accumulate a large amount of Bitcoin in a very short period of time.

Holding pattern: This long-term holding, almost "forgotten" pattern is consistent with the attitude of early technology idealists towards Bitcoin - they see Bitcoin as a social experiment or future currency rather than a speculative asset.

If this theory holds true, the miner's wealth at current prices would reach a staggering $22 billion, making him one of the richest individual holders in Bitcoin history. However, this also raises new questions: Why choose to activate these addresses now, 14 years later? Possible explanations include estate planning, private key backup updates, or the decision to finally cash out some of the wealth.

Guess 2: Fried Cat (Jiang Xinyu) - One of the "Fathers of Bitcoin" in China

In the Chinese community, many people have linked these bitcoins to the long-lost legend in the crypto, Friedcat (real name Jiang Xinyu). Friedcat is a genius who graduated from the junior class of the University of Science and Technology of China. He was admitted to the University of Science and Technology of China at the age of 15 and later went to Yale University for a visiting scholar program. In 2012, he launched a crowdfunding campaign on the BitcoinTalk forum under the name "friedcat" and successfully founded ASICminer, becoming one of the earliest entrepreneurs to develop a dedicated Bitcoin mining machine.

At one time, FriedCat's mining machines accounted for 42% of the global Bitcoin network's computing power, and the company was known as the "mining tyrant" with unlimited glory. However, he suddenly disappeared mysteriously at the end of 2014, and his whereabouts are still unknown, and no public clues have been left. His sudden disappearance and close connection with the early days of Bitcoin naturally led people to speculate that this batch of "dormant" Bitcoins may be related to him.

However, this theory suffers from several glaring timeline inconsistencies:

Time mismatch: This batch of activated bitcoins was first received in April 2011, while Baked Cat’s bitcoin activities (according to public records) began in 2012. Baked Cat only started developing mining machines and earning a lot of bitcoin in 2012.

Address characteristics do not match: FC’s known public address activities started in 2013, and its transaction pattern is more consistent with the characteristics of mining machine sales revenue rather than early mining rewards.

Technical differences: Friedcat is mainly active in the BitcoinTalk forum and domestic forums, while the address transferred this time shows the style of an "independent miner", and there are differences in the technical behavior patterns of the two.

Therefore, although the legendary story of FriedCat is fascinating, based on the existing evidence, it is less likely that this batch of bitcoins belongs to him.

Guess 3: Roger Ver ("Bitcoin Jesus")

Many people in the Western community speculate that these bitcoins may be related to Roger Ver, an early Bitcoin evangelist. Roger Ver was dubbed "Bitcoin Jesus" for his early promotion of Bitcoin. He started investing in Bitcoin in 2011 and was one of the first entrepreneurs to accept Bitcoin payments (MemoryDealers.com). He also invested in many early Bitcoin projects such as BitPay, Ripple, and Blockchain.info.

Some of the evidence supporting this speculation includes:

Timing matches: Roger Ver has indeed been heavily involved in Bitcoin activity since 2011, which is consistent with the creation of these addresses.

Legal Pressure: Roger Ver is currently facing tax evasion charges from the IRS for $48 million and faces possible extradition and criminal penalties, which may be his motivation for using his early assets to deal with the legal crisis.

Libertarian Beliefs: Roger Ver is a well-known libertarian, and it is in line with his philosophy to hold a large amount of Bitcoin for a long time and not sell it easily.

However, this theory lacks direct on-chain evidence. Roger Ver himself has publicly stated that he does not use early assets, and his existing known cold wallets have no obvious connection with these activated addresses. The community's speculation is based more on his legal difficulties and timing coincidences rather than substantive evidence.

Furthermore, the style of operations of these addresses (such as SegWit adoption) does not fully align with Roger Ver’s known technical preferences. Therefore, while this speculation has been widely circulated on social media, it is generally more emotional and speculative.

Other possibilities explored

In addition to the three main speculations mentioned above, analysts have also proposed several other possibilities:

1. Funds from early exchanges or service providers: These may be residual funds from cold wallets of closed early Bitcoin exchanges (such as Mt.Gox). However, such funds usually have more complex transaction histories, which do not match the "miner reward" characteristics of these funds.

2. Satoshi Nakamoto-related addresses: Some people speculate that this may be related to Satoshi Nakamoto, the anonymous founder of Bitcoin. However, Satoshi Nakamoto's known mining activities were concentrated in 2009-2010, and the technical characteristics of this batch of addresses (such as activity only started in 2011) do not match Satoshi Nakamoto's mining period.

3. Legal seizure or estate execution: It may be assets seized by judicial authorities or "lost" Bitcoins discovered by estate executors. The person who held Bitcoin in 2011 may have passed away now, and these assets may be discovered and taken over by the heirs.

4. Long-term investment institutions: A very small number of early investment institutions may have allocated Bitcoin in 2011. However, almost no professional investment institutions were interested in Bitcoin at that time, and it is unlikely that institutional investors would not operate at all for 14 years.

Historical comparison and industry enlightenment: the laws and impacts of ancient Bitcoin movement

In the more than ten years since the Bitcoin network was launched, this is not the first time that a similar large-scale "dormant" Bitcoin activation event has occurred. By analyzing historical cases, we can identify certain regular characteristics and assess the long-term impact of such events on the cryptocurrency ecosystem. The transfer of 80,009 BTC has left another case in the history of Bitcoin development that deserves in-depth study.

Comparative analysis of similar historical cases

In recent years, the Bitcoin network has experienced several activations of "ancient" Bitcoins, but the scale and context vary:

1. Dormant whale in November 2024: Two "dormant" addresses holding 404 and 429 BTC (a total of $80.77 million) were activated after 10.9 years of silence. Similar to this incident, these bitcoins also came from the early stages (around 2011), but on a much smaller scale. The market reaction was relatively mild at the time, and analysts believed that such small-scale activations had limited impact on the overall market.

2. The so-called "Satoshi" Bitcoin movement: Bitcoin research organization BTCparser has theorized that Satoshi Nakamoto may have resumed mining in 2010 under another identity and accumulated thousands of BTC. The "2010 whale" is said to have strategically sold Bitcoin since 2019, and by November 2024, he had transferred a total of 24,000 BTC. This planned cash-out behavior contrasts with the one-time large-scale transfer in this incident.

3. Bitcoin release by Mt.Gox creditors: As one of the most famous Bitcoin unlocking events in history, the Bitcoin repayment process after the bankruptcy of Mt.Gox had a long-term impact on the market. Unlike this incident, the Bitcoin of Mt.Gox was widely distributed and well-predicted, while the control of the 80,009 BTC this time is completely concentrated in the hands of a single individual or entity.

By comparison, we can find that the uniqueness of this event lies in its large scale and long holding period. 80,009 BTC suddenly moved after being held for 14 years, setting a new record for the single activation of "dormant" Bitcoin. Even if the funds of this scale are not immediately sold on the exchange, they will have a profound impact on market psychology.

Behavior patterns of long-term holders

There is a type of long-term holder in the Bitcoin network called "Diamond Hands" who are able to withstand market fluctuations and hold Bitcoin for a long time without selling it easily. By analyzing the behavior of these holders, several common patterns can be identified:

1. Technical idealists: Bitcoin attracted many technical idealists in its early days, who viewed Bitcoin as a social experiment or future monetary system. Such holders are often the most likely to hold it for a long time, and will not consider using it until there are major changes in the individual or family (such as health problems or estate planning).

2. Libertarians: Influenced by the Austrian School of Economics, many early Bitcoin holders are staunch libertarians who see Bitcoin as a tool to combat fiat currency inflation. Such holders usually adopt a "buy and hold forever" strategy and will not sell unless faced with extreme circumstances (such as legal crises or survival needs).

3. Institutional and fund investors: Professional Bitcoin investors that have emerged in recent years (such as listed companies, ETFs, and investment funds) usually have clear fund management strategies. Their buying and selling decisions are more based on cash flow needs and risk balance rather than long-term holding concepts.

The holders in this incident clearly belong to the first two categories of early participants. It is extremely rare in the volatile cryptocurrency market to be able to purchase or mine a large number of Bitcoins in 2011 and hold them until now. This also makes the market pay special attention to their final decision - if such "diamond hands" choose to sell, does it mean that Bitcoin has reached a certain long-term valuation peak?

Systemic impact on the cryptocurrency ecosystem

The sudden activation of such a large-scale Bitcoin will have multi-level impacts on the entire cryptocurrency ecosystem:

1. Market structure and liquidity impact:

Increasing the actual circulating supply of Bitcoin could change the short-term supply and demand balance

Prompt exchanges and market makers to adjust their liquidity provision strategies to prevent potential large sell-offs

It may give rise to a new over-the-counter bulk trading market, reducing the direct impact on the spot market

2. Increased focus on supervision and compliance:

Attracting regulatory attention to large Bitcoin holders, potentially increasing transaction monitoring

Increased requirements for cryptocurrency tax compliance, especially capital gains tax collection for long-term holders

Encourage exchanges to improve their large-value transaction reporting system to prevent market manipulation

3. Evolution of technology and security practices:

Highlighting the technical challenges of long-term custody of private keys and promoting more robust multi-signature and inheritance solutions

Promote the advancement of on-chain analysis tools and improve early warning capabilities for large-scale fund movements

May accelerate the adoption of privacy technologies (such as CoinJoin) and help large holders reduce market influence

4. Changes in investor psychology and behavior:

Shake up the absoluteness of the "HODL" culture and encourage investors to more rationally evaluate long-term holding strategies

Improve market awareness of "supply shocks" so that price models focus more on actual circulation rather than total supply

Strengthening Bitcoin’s “Store of Value” Narrative Even in the Face of Heavy Selling Pressure

From a broader perspective, such events are actually stress testing the maturity of the Bitcoin system. A network of assets worth trillions of dollars must be able to accommodate the reasonable asset allocation needs of large holders while maintaining overall market stability. The evolution of this process will profoundly affect the future development path of Bitcoin as digital gold.