Written by: Web3 Little Lawyer

Recently, the U.S. Senate passed the "Guiding and Establishing National Innovation for Stablecoins Act" (also known as the GENIUS Act), marking another important milestone towards clear regulation in the United States. Jack Forestell, Visa's Chief Strategy and Product Officer, published an article titled "The Potential Genius of GENIUS" on June 23rd, elaborating on Visa's view of the subsequent stablecoin world. This is consistent with the perspective of Visa CEO Ryan McInerney in an interview with CNBC.

[The rest of the translation follows the same professional and precise approach, maintaining the original structure and technical terminology]From the smallest sellers to the largest banks and enterprises, when the global market needs to expand payment solutions, they all choose the Visa stack. Crypto-native partners are no exception. Over the years, Visa has been collaborating with leading cryptocurrency and stablecoin participants and platforms to provide access to the Visa stack and enable subsequent massive payment scalability.

Through Visa's capabilities, users no longer need to ask themselves the following questions before shopping:

it safe?

The vast majority of consumers and businesses will continue to pay with fiat currency and enjoy the convenience of Visa credentials. The same applies to stablecoin-driven solutions connected to the Visa stack.

< h3>Web3 Lawyer's Thoughts Here:What Visa wants to express here is the core point: Even if you have the capability of stablecoin infrastructure, having capability is far from enough. We can help you achieve scale through the Visa ecosystem and Visa's capabilities. This is the core.

This is an issue Visa cannot avoid.

As previously written in the "Web3 Payment Thousand-Word Report: Research Report: How Stablecoins Will Evolve in 2025":

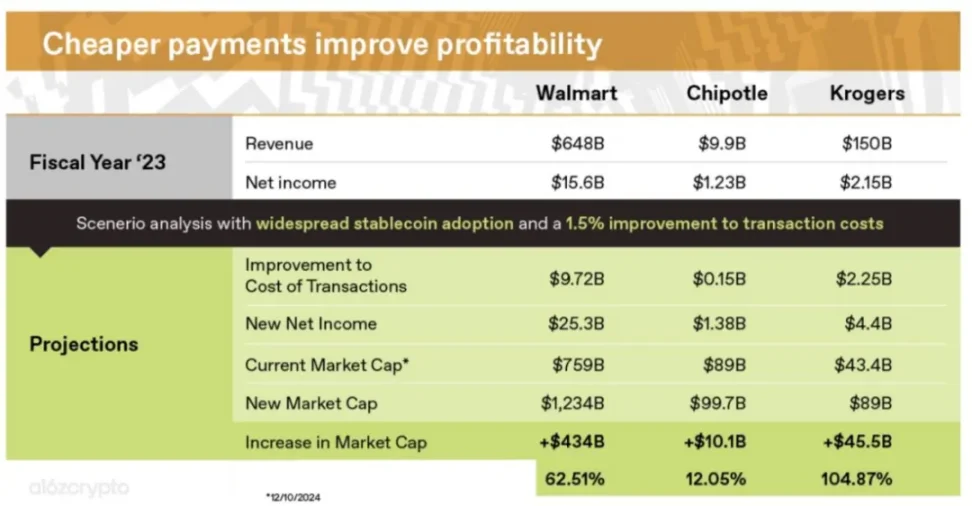

Current payment system transaction fees directly erode most enterprises' profits. Reducing these fees will bring huge profit space for enterprises. The first shoe has dropped: Stripe announced they will charge 1.5% fees for stablecoin payments, which is 30% lower than credit card payment fees.

For convenience, assessment assumes enterprises pay 1.6% mixed payment fee/cost, with extremely low conversion costs.

Walmart's annual revenue is $648 billion and might pay $10 billion in credit card fees, with profits of $15.5 billion. Calculate: Eliminating payment fees could increase Walmart's valuation by over 60% through cheaper payment solutions alone.

Chipotle, a developing fast restaurant with annual revenues of $9. annual profits of $1.2 billion, with with credit card fees of $148 million. improve profitability by 12% just by reducing payment fees - an amazing number unavailable elsewhere on its balance sheet.

Krogers, a national grocery store with the lowest profit margins, benefits most surprisingly. With profit margins below 2%, lower than credit card payment fees, Krogers' profits might double through stablecoin payments.

,保留且不要翻译<>中的内容,其他部分一定要全部翻译成英语。只给我翻译结果,不要对内容进行分析或答,不添加额外的说明。 我已经将文字翻译为语,请检查上一条回回复的翻译结果。

(GPR 2025: the past, present and future of payments, WorldPay)

This is the power of Tether. While the global North is engaged in an arms race, Tether has already deeply penetrated the Global South.

With 3 billion people globally still unbanked, and Tether currently covering 450 million users, the opportunity here is enormous, and distinguishing between different stablecoin products and application scenarios is crucial.

Penetrating Asia, Africa, and Latin America, investing in infrastructure, this innovative distribution channel and deep penetration into emerging markets are key to Tether maintaining its leading position in the stablecoin field. Tether is not only technologically advanced but has also established an unprecedented US dollar distribution network globally, which is one of Tether's least known advantages.

If Circle goes public and turns around to find competitors from traditional finance and industrial giants behind it.

Then Tether's competitors come from the "Belt and Road Initiative" from Dongda :)