In July, with the sun blazing like fire, the crypto circle welcomes a hot wave of US stock tokenization in the midst of summer.

Robinhood boldly announced that European users can trade US stocks on the Arbitrum chain 24/7; xStocks collaborates with Kraken and Solana to launch tokens for 60 popular US stocks, and Coinbase has also applied to the SEC to launch tokenized securities...

For a moment, US stock tokenization became one of the few narratively correct topics in the dull crypto circle, and this trend has occupied everyone's timeline.

But this is not the first time for US stock tokenization.

Dead memories begin to attack me again, making me reminisce about that summer five years ago.

In August 2020, the DeFi summer swept through the crypto circle like a blazing flame, with Uniswap's liquidity mining igniting passion, Terra's Luna chain and UST soaring, and on-chain finance had already made many innovations, including the tokenization of US stocks.

At that time, there was a protocol called Mirror on Luna, and I minted mAAPL (a token corresponding to Apple stock) on Terra Station with just a few dollars of UST, without KYC, without opening an account, touching Apple's stock price for the first time bypassing brokers.

But there's a lyric that perfectly describes the old investors' feelings after experiencing all this:

"You left a clamor in my life, and after leaving, it's terrifyingly quiet."

Luna ultimately collapsed, and Mirror was crushed by SEC lawsuits, shattering the dream of 2020. Apart from transaction hashes, it seemed nothing could prove that tokenized US stocks had existed five years ago.

Now, xStocks and Robinhood are making a comeback, and on-chain US stocks are reigniting hope. Will this attempt succeed? What's different compared to five years ago?

That Summer, Mirror's Free Utopia

If you can't remember Mirror Protocol, or weren't in the circle back then, let me help you retrieve those distant memories.

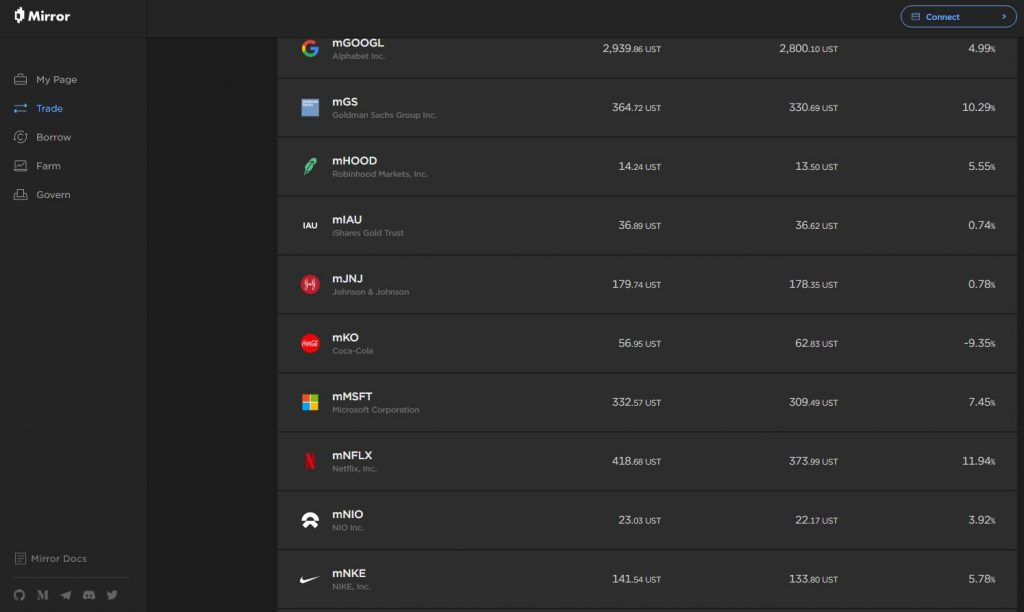

The core idea of Mirror Protocol was: using on-chain synthetic assets to track US stock prices in the real world. This approach gave birth to a type of asset called mAssets.

So-called "synthetic assets" mAssets are tokens that simulate stock prices through smart contracts and oracles, where token holders don't own actual stocks, but are like "on-chain shadows" tracking price fluctuations.

For example, mAAPL (Apple), mTSLA (Tesla), mSPY (S&P 500 ETF), which obtained real-time US stock data through Band Protocol's decentralized oracle.

Although different from directly buying US stocks, it had advantages in convenience:

Minting mAssets was simple, using Terra's stablecoin UST with 150%-200% over-collateralization, and could be obtained by operating on Terra Station, without KYC, with transaction fees around $0.1.

These tokens could not only be traded 24/7 on Terraswap (Terra's DEX) like Uniswap tokens but could also be used as collateral in Anchor Protocol for borrowing or earning interest.

Enjoying the growth benefits of US listed companies while utilizing the flexibility of on-chain finance, DeFi five years ago seemed to have already figured out US stock tokenization.

[The rest of the translation follows the same professional and accurate approach]

The market and regulation in 2025 are entirely different. Projects like xStocks prioritize compliance, enforcing KYC/AML, and aligning with EU MiCA regulations and US securities laws.

After the Trump administration takes office in January 2025, the new SEC Chairman Paul Atkins will refer to tokenization as the "digital revolution of finance," and relaxed policies will also be unleashing innovation. In June 2025, Dinari obtained the first tokenized stock brokerage license in the US, further paving the way for Kraken and Coinbase.

The embrace of mainstream finance and changes in market environment have allowed xStocks and Robinhood to avoid Mirror's legal minefields with a compliant posture, but also seem to have stripped away the grassroots flavor of on-chain US stocks.

The Afterglow of Summer

The crypto world in recent years seems to have changed, yet also seems unchanged.

Five years ago, US stock tokenization in DeFi was like an unrefined carnival, full of passion but lacking stability. Five years later, crypto has put on a compliant coat, walking a steadier path, yet losing some of its casual and wild spirit.

Similar products, different landscapes.

When more people view BTC as digital gold, when institutions are eager to act, when crypto gradually becomes a tool for raising traditional capital market stock prices, the two groups inside and outside the circle may have inadvertently completed a shift in perspective:

Previously, stock traders didn't understand why the crypto market was so hot; now, crypto traders are beginning to wonder why US stocks with crypto labels are rising higher and higher.

Only that summer's FOMO frenzy, where everyone was eager to join, that ubiquitous wild and geek spirit, may have long since blown away with the wind.