Written by: TechFlow

From the US "GENIUS Act" to the Hong Kong "Stablecoin Ordinance", stablecoins are ushering in an unprecedented dividend window in the new compliance cycle.

With the huge success of Circle, stablecoins have become the beautiful land of Canaan flowing with milk and honey in the Bible, not only attracting the attention of Web3 investors, but also attracting traditional Web2 giants such as JD.com, Ant, and Walmart to join in high-profile investment.

In this hot track, how can you find your position quickly and accurately?

We noticed that as a full-featured digital asset custody and wallet platform, Cobo launched a stablecoin solution as early as last year. The forward-looking thinking created by years of roots in the industry has given Cobo a lot of experience in dealing with this issue.

In a conversation with Alex Zuo, senior vice president and head of payment business at Cobo, the difficulties of stablecoins were briefly broken down:

Stablecoin-related businesses are very demanding of interdisciplinary collaboration and require solid knowledge reserves in Fin, Tech, and Crypto. However, it is currently difficult for us to find a team that can excel in all three aspects.

Talking about the role that Cobo plays in the financial infrastructure revolution led by stablecoins, Alex elaborated:

Cobo has always focused on the construction of underlying infrastructure. For stablecoin customers, Cobo can provide comprehensive technical support, has strong compliance advantages, and has rich experience in serving listed companies. At the same time, Cobo has strong distribution capabilities and can help stablecoin issuers quickly build stablecoin circulation scenarios.

As for the opportunities for entrepreneurs in the stablecoin wave, Alex said:

As stablecoins move towards large-scale adoption, new demands, tools and functions will emerge in many different scenarios, which are worth thinking about and exploring in depth.

In this issue, let us follow Alex’s perspective and explore the path to large-scale adoption of stablecoins in cross-border payment scenarios, as well as the huge potential of stablecoins as the future “Internet currency layer”.

Cross-border payment customers actively come to us, opening up the evolution of Cobo’s stablecoin payment products

TechFlow: Thank you for your time. First of all, please introduce yourself.

Alex:

Hello everyone, I am Alex Zuo, Senior Vice President and Head of Payment Business at Cobo.

My earliest career experience was in the VC field. About a dozen years ago, I worked at PreAngel. Our partner at the time was Wang Lijie, who started looking at Crypto very early. Then, I joined the Asian fund of Formation 8. At that time, one of the owners of the fund was from the Korean LG Family. In 2016, he invested in Coinone, one of the top three exchanges in Korea. It was at this stage that I began to get in-depth contact with Crypto. In 2018, I started my own business. At that time, I worked with a few friends, including the project party previously invested by PreAngel, to set up a rating company called TokenInsight. I was the co-founder and COO at the time, mainly responsible for the company's business and commercial affairs. In 2019, I joined Cobo.

I have been with Cobo for almost six years. At the beginning, I was also doing investment-related work at Cobo, including institutional lending, Cobo Venture and other sectors. After the FTX explosion, the company decided to shrink its investment line and focus on business, so I began to be responsible for all the company's BD Sales and domestic Marketing work. Currently, I am responsible for the entire payment and stablecoin-related business.

TechFlow: People may not be so familiar with Cobo’s business in payment and stablecoins. Could you please first introduce Cobo’s current stablecoin solution and the role it plays in the entire payment scenario?

Alex:

In fact, we have always focused on the construction of the underlying infrastructure of the industry, especially wallet-related infrastructure. When exchanges were very popular five or six years ago, our customers were mainly trading platforms. As the industry gradually became compliant, asset management platforms, mining companies and miners became our main service targets. Last year, we shifted our focus to BTCFi, believing that this is an important area.

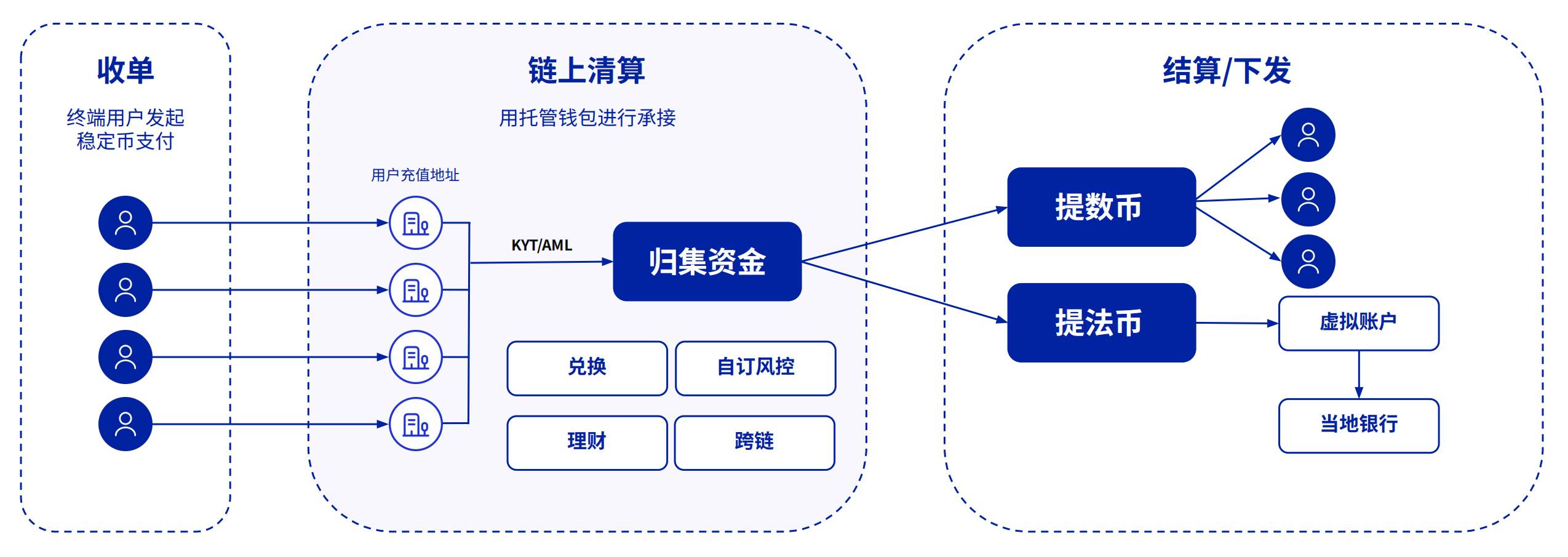

Since last year, more and more cross-border payment customers have come to us. The upstream and downstream customers of these companies, actively or passively, have more or less U in their hands. They have payment problems, such as receiving or sending money. In this process, they hope that we can provide wallet functions, which prompted us to conduct more in-depth research and functional development in the field of payment.

Payment customers are very different from native Crypto customers. They have a weaker understanding of security and chains, but have higher expectations for compliance, product scalability, and long-term business development. They may even consider issues such as applying for licenses in the future. We found it difficult to provide better services to customers based on the previous underlying infrastructure and hosting architecture, so we made deeper optimizations, which are mainly reflected in the following aspects:

First, we have done a lot of so-called chain abstraction to allow customers to use products with a lower threshold. For example, it is natural to transfer U to pay Gas fee in the crypto, but for traditional Web2 companies, the threshold is very high in terms of both conceptual understanding and specific operations. Therefore, we use chain abstraction to transfer and pay based on U to further lower the threshold.

Second, anti-money laundering and compliance capabilities. Payment customers are very afraid of encountering black money on the chain, and they are also very concerned about the compliance of funds on the chain. Therefore, our products have been simplified and the threshold has been lowered. The biggest advantage of Cobo is that we are the only company in the world that does both centralized custody and MPC self-custody. Now many customers are mainly MPC. Cobo can combine the advantages of centralized custody and MPC self-custody to output our centralized custody compliance capabilities to MPC customers, which is equivalent to providing customers with on-chain anti-money laundering services to help them further reduce risks.

In addition, the entire cross-border payment involves three levels: the first level is the wallet that receives stablecoins; the second level is acceptance; and the third level is the bank account. Payment companies may be strong in acceptance and bank accounts, but they are still more timid in accessing the unfamiliar field of digital currency. We will introduce our partners to connect with these traditional payment institutions. We are also a licensed institution in Hong Kong and have a licensed trust account to help customers solve problems.

Cobo's advantage lies in wallets and infrastructure. We hope to build a complete service network around wallet capabilities to lower the threshold for everyone to use stablecoins. Ultimately, we hope to promote the popularization of stablecoins on a compliant track in this way, so that more customers can cross the "last mile" without obstacles.

Cobo's unique value: technology, compliance, distribution and experience

TechFlow: Cobo’s path seems to be different from other stablecoin projects. Cobo first has its own advantages, and then slowly develops its own products based on customer needs. So it is equivalent to that customers can use it directly after you finish it. Can I understand it this way?

Alex:

Because we may be more grassroots, our main customer groups are currently divided into two categories.

One category is customers who do cross-border payments. These customers may not necessarily issue their own stablecoins, but their upstream and downstream customers have begun to have business needs for stablecoins or digital currency transactions, so they find Cobo, or they will find an acceptor, or even at the beginning they will find an exchange to solve these transaction-related issues. However, as the business scale of these cross-border payment companies expands, past solutions are no longer applicable, and they will need wallet parties like us to help them generate and manage a series of addresses to connect to multiple acceptors, and find the cheapest way to trade between fiat currency and digital currency in a router way. The above is what we do around the cross-border payment scenario, or PSP (Payment Service Provider) scenario.

Another major scenario is the issuance and circulation of stablecoins. A few months ago, many of our clients, including many large Internet companies, did not feel a sense of urgency and were not in a hurry to apply for stablecoin licenses or the like, or wait and see what others were like. However, recently, influenced by the momentum of Circle's stock price and JD.com's positive attitude, everyone began to think that this is a very worthwhile business and began to promote related work.

In this process, clients need support from law firms, consulting companies, and technical service providers. On the one hand, Cobo can provide technical support, such as the Mint and Burn of stablecoins, as well as more freezing, blacklisting and other functions. On the other hand, clients also value cooperation with Cobo because of Cobo’s powerful distribution capabilities. We have also connected with many PSPs, and even our existing clients have already reached a transfer volume of three to four hundred billion US dollars. Stablecoin clients hope that their stablecoins can be distributed quickly. At this time, our customer network can help stablecoin issuers quickly expand their business scope and quickly build stablecoin circulation scenarios. This is also one of our core values.

TechFlow: Many traditional banks claim that they can help customers with cryptocurrency settlements. Are they looking for the PSP (Payment Service Provider) you mentioned? And does Cobo also cooperate with many banks?

Alex:

Our definition of PSP is that they already have a lot of scene traffic and upstream and downstream customers. This is the type of customer we value most now.

In the past, when crypto-friendly banks wanted to help clients with cryptocurrency settlements, since they did not have the license or capabilities, they would generally choose OTC services. The core of OTC services is the final exchange.

Cobo wants to help customers gradually build up the Crypto system, or the entire payment system. We believe that such customer service has higher added value.

TechFlow: You mentioned earlier that Cobo is the only company in the world that does both centralized custody and MPC self-custody. What are the specific advantages of this? Because for some customers, perhaps they can choose to cooperate with two companies (a self-custody company and an MPC company)?

Alex:

Now more customers will choose the MPC technology system. This self-custody model can also apply for a license in the future, and future business will be more scalable. There are indeed fewer and fewer customers choosing centralized custody, but customers will encounter many problems in the MPC system, such as private key management, compliance issues, etc. At this time, Cobo's advantages of both centralized custody and MPC self-custody are highlighted.

First, in some applicable legal systems, Cobo's centralized custody may be required, which can directly empower customers with our licensing capabilities; secondly, in some legal areas, customers who want to apply for licenses themselves can also choose Cobo's MPC solution; in addition, for some customers in the start-up stage, if they have not yet established a compliance team, choosing Cobo's MPC solution can also obtain Cobo's centralized custody risk control and anti-money laundering capabilities, further lowering the customer's risk control compliance threshold.

In addition, Cobo has been in this industry for such a long time, and our technical reserves are relatively strong. Over the years, we have developed various wallets and various types of underlying wallet solutions. In the process of payment, we found that some wallet solutions are no longer so popular, such as smart contract wallets, or the market has not found specific application directions for these wallet solutions, but in the process of larger-scale expansion, these wallet solutions will still have a relatively large demand.

TechFlow : What do you think are the main obstacles to stablecoins?

Alex:

I think stablecoin-related business is a test of interdisciplinary cooperation. It requires you to have solid knowledge reserves in Fin, Tech, and Crypto, and these three have different specific requirements.

In the Fin field, the focus is on compliance and a deep understanding of the financial system and various financial practices; in the Tech field, it is necessary to focus on product design and how to access blockchain technology; and in the Crypto dimension, when you actually own a stablecoin, if you only provide exchange services, the profit margin has dropped from 0.4% or 0.2% in the past to 0.5% today, leaving almost no room for improvement. Therefore, how to help users manage assets, increase value, swap, etc. through Crypto in the future is the key, which requires in-depth knowledge of Crypto Native.

From my experience, especially in the field of stablecoins, it is difficult to find a team that can excel in all three aspects of Fin, Tech, and Crypto, and many companies have obvious shortcomings. Therefore, when judging whether a project can succeed, I think the core is still to look at the team's capabilities and overall quality.

TechFlow : Circle’s stock price has soared recently, and JD.com and Ant have recently announced their entry into the stablecoin market. In the stablecoin competition, how does Cobo define its role?

Alex:

According to my understanding, stablecoin licenses in Hong Kong are still relatively scarce, and can be counted on one hand. Currently, more than 40 companies have submitted applications, and law firms have reported that dozens of companies are interested in applying. The competition is very fierce, and the competitors are basically China's largest financial institutions and Internet companies. Many small and medium-sized institutions are not even eligible to submit applications.

From the perspective of stablecoin issuance, Cobo is currently providing technical support to some large customers. These customers are partners we value very much. Of course, we also hope that they can succeed in Hong Kong, but even if they fail, these customers have basically expressed their inclination to obtain licenses in various parts of the world, such as Singapore, the Middle East or Switzerland. For companies that are determined to deepen their roots in this field, business expansion will not be limited to Hong Kong.

In the process of helping customers, we not only provide issuance tools, but also help build an underlying wallet system that connects issuers and merchants, just like Circle has a merchant system that can connect acceptors and merchants, and acceptors do mint and burn, etc. From a broader perspective, our goal is to become a distribution channel for stablecoins.

According to my observation, there are currently three main modes of stablecoin distribution:

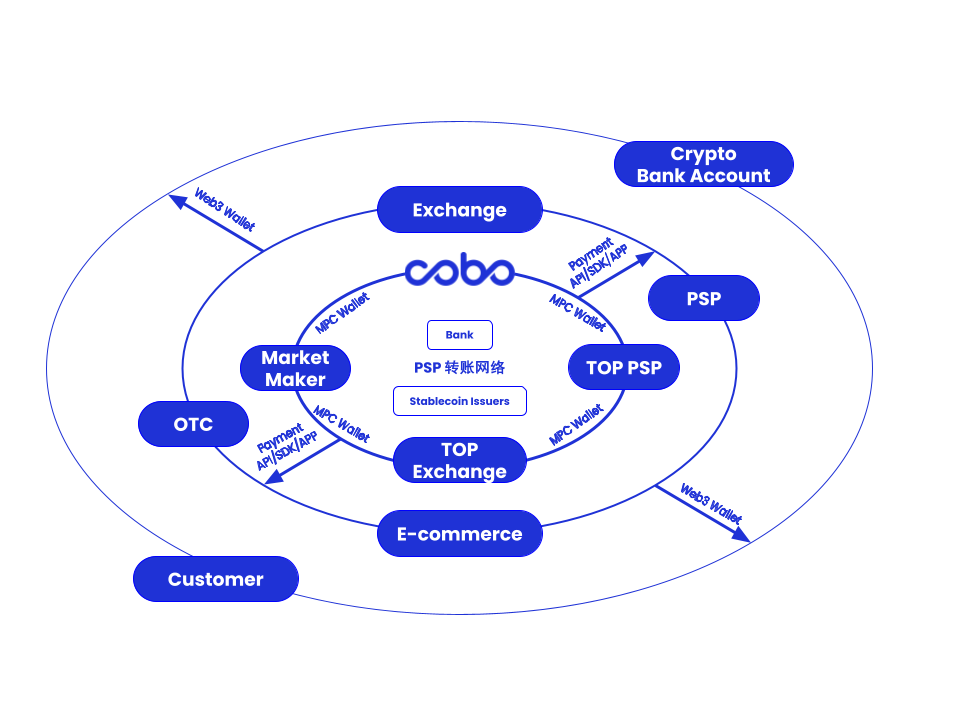

The first is the centralized, wealthy type, represented by Stripe, which builds a global network through its own banks and licenses. It is centered around itself, and customers rely entirely on its system to complete all interactions.

The second type is a decentralized type like Circle. The Circle Payment Network uses a network of certified suppliers, and all parties transfer money to each other through a whitelist. Circle itself does not directly provide a bank account for actual exchange, but achieves compliance and information transmission through partners.

Cobo is the third model, and also a more intermediate model: we build a large PSP transfer network at the core layer, connecting exchanges, OTC merchants and Cobo, and relying on deep cooperation with banks and top market makers, combining on-chain transfers with off-chain bank fast settlements. For example, after completing a transfer of 1 million USDT on the chain, the funds are quickly received in one minute off-chain through a Crypto-friendly bank; the outer layer is small and medium-sized PSPs and exchanges, and they use the super market makers at the core layer to make acceptances; the outer layer is small merchants and retail investors.

In this system: the outermost customers need self-hosted wallets, and it is difficult to trust funds to the core layer for regulatory reasons; the middle-layer customers need more payment tool support, such as chain abstraction, anti-money laundering functions, etc.; the core-layer customers rely on the MPC-based transfer system. In this way, if a large number of customers use the Cobo system, transfers between customers will be faster, safer and more compliant. This model is similar to the CeDeFi concept proposed by AAVE a few years ago. Institutions have a dedicated pool in DeFi, and screen participants through compliant custodians or wallet providers to ensure the security and traceability of funds.

Our goal is to help customers quickly increase their transaction volume through this network. Cobo's current transfer volume is about 300 to 400 billion US dollars, while many stablecoin issuers in Hong Kong may only issue tens or even hundreds of millions of US dollars. If we can provide them with a strong circulation network, significantly improve their distribution capabilities, and connect stablecoin issuers and customers through the Cobo wallet system, on the one hand, issuers can attract users through incentives and subsidies, and on the other hand, customers can provide issuers with more application scenarios, ultimately achieving mutual benefit for both parties.

TechFlow: Regarding the distribution network, what changes do you think will happen in the future? Or what we just talked about is the existing distribution system. Do you think there will be any new distribution systems in the future?

Alex:

The Cobo distribution network we are currently promoting relies on banks and leading market makers to gradually distribute stablecoins through layered logic. We believe this is a set of logic that works. There is currently no clear answer to how this network will evolve in the future.

In the past, the distribution of stablecoins mainly relied on exchanges, such as Circle giving half of its revenue to Coinbase. However, in the future, there is still uncertainty about which scenarios can truly carry large-scale stablecoin circulation. Now many people are optimistic that some small countries with relatively weak banking systems (such as Latin America and Africa) may be occupied by stablecoins, including using stablecoins as equivalents in cross-border payments, and even without the need for final acceptance. However, as stablecoins gradually become compliant, it is still hard to say whether these scenarios really have great potential.

In addition, we were discussing during our internal study two days ago that the banking system may also undergo fundamental changes in the future. In the past, cross-border bank transfers relied on the Federal Reserve's account system, but in the future they may turn to a token system issued by the bank itself. This model may break through existing limitations and even allow some commercial banks to surpass the Federal Reserve in some aspects. This is a very promising future development direction. Of course, there is also a view that AI-driven payment agents (AI Agents) may become the next outlet, but their specific architecture and implementation methods are still unknown.

TechFlow : We just talked about how many companies have applied for Hong Kong licenses. In your opinion, are there any barriers for traditional companies to get involved in stablecoins, whether they apply for licenses themselves or establish relevant cryptocurrency reserves? And when it comes to compliance, what are the specific advantages of Cobo?

Alex:

There are actually two types of businesses that are most suitable for listed companies now. One is to learn micro-strategies to hoard coins, which many Hong Kong listed companies are doing. The other direction is to obtain a stablecoin license.

From the perspective of hoarding coins, the threshold for this business is not high and the operation is relatively simple, especially under the current loose regulation. However, the key issues of hoarding coins are two points: first, when to sell; second, when more and more companies start to hoard coins, this business is no longer scarce, and the market will not be particularly optimistic about your stocks. Therefore, if you want to stand out in this field, you must be a leader or explore the deep connection between coins and stocks. So I think the difficulty of this direction lies in how to operate it later.

As for stablecoin licenses, many small companies claim to enter this field, but they are more for short-term stock price speculation. We have come into contact with many such companies, which may have had no interest in this field half a year ago, and even issued announcements without in-depth communication. Such companies usually just use this to attract market attention, but actually have no real execution ability or opportunity to obtain a license.

In the business system related to Hong Kong and listed companies, Cobo's advantages are mainly reflected in two aspects:

First of all, we are experienced in serving listed companies. We provide services to many mining companies listed on Nasdaq and Hong Kong stocks. We have also accumulated experience in cooperating with auditing agencies, including how to audit and count crypto assets, as well as full-process services such as docking with consulting companies.

In addition, in terms of stablecoin licenses and technical solutions, Cobo's advantage lies not only in its technical capabilities, but also in the completeness of its solutions. We not only provide issuance, but also support distribution, not only from Mint and Burn, but also the entire process of merchant wallet management, helping customers to quickly get started. This comprehensiveness is an important advantage that distinguishes us from other suppliers.

Wallets are the real missing link of stablecoins, and stablecoin exchanges are optimistic

TechFlow : When it comes to mass adoption, if we only look at the mass adoption of stablecoins, what key infrastructures do you think are yet to be developed? Or what infrastructures can form a strong synergy in promoting the mass adoption of stablecoins?

Alex:

First of all, I think our wallets can form a synergy. Judging from Stripe's recent acquisition direction and actions, they hope that merchants and even individual users can use self-hosted wallets directly through Privy. This kind of wallet can generate an address through an email and can be used directly. Then they will link this system with the acquiring service based on Bridge to achieve fast transfer and management between wallets. From our observation, Stripe is using blockchain technology to quickly reconstruct the core functions of Alipay in the past. At present, they are filling in the wallet field through acquisitions.

Similarly, this year, many customers came to us and realized that wallets were a real missing link in their business, or a sector that was difficult to quickly fill in the short term. Therefore, I am confident in our track.

As for other infrastructure, such as payment, compliance is still the core issue, including on-chain KYB and KYC, etc. How to deeply integrate with real Web2 data is a common pain point for many customers. For example, when you complete a transfer, you need to protect user privacy and ensure user reliability. There is currently no particularly mature solution to this problem.

In addition, how to expand into the asset management field in a compliant and legal manner after payment is also a direction worth exploring. In the past, whether it was a centralized or decentralized asset management company, how to better serve traditional customers still needed further optimization.

Finally, I am very optimistic about the exchange of stablecoins. According to the current trend, a large number of stablecoins may emerge, whether from large technology companies in China, the United States, Europe, or other regions such as South Korea. The exchange of these stablecoins may no longer rely on the Curve model. How to build an efficient exchange system will be a huge opportunity and a focus of our company.

Now is the critical node for stablecoins to truly move towards large-scale adoption

TechFlow: How big a market space do you think the entire stablecoin market has? What market share will Cobo occupy in the future?

Alex:

According to data such as the total amount of MPC transfers collected by centralized custodial wallets and our own internal statistics, we may currently account for around 5% of the market share.

As for the future, I think that first of all, our basic base should not be lost. As more Chinese, large Chinese payment companies, and Web2 payment giants enter, and the Cobo fast transfer system that I just shared is truly established, we should be able to do much more than we do now, and our share may expand to around 10% - 15%.

The above is an estimate I made from the perspective of transfer volume, but it is difficult to judge how big the stablecoin track will be. On the one hand, it depends on whether the future regulatory trend is really favorable. On the other hand, it depends on whether the scenarios of injecting AI Agents can really be implemented. If there are really hundreds of millions of AI agents transferring money in the world in the future, the scale may be larger than the current Internet. In the short term, we first see scenarios such as cross-border payments. In the future, a large number of online, on-chain and even intelligent business may evolve into stablecoin settlement. This volume is difficult to estimate.

TechFlow: Hong Kong, Singapore, and Dubai, which one do you think is most likely to become a hotbed for the rapid growth of stablecoins?

Alex:

From our perspective, there are some differences in different regions. For example, from the perspective of custody: the EU is applying for the MiCA license; Singapore has the DTSP license from the Monetary Authority of Singapore (MAS), and then a Digital Payment Token (DPT) license under the Major Payment Institution Licence (MPI); Hong Kong does not have clear regulations yet; the United States has New York's BitLicense, which is a pure custody license; Dubai in the Middle East has a VARA license.

From the perspective of issuance: the United States does not have high requirements for issuers, but issuers must use compliant custody, or in other words, have relatively high requirements for the commercial banks used; in Europe, I think Switzerland's Crypto Valley is more friendly, but the problem in Europe is that it requires offline assets to be reserved in Europe's own commercial banks, but historically, too many European commercial banks have gone bankrupt, and many people think that this is a big risk; the Middle East is relatively friendly, but the biggest problem in the Middle East, especially Dubai, is that its banking system has a relatively low global recognition; Hong Kong's biggest problem is that the number of licenses is too small and the review is too strict; although Singapore issued the earliest stablecoin bill, many details are vague and there are many uncertainties.

So after comprehensive comparison, we would recommend trying to apply for licenses in Switzerland, Singapore, Dubai and other regions. However, applying for a license depends on your own strength. As long as your scenario is large enough, supervision will be easier. For regulators, they are only worried about these issues: one is whether the scenario is compliant and legal; the second is whether the license will be sold two years after it is applied for; the third is that the circulation volume is too small to use the value of the license.

TechFlow : In the broader financial market beyond payment, stablecoins are seen as the next generation of "Internet currency layer". What do you think of this view? What huge effects/impacts do you think stablecoins will have? What preparations will Cobo make?

Alex:

I think first of all , stablecoins will squeeze the monetary and fiscal autonomy of small countries in the short term, such as Nigeria, where the local currency is very unstable. In the medium and long term, the impact of US dollar stablecoins on local currencies is huge, especially in standardized online services and transaction scenarios, where stablecoins denominated in US dollars become mainstream, which has a serious impact on the monetary system of small countries.

From the perspective of the banking system, it is foreseeable that the mid- and long-term competitiveness of many small and medium-sized banks will be even worse, especially among the younger generation. Once everyone starts to circulate money with each other, accounts will be designed to be based on stable currencies, and there will be no need to exchange money to the bank. Then, bank cards may be even less needed.

For centralized exchanges and banks, their core role in the future may be concentrated on the compliance level. That is, when cryptocurrencies need to be exchanged for fiat currencies, these institutions provide compliance guarantees and reduce counterparty risks. You can't say that they are meaningless, but their value will be weakened.

Cobo has made multi-level preparations in this trend, such as fully compliant centralized custody, fully client-compliant self-custody, the construction of various wallet systems, and more product function optimization. In addition, in terms of licenses, we will still apply for licenses required by various regions to meet the needs of companies that rely on our services for licensed institutions. In addition, we have also discussed whether we should buy a bank ourselves in the end, but the final conclusion is that it is a bit too early at the moment.

In general, many things will indeed migrate to the chain. Coinbase has created its own Base chain, which captures and stores the value. We are more committed to becoming a bridge to the chain with the wallet as the starting point.

TechFlow: Many people say that stablecoins are a game for institutions. What do you think of this view? In your opinion, how can ordinary users better seize the opportunities of stablecoins?

Alex:

First of all, I think several A-share companies need to remain cautious at this stage. After communicating with them, I found that some people really want to do it but are powerless, while others just want to hype in the short term.

As for whether stablecoins are an institutional game, I think from the perspective of issuance, this track will definitely be led by very centralized large institutions. But for entrepreneurs, if you are optimistic about large-scale adoption and believe that 20%-30% of traffic in the future will be settled in stablecoins, then many new demands, tools and functions in different scenarios will be born that are worth thinking about and exploring.

I think the current situation is a critical node towards mass adoption, which also brings a lot of new entrepreneurial opportunities. In the past, the industry was more about rebuilding traditional financial functions on the chain, but now the trend is to migrate on-chain innovations to a model that traditional finance can accept, while taking into account compliance and on-chain flexibility.

For example, many people think that U-card is a bad business, but the core problem of U-card is not only compliance, but also poor user experience. Most of the existing U-cards are debit cards, and you can use as much as you deposit. If the problem of on-chain credit or on-chain traditional credit can be solved, it will bring a huge breakthrough in the experience of U-card. In addition, there is also a lot of room for exploration in the evolution of traditional trust architecture and insurance system on the chain.

I am more optimistic than many people about the current market. In the past, many projects were just issuing coins and making prototypes, but the old model of issuing coins and listing on exchanges is no longer feasible. At this point in time, real customers have entered the market, and products need to be more mature and more in line with actual needs. For example, if Coinbase's account system can really be connected with Shopify, Amazon, Walmart, etc. next year, and everyone has their own on-chain wallet and assets, then the product must be simpler and more popular. This is a brand new starting point.

Finally, I think CeDeFi is a direction worth exploring. Ce in the past was a centralized exchange, but now Ce is more like a technology platform. The key lies in how to balance liquidity and compliance, both to meet regulatory requirements and to serve a wider user group. There are huge entrepreneurial opportunities in this.