Original author: Weilin, PANews

Original link: https://www.panewslab.com/zh/articles/tp9aul8y

Disclaimer: This article is a reprint. Readers can get more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. The reprint is only for information sharing and does not constitute any investment advice, and does not represent Wu Blockchain views and positions.

On July 3, the first Solana staking ETF in the United States, REX-Osprey Solana staking ETF (code: SSK), was officially listed on the Chicago Board Options Exchange (Cboe BZX) and received a relatively positive market response. The first-day trading volume was $33 million, with $12 million in inflows, and the performance exceeded the expectations of many market observers.

The ETF not only tracks the market price of Solana (SOL), but also provides investors with Solana staking rewards. It is jointly managed by REX Shares and its sister company Osprey. The first-day trading volume has exceeded the earlier launched Solana futures ETF and XRP futures ETF.

Compared with traditional crypto asset ETFs, the REX-Osprey Solana staking ETF offers an innovative feature - a variable monthly dividend on staking rewards, with a current dividend rate of 7.3%. Bloomberg ETF analyst James Seyffart commented: "This is a healthy start to trading," noting that trading volume reached $8 million in the first 20 minutes of listing.

Providing direct price exposure and staking rewards for SOL

Looking back at the recent performance of the SOL futures ETF, on March 17, the Solana futures ETF of the Chicago Mercantile Exchange (CME) was listed, with a first-day trading volume of US$12.1 million, which was lower than market expectations. On March 20, Volatility Shares launched two Solana futures ETFs, The Solana ETF (SOLZ) and 2x Solana ETF (SOLT). According to Yahoo Finance, as of April 1, the two products have performed steadily since their listing, with average daily trading volumes of approximately 80,000 and 140,000, or US$1.25 million and US$2.16 million, respectively. The volume remains small, indicating that market demand has not been effectively boosted.

In comparison, in January 2024, the total trading volume of multiple spot Bitcoin ETFs listed on their first trading day reached US$4.6 billion.

The Solana collateralized ETF “SSK” performed well after its launch, bypassing the traditional regulatory framework by registering as a “Type C Corporation”. Are other copycat ETFs on the way?

According to the official website, SSK is designed to meet the needs of a variety of investors:

Retail investors seeking exposure to cryptocurrencies through brokerage accounts

Crypto-native investors who want to support the bridge between blockchain innovation and mass adoption

Financial advisors and registered investment advisors (RIAs) seeking compliant access to blockchain income

Institutions that need ETF transparency

According to official tips, staking rewards are paid to the fund in kind and increase its net asset value (NAV), which may result in taxable income for shareholders. Depending on the fund's earnings and distributions, these income may be treated as ordinary income, capital gains, or capital returns. Investors should consult a tax advisor for relevant guidance.

“C-Corporation” structure bypasses traditional regulatory framework

The REX-Osprey Solana Collateralized ETF was able to be launched in a relatively short period of time, in part due to its choice of a "C-Corporation" registration form. This structure allowed the fund to bypass the traditional ETF approval process and quickly go public. Unlike traditional crypto asset ETFs, the REX-Osprey Solana Collateralized ETF chose to register under the Investment Company Act of 1940 rather than the Securities Act of 1933.

The requirements of the Investment Company Act of 1940 for ETFs require that they be diversified, distribute income regularly, and avoid investing in assets that are considered too risky for retail investors (such as futures, commodities, and Bitcoin derivatives). These restrictions make the Investment Company Act of 1940 funds a good fit for stocks and fixed income assets, but more complicated when dealing with assets such as commodities and futures, which usually fall into the category of "33 Act" funds - such as grantor trusts (physical trusts providing spot price access) and publicly traded partnerships or commodity pools (futures-based portfolios).

Meanwhile, the tax rules for the 40 Act are simple, with capital gains taxed at 20% for long-term holdings of more than 12 months, and distributions taxed at ordinary income rates (up to 37%). The tax treatment for the 33 Act requires dealing with complex tax paperwork.

Unlike existing spot Bitcoin and Ethereum ETFs, SSK falls under a different regulatory framework, registered under the Investment Company Act of 1940. This means that a qualified custodian, rather than the fund issuer, is required to hold the underlying assets. Anchorage Digital, currently the only bank with federal regulatory authorization to both custody and pledge digital assets, plays this role.

Double taxation increases investment costs and may attract other copycat ETFs to follow suit

This structure is not without controversy, with tax issues being one of its main challenges. Since staking rewards are treated as ordinary income, the fund is subject to corporate income tax, while investors are also subject to dividend tax and capital gains tax. This makes the overall tax burden high, despite the fund's management fee of 0.75%.

In addition, although there were no significant obstacles in the SEC's approval process, due to the innovative nature of this structure, the SEC has shown hesitation about C-type companies circumventing traditional approval procedures, which means that there is uncertainty about whether this model is applicable to the launch of more funds in the future. In the context of increasingly fierce market competition, the REX-Osprey Solana pledge ETF may provide a reference structure for other crypto asset ETFs in the future, but it may also face more regulatory scrutiny in the future.

Jason Chen, an independent crypto researcher and KOL, explained: "So the threshold is low and the approval speed is fast. From submission to approval, it can be completed within 75 days as long as the SEC does not object. But the disadvantage is that on the one hand, because it has not been through very strict approval, the strictness of subsequent disclosure will be much higher than the regular disclosure of 19b-4. Instead, it needs to be disclosed every day, which will increase management costs and will be double taxed. When the price of the currency rises, it will be regarded as a profit of the company, so the company will be charged 21% corporate income tax, and investors will also be charged dividend tax and capital gains tax. Therefore, 19b-4 is more suitable for mature large assets such as BTC, while the 1940 Company Investment Act applies to SOL and a series of other Altcoin."

Some users also commented on the topic of predicting the market, raising the corresponding risk that the price of the ETF cannot accurately reflect the price changes of SOL. The SEC documents submitted by SSK show that "under normal market conditions, the SSK ETF will invest at least 80% of its net assets in reference assets and other assets that provide exposure to reference assets. The fund will invest directly or through REX-Ospre SOL subsidiaries. Although the fund seeks returns corresponding to the reference assets, the performance of the fund will not completely replicate the performance of the reference assets (that is, due to factors such as staking rewards, trading and other fees, the fund's returns will not necessarily be the same as the reference assets, although they will generally be in the same direction, whether positive or negative)."

The application process was full of twists and turns, but it was finally successfully "passed"

In May, REX Shares and Osprey Funds filed applications with the U.S. Securities and Exchange Commission (SEC) seeking approval to launch C-corporation ETFs focused on Solana and Ethereum.

On May 30, the SEC asked REX and Osprey to delay the effective date of their registration statements, citing unresolved issues regarding whether the proposed fund structures meet the definition of an “investment company” under the Investment Company Act of 1940.

On June 29, the SEC notified REX Shares and Osprey Funds that it had “no further comments” on their Solana collateralized ETF application. In ETF regulatory terms, industry observers generally regard this statement as an implicit approval from the SEC. This is the same as the “tacit approval” given by BlackRock, Fidelity and other companies when they launched spot Bitcoin ETFs.

Bloomberg analyst James Seyffart noted at the time that the funds’ “unique” C-corporation format could circumvent the typical 19b-4 rule change process, and the SEC’s silence on the C-corporation workaround now appears to confirm it as a compliant solution.

Originally, the path to staking usually meant handing over tokens to a crypto exchage or configuring your own validator setup, but the SSK ETF significantly lowers this barrier. For the first time, traditional investors can get passive exposure to Solana and earn staking returns through the same brokerage account they use for stocks or index funds. The approval of the Solana staking ETF now provides a roadmap. However, Ethereum's staking mechanisms (such as penalties and longer unlocking periods) may have more complications.

Some market opinions point out that, at least under the supervision of the current US government, the SEC is not trying to completely block pledges. It just needs the right framework: a framework that can handle returns, taxes, custody and compliance in a way that traditional finance understands. Although REX and Osprey are not household names like BlackRock, they now have a first-mover advantage in this field that may become a multi-billion dollar ETF category.

Currently, multiple companies are vying for the opportunity to launch a Solana spot ETF, with Invesco and Galaxy joining the race at the end of June. Analyst Balchunas said the funds could be approved within two to four months. There are currently at least 60 other Altcoin ETF proposals awaiting SEC review and potential approval.

Original link: https://www.panewslab.com/zh/articles/tp9aul8y

Disclaimer: This article is a reprint. Readers can get more information through the original link. If the author has any objection to the reprint format, please contact us and we will modify it according to the author's request. The reprint is only for information sharing and does not constitute any investment advice, and does not represent Wu Blockchain views and positions.

On July 3, the first Solana staking ETF in the United States, REX-Osprey Solana staking ETF (code: SSK), was officially listed on the Chicago Board Options Exchange (Cboe BZX) and received a relatively positive market response. The first-day trading volume was $33 million, with $12 million in inflows, and the performance exceeded the expectations of many market observers.

The ETF not only tracks the market price of Solana (SOL), but also provides investors with Solana staking rewards. It is jointly managed by REX Shares and its sister company Osprey. The first-day trading volume has exceeded the earlier launched Solana futures ETF and XRP futures ETF.

Compared with traditional crypto asset ETFs, the REX-Osprey Solana staking ETF offers an innovative feature - a variable monthly dividend on staking rewards, with a current dividend rate of 7.3%. Bloomberg ETF analyst James Seyffart commented: "This is a healthy start to trading," noting that trading volume reached $8 million in the first 20 minutes of listing.

Providing direct price exposure and staking rewards for SOL

Looking back at the recent performance of the SOL futures ETF, on March 17, the Solana futures ETF of the Chicago Mercantile Exchange (CME) was listed, with a first-day trading volume of US$12.1 million, which was lower than market expectations. On March 20, Volatility Shares launched two Solana futures ETFs, The Solana ETF (SOLZ) and 2x Solana ETF (SOLT). According to Yahoo Finance, as of April 1, the two products have performed steadily since their listing, with average daily trading volumes of approximately 80,000 and 140,000, or US$1.25 million and US$2.16 million, respectively. The volume remains small, indicating that market demand has not been effectively boosted.

In comparison, in January 2024, the total trading volume of multiple spot Bitcoin ETFs listed on their first trading day reached US$4.6 billion.

The Solana collateralized ETF “SSK” performed well after its launch, bypassing the traditional regulatory framework by registering as a “Type C Corporation”. Are other copycat ETFs on the way?

According to the official website, SSK is designed to meet the needs of a variety of investors:

Retail investors seeking exposure to cryptocurrencies through brokerage accounts

Crypto-native investors who want to support the bridge between blockchain innovation and mass adoption

Financial advisors and registered investment advisors (RIAs) seeking compliant access to blockchain income

Institutions that need ETF transparency

According to official tips, staking rewards are paid to the fund in kind and increase its net asset value (NAV), which may result in taxable income for shareholders. Depending on the fund's earnings and distributions, these income may be treated as ordinary income, capital gains, or capital returns. Investors should consult a tax advisor for relevant guidance.

“C-Corporation” structure bypasses traditional regulatory framework

The REX-Osprey Solana Collateralized ETF was able to be launched in a relatively short period of time, in part due to its choice of a "C-Corporation" registration form. This structure allowed the fund to bypass the traditional ETF approval process and quickly go public. Unlike traditional crypto asset ETFs, the REX-Osprey Solana Collateralized ETF chose to register under the Investment Company Act of 1940 rather than the Securities Act of 1933.

The requirements of the Investment Company Act of 1940 for ETFs require that they be diversified, distribute income regularly, and avoid investing in assets that are considered too risky for retail investors (such as futures, commodities, and Bitcoin derivatives). These restrictions make the Investment Company Act of 1940 funds a good fit for stocks and fixed income assets, but more complicated when dealing with assets such as commodities and futures, which usually fall into the category of "33 Act" funds - such as grantor trusts (physical trusts providing spot price access) and publicly traded partnerships or commodity pools (futures-based portfolios).

Meanwhile, the tax rules for the 40 Act are simple, with capital gains taxed at 20% for long-term holdings of more than 12 months, and distributions taxed at ordinary income rates (up to 37%). The tax treatment for the 33 Act requires dealing with complex tax paperwork.

Unlike existing spot Bitcoin and Ethereum ETFs, SSK falls under a different regulatory framework, registered under the Investment Company Act of 1940. This means that a qualified custodian, rather than the fund issuer, is required to hold the underlying assets. Anchorage Digital, currently the only bank with federal regulatory authorization to both custody and pledge digital assets, plays this role.

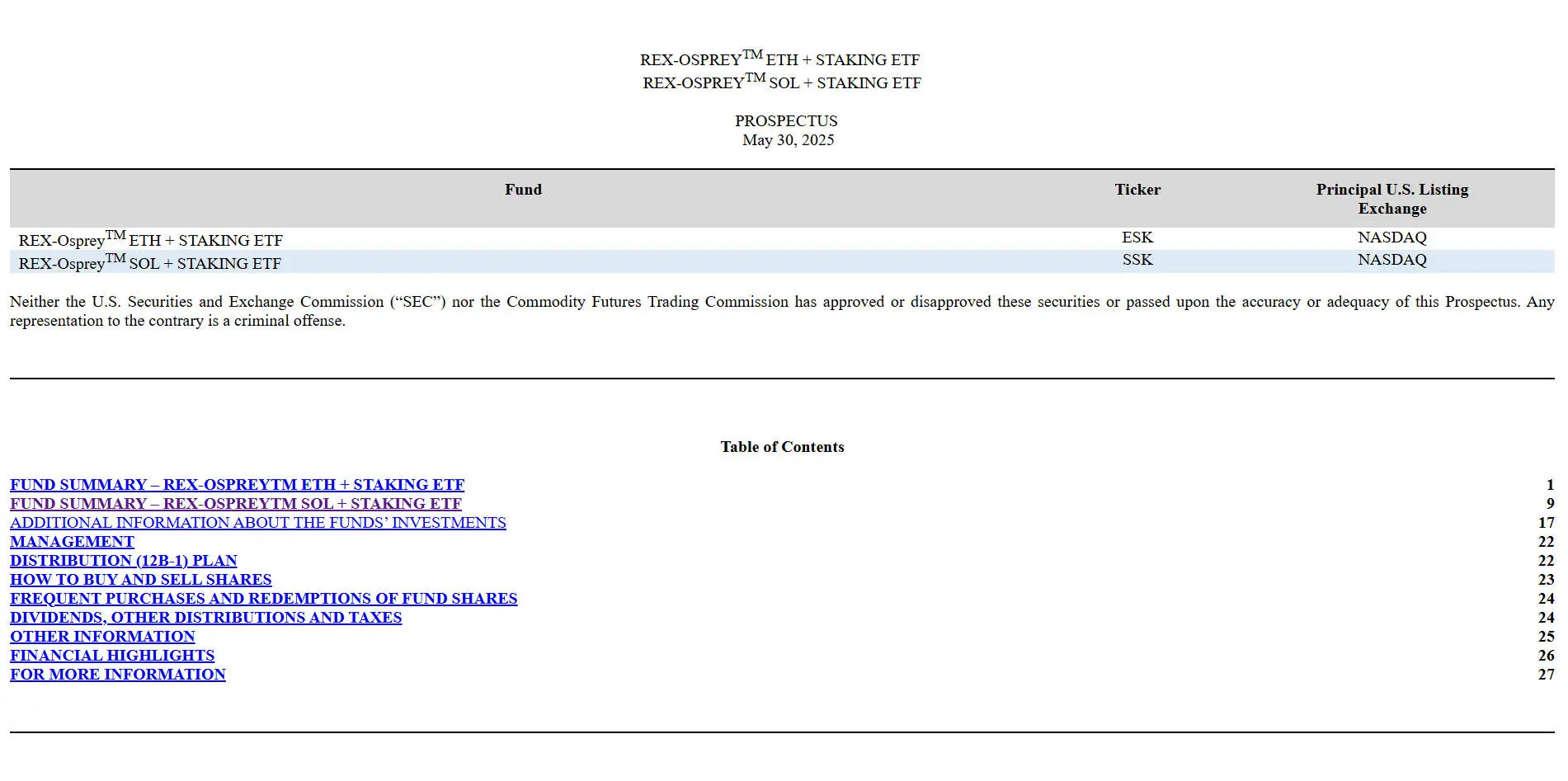

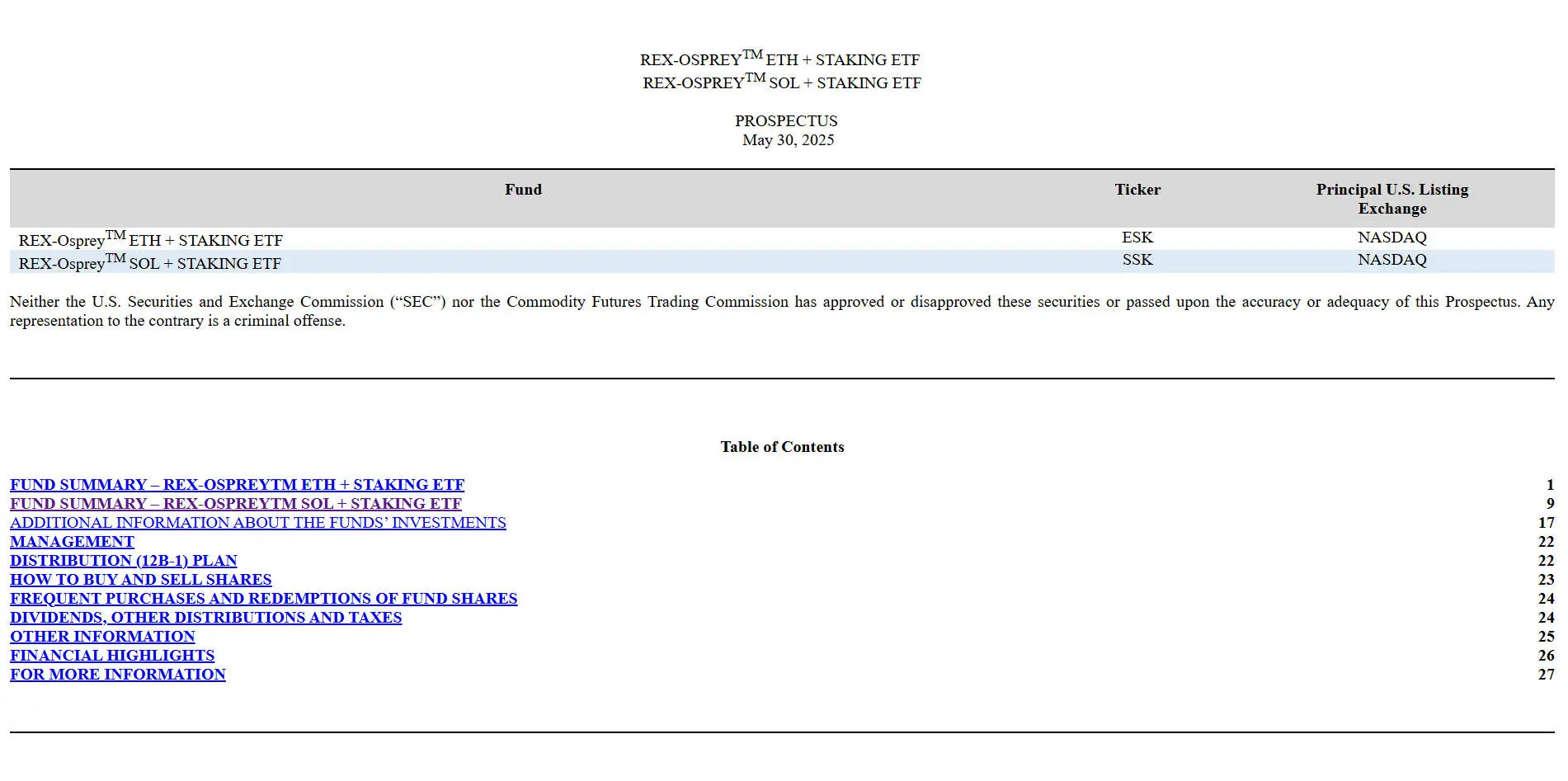

REX-Osprey Solana Collateralized ETF Prospectus Submitted to the SEC

Double taxation increases investment costs and may attract other copycat ETFs to follow suit

This structure is not without controversy, with tax issues being one of its main challenges. Since staking rewards are treated as ordinary income, the fund is subject to corporate income tax, while investors are also subject to dividend tax and capital gains tax. This makes the overall tax burden high, despite the fund's management fee of 0.75%.

In addition, although there were no significant obstacles in the SEC's approval process, due to the innovative nature of this structure, the SEC has shown hesitation about C-type companies circumventing traditional approval procedures, which means that there is uncertainty about whether this model is applicable to the launch of more funds in the future. In the context of increasingly fierce market competition, the REX-Osprey Solana pledge ETF may provide a reference structure for other crypto asset ETFs in the future, but it may also face more regulatory scrutiny in the future.

Jason Chen, an independent crypto researcher and KOL, explained: "So the threshold is low and the approval speed is fast. From submission to approval, it can be completed within 75 days as long as the SEC does not object. But the disadvantage is that on the one hand, because it has not been through very strict approval, the strictness of subsequent disclosure will be much higher than the regular disclosure of 19b-4. Instead, it needs to be disclosed every day, which will increase management costs and will be double taxed. When the price of the currency rises, it will be regarded as a profit of the company, so the company will be charged 21% corporate income tax, and investors will also be charged dividend tax and capital gains tax. Therefore, 19b-4 is more suitable for mature large assets such as BTC, while the 1940 Company Investment Act applies to SOL and a series of other Altcoin."

Some users also commented on the topic of predicting the market, raising the corresponding risk that the price of the ETF cannot accurately reflect the price changes of SOL. The SEC documents submitted by SSK show that "under normal market conditions, the SSK ETF will invest at least 80% of its net assets in reference assets and other assets that provide exposure to reference assets. The fund will invest directly or through REX-Ospre SOL subsidiaries. Although the fund seeks returns corresponding to the reference assets, the performance of the fund will not completely replicate the performance of the reference assets (that is, due to factors such as staking rewards, trading and other fees, the fund's returns will not necessarily be the same as the reference assets, although they will generally be in the same direction, whether positive or negative)."

The application process was full of twists and turns, but it was finally successfully "passed"

In May, REX Shares and Osprey Funds filed applications with the U.S. Securities and Exchange Commission (SEC) seeking approval to launch C-corporation ETFs focused on Solana and Ethereum.

On May 30, the SEC asked REX and Osprey to delay the effective date of their registration statements, citing unresolved issues regarding whether the proposed fund structures meet the definition of an “investment company” under the Investment Company Act of 1940.

On June 29, the SEC notified REX Shares and Osprey Funds that it had “no further comments” on their Solana collateralized ETF application. In ETF regulatory terms, industry observers generally regard this statement as an implicit approval from the SEC. This is the same as the “tacit approval” given by BlackRock, Fidelity and other companies when they launched spot Bitcoin ETFs.

Bloomberg analyst James Seyffart noted at the time that the funds’ “unique” C-corporation format could circumvent the typical 19b-4 rule change process, and the SEC’s silence on the C-corporation workaround now appears to confirm it as a compliant solution.

Originally, the path to staking usually meant handing over tokens to a crypto exchage or configuring your own validator setup, but the SSK ETF significantly lowers this barrier. For the first time, traditional investors can get passive exposure to Solana and earn staking returns through the same brokerage account they use for stocks or index funds. The approval of the Solana staking ETF now provides a roadmap. However, Ethereum's staking mechanisms (such as penalties and longer unlocking periods) may have more complications.

Some market opinions point out that, at least under the supervision of the current US government, the SEC is not trying to completely block pledges. It just needs the right framework: a framework that can handle returns, taxes, custody and compliance in a way that traditional finance understands. Although REX and Osprey are not household names like BlackRock, they now have a first-mover advantage in this field that may become a multi-billion dollar ETF category.

Currently, multiple companies are vying for the opportunity to launch a Solana spot ETF, with Invesco and Galaxy joining the race at the end of June. Analyst Balchunas said the funds could be approved within two to four months. There are currently at least 60 other Altcoin ETF proposals awaiting SEC review and potential approval.