Author: Alex Xu, Mint Ventures

Introduction

After Circle's listing, its stock price soared (recently showing a significant pullback), and global stablecoin concept stocks have been unusually active. The U.S. stablecoin bill 'Genius Act' has passed the Senate vote and is boldly advancing to the House. Recently, the Trump family's pure-blood project World Liberty Financial has been rumored to potentially unlock tokens in advance, which is a heavyweight news in the currently sluggish Altcoin market with a lack of themes.

So how is World Liberty Financial doing right now? How is its token mechanism designed? And what should be used as an anchor for valuation?

The author will attempt to sort out World Liberty Financial's business status, project background details, token mechanism, and valuation expectations from multiple dimensions, providing several perspectives for observation.

PS: This article represents the author's phased thinking at the time of publication, which may change in the future, and the views are highly subjective and may contain errors in facts, data, and reasoning logic. None of the views in this article constitute investment advice, and constructive criticism and further discussion from peers and readers are welcome.

Business: Product Status and Core Competitive Advantages

World Liberty Financial (WLFI) is a decentralized financial platform established with the participation of the Trump family. Its core product is the USD1 stablecoin. USD1 is a stablecoin that is 1:1 pegged to the U.S. dollar and fully backed by cash and U.S. Treasury reserves. World Liberty Financial also has plans for lending (based on Aave) and a DeFi App, but these are not yet online.

USD1 Business Data

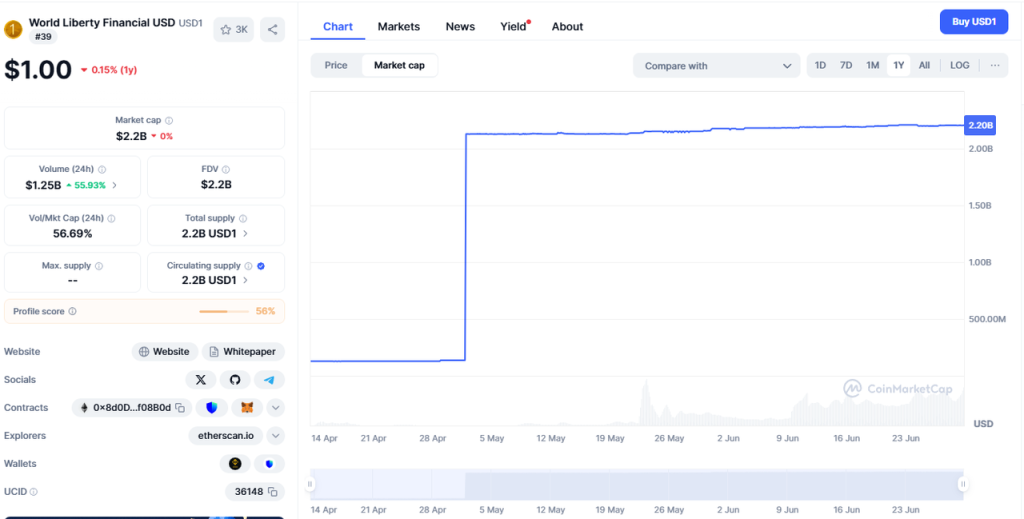

As of June 2025, the USD1 stablecoin circulation is approximately 2.2 billion dollars. Among this, BNBchain supply is 2.156 billion, Ethereum supply is 48 million, and Tron supply is 26,000, with USD1 issued on BNBchain accounting for 97.8% of the total supply.

In terms of on-chain user volume, BNBchain has 248,000 token-holding addresses, Ethereum has 66,000, and Tron currently has only 1.

Looking at token holdings, 93.7% of USD1 on BNBchain (corresponding to 2.02 billion) is in two Binance addresses, with 1.9 billion concentrated in one Binance address (0xF977814e90dA44bFA03b6295A0616a897441aceC).

Reviewing USD1's token scale, we find that its market value was only around 130 million before May 1st, 2025, but on May 1st, it suddenly increased to 2.13 billion, growing by nearly 2 billion dollars overnight.

USD1's scale growth curve, source: CMC

This scale surge actually mainly came from the 2 billion dollar equity investment in Binance by Abu Dhabi investment company MGX in May 2025, which chose USD1 as the payment currency, and the current USD1 token scale remaining in Binance addresses is also around 2 billion.

This means:

After receiving the USD1 investment from MGX, Binance did not convert it to U.S. dollars or other stablecoins and is currently the largest USD1 holder, occupying 92.8% of the total USD1 scale

Excluding this exchange-formed transaction, USD1 is still a small-scale stablecoin with a circulating market value of just over 100 million

In the project's future development, this business expansion model is believed to recur.

[The translation continues in the same manner for the rest of the text, maintaining the specified translations for specific terms.]Besides the Trump family, another heavyweight team member is Steven Witkoff, Donald Trump's long-term business partner and New York real estate tycoon, who serves as the honorary co-founder. He is the founder and chairman of Witkoff Group, having known Donald Trump since the 1980s. They have long been close, often playing golf together, and are well-known as "old friends and business partners".

After Trump took office, Steven Witkoff was appointed as the "US Middle East Special Envoy" by Trump, reporting directly to him and playing a core role in major negotiations, including talks involving Israel, Qatar, Russia, and Ukraine. He also served as Trump's "private messenger", meeting with Russian leaders in Moscow multiple times on Trump's behalf.

The Witkoff family was also actively involved in the project: his sons Zach Witkoff and Alex Witkoff are both co-founders of WLFI.

Besides political and business celebrities, WLFI's technology and operations are primarily handled by crypto industry professionals. Zak Folkman and Chase Herro, both co-founders, are serial entrepreneurs in the cryptocurrency field. They previously founded the DeFi platform Dough Finance, which failed due to an early hacker attack, making their entrepreneurial experience less successful. In the WLFI project, Folkman and Herro were initially the main controllers, but in January 2025, they handed over control to an entity controlled by the Trump family.

Another core member, Richmond Teo, serves as the head of WLFI's stablecoin and payment department. Richmond Teo was previously a co-founder and former Asia CEO of the well-known compliance stablecoin company Paxos. The team also includes blockchain practitioners such as Corey Caplan (Technical Strategy Director), Ryan Fang (Growth Lead), and traditional financial compliance experts like Brandi Reynolds (Chief Compliance Officer).

The project has invited several advisors, including Luke Pearson from Polychain Capital and Sandy Peng, co-founder of Ethereum Layer 2 Scroll network. Sandy Peng assisted with operational work during the token sale.

Equity Changes of the Trump Family in World Liberty Financial

In fact, the Trump family's shareholding in World Liberty Financial has been continuously declining, currently dropping from the initial 75% to 40%.

From the initial 75% to 40%, the decreased equity might have been transferred to Justin Sun, DWF Labs, and potentially the recently announced Aqua 1 Foundation with a $100 million investment (purely speculative).

Financing History and Investment Institutions

Since launching in September 2024, World Liberty Financial has raised over $700 million through multiple funding rounds, with its valuation rapidly increasing after Trump's inauguration and token issuance.

[The rest of the translation follows the same professional and accurate approach, maintaining the original structure and meaning while translating to English.]WLFI may be just one of the many "licensed projects" of the Trump family, who will be as ruthless in selling and operating it as Trump tokens and a series of Trump Non-Fungible Tokens, and may not be able to make long-term investments

The crypto market, especially the liquidity of Altcoins, has long been exhausted, and secondary players almost do not believe in any stories without hard business data support, and most new coins launched are in free fall

...

As an investor, which perspective are you more inclined to adopt? Different people have different views.

In the author's opinion, the short-term price trend of WLFI after its launch depends on one hand on the final content and timing of the Genius Act, and more importantly, whether the Trump family is willing to place WLFI in a relatively core position as a medium for interest exchange. Specifically, this means that "influential individuals, businesses, or sovereign states" actively embed USD1 (even symbolically) into their business processes to obtain political and commercial interests, such as using USD1 as an investment currency (equity investment) or settlement currency (cross-border trade).

If there is a lack of similar dense commercial news after the launch, WLFI's position in the Trump family's business landscape may be worrying, as they have better revenue channels.

Let's wait and see the development of WLFI after its launch.

So, when will the WLFI token be transferable?

I guess it will be after the final official passage of the US Genius Act (which has already passed the Senate), which will be the time when the project party can freely operate, and it's not far off.