Written by: Thejaswini MA

Translated by: AididiaoJP, Foresight News

Does this create real value, or is it merely speculation disguised with regulatory approval?

January 2024 seems like a lifetime ago. Although only 18 months have passed, it feels like a century. For cryptocurrency, this period has been an epic journey.

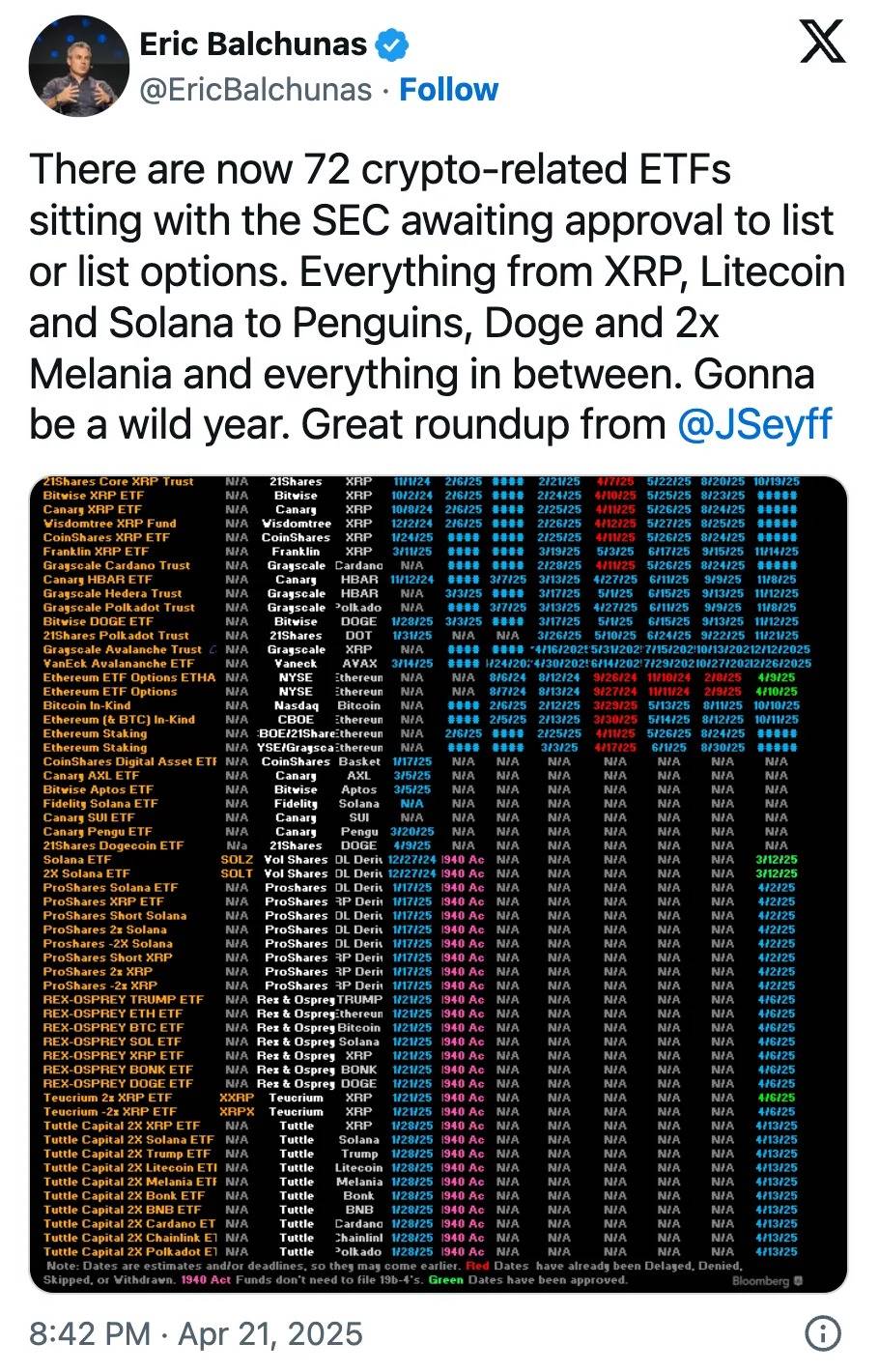

On January 11, 2024, the spot Bitcoin ETF landed on Wall Street. About six months later, on July 23, the Ethereum ETF also took the stage. Now, the SEC's desk is flooded with 72 crypto ETF applications, and the number is still increasing.

From Solana to Dogecoin, from XRP to Pudgy Penguins, asset management companies are packaging various digital assets into compliant financial products. Bloomberg analysts Eric Balchunas and James Seyffart have raised the probability of approval to "over 90%", signaling we will witness the largest expansion in crypto investment product history.

If 2024 was a year of difficult breakthrough, then 2025 will be a moment of harvest for many.

Bitcoin ETF's $107 Billion Feast

To understand the significance of Altcoin ETFs, first, we need to see how the Bitcoin spot ETF has overturned everyone's expectations and rewritten the rules of the asset management industry.

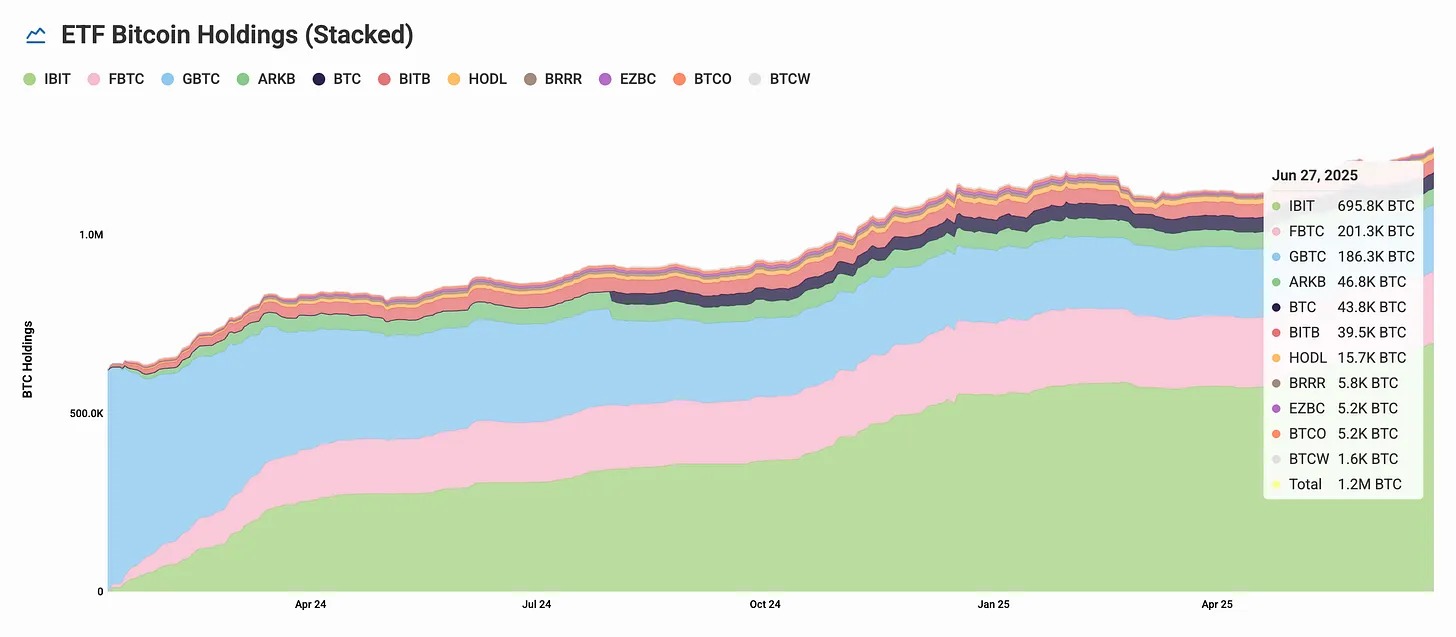

In just one year, the Bitcoin ETF has attracted $107 billion, becoming the most successful ETF launch in history, and today, 18 months later, its assets under management have reached $133 billion.

BlackRock's IBIT alone holds 694,400 Bitcoins, valued at over $74 billion. All Bitcoin ETFs collectively control 1.23 million Bitcoins, about 6.2% of the total circulation.

When BlackRock's Bitcoin ETF broke through the $70 billion mark at an unprecedented speed, it proved that the demand for accessing crypto exposure through traditional investment tools is real, massive, and far from saturated. Institutions and retail investors are all lining up to enter.

This success created a virtuous cycle: ETF accumulation led to a decrease in Bitcoin exchange balances, accelerated institutional holdings, improved Bitcoin price stability, and provided unprecedented compliance for the entire crypto market. Even with market volatility, institutional funds continue to flow in. These are not day traders or retail speculators, but pension funds, family offices, and sovereign wealth funds that view Bitcoin as a legitimate asset class.

It is this success that has led to approximately 72 Altcoin ETF applications on the SEC's desk as of April.

What Value Do ETFs Provide?

Since Altcoins can be directly purchased on exchanges, what use do ETFs have? This is precisely the market logic surrounding mainstream adoption. ETFs are a milestone for cryptocurrencies.

They grant digital assets the qualification to trade legally on traditional securities exchanges, allowing investors to buy and sell crypto assets through ordinary securities accounts. For most ordinary investors unfamiliar with crypto technology, this is a lifesaver. No need to set up wallets, manage private keys, or deal with blockchain technical details. Even after overcoming wallet barriers, risks like hacker attacks, lost private keys, and exchange collapses loom. ETFs represent management of custody and security issues for investors, providing highly liquid assets that trade on mainstream exchanges.

Altcoin Gold Rush

The application list reveals the upcoming diversity of compliant crypto assets. Giants like VanEck, Grayscale, Bitwise, and Franklin Templeton have submitted Solana ETF applications with a 90% approval probability. Including newcomer Invesco Galaxy (proposed ticker QSOL), nine institutions are competing for the SOL pie.

XRP follows closely, with multiple applications targeting this payment token. Cardano, Litecoin, and Avalanche ETFs are also in the review process.

Even meme coins are not exempt. Mainstream issuers have submitted Dogecoin and PENGU ETF applications. "Surprisingly, no one has applied for a Fartcoin ETF yet," Eric Balchunas of Bloomberg joked on X platform.

Why is this happening now? It's the result of multiple converging factors. The Trump administration's pro-crypto policy marked a regulatory shift, with new SEC Chair Paul Atkins abolishing Gary Gensler's "enforcement as regulation" approach and establishing a crypto working group to set clear rules.

The regulatory thaw reached its peak in the SEC's latest statement, declaring that "protocol staking activities" do not constitute securities issuance, completely changing the previous government's crackdown on staking service providers like Kraken and Coinbase.

Bitcoin and Altcoin institutional certification, coupled with corporate crypto reserve trends and Bitwise's survey showing 56% of financial advisors willing to allocate crypto assets, have collectively generated demand for diversified crypto exposure beyond Bitcoin and Ethereum.

Demand Test

While the Bitcoin ETF proved the authenticity of institutional demand, early analysis suggests Altcoin ETFs will face a drastically different situation.

Sygnum Bank's Research Head Katalin Tischhauser estimates Altcoin ETF total inflows at "hundreds of millions to $1 billion", a fraction of Bitcoin's $107 billion scale.

Even the most optimistic estimates show Altcoin ETFs will struggle to reach 1% of Bitcoin's scale. From a fundamental perspective, this difference is reasonable.

The comparison with Ethereum is even more brutal. As the second-largest cryptocurrency, the Ethereum ETF has only attracted about $4 billion in net inflows over 231 trading days, barely reaching 3% of Bitcoin's $133.3 billion scale. Despite recent $1 billion inflows in 15 trading days, Ethereum's institutional appeal remains far behind Bitcoin's, suggesting Altcoin ETFs will face an even more challenging battle for investor attention.

Bitcoin won institutional favor through first-mover advantage, regulatory clarity, and the simple narrative of "digital gold". Now, 72 applications are competing for a market that might only accommodate a few winners.

Staking Rewrites the Rules

A key factor that might differentiate Altcoin ETFs from Bitcoin products is generating returns through staking. The SEC's approval of staking opens new possibilities for ETFs, allowing staked holdings and reward distribution to investors.

Currently, Ethereum staking offers around 2.5-2.7% annual yield. After deducting ETF fees and operating costs, investors might receive 1.9-2.2% net returns. While modest by traditional fixed-income standards, it becomes attractive when combined with potential price appreciation.

Solana staking offers similar opportunities. This creates a new profit model for ETF issuers and provides new value for investors. ETFs with staking functionality are no longer just price exposure tools but become income-generating assets.

Multiple Solana ETF applications explicitly include staking clauses, with issuers planning to stake 50-70% of holdings while maintaining liquidity reserves. The Invesco Galaxy Solana ETF application specifically mentions using "trusted staking service providers" to generate additional earnings.

However, staking also brings operational complexity. ETF managers handling staked crypto assets face multiple challenges: maintaining sufficient non-staked assets for redemptions while maximizing staking percentage to increase returns, and managing "slashing" risks where validators' mistakes could result in fund losses. Operating validator nodes requires professional technology and reliable infrastructure. Successfully operating a crypto ETF with staked assets is like walking a high wire - not impossible, but extremely difficult.

Previous Bitcoin and Ethereum ETFs did not have this option, as the SEC under Gary Gensler considered staking a violation of securities laws and an unregistered securities offering.

Fee War

The 72 applications will inevitably trigger a fee war. When many products compete for limited institutional funds, price becomes a critical differentiator. Traditional crypto ETF management fees range from 0.15-1.5%, but competition might drive them even lower.

Some issuers may even use staking revenue to subsidize management fees, launching zero or negative fee products to attract funds. The Canadian market has seen multiple Solana ETFs introduced with temporary fee waiver clauses.

This fee compression benefits investors but squeezes the profit margins of issuers. Only the largest and most efficient operators can survive. Mergers, exits, and transformations are expected, and the market will ultimately determine the winners.

Perspective

Altcoin ETF fever is changing the crypto investment logic.

Bitcoin ETF was highly successful. Ethereum ETF provided a second choice, but received a lukewarm response due to complexity and poor returns. Now, asset management companies are betting on the strengths of different cryptocurrencies.

Solana focuses on speed, XRP concentrates on payment scenarios, Cardano boasts "academic rigor", and even Dogecoin tells a story of mainstream acceptance. This indeed has significance for portfolio construction. Cryptocurrencies are no longer an alternative asset class, but have diversified into dozens of investment targets with different risk characteristics and use cases.

As the largest cryptocurrency by market cap, Bitcoin has become an extension of many stock market investors' traditional portfolios, providing risk diversification and serving as a hedge against market uncertainty. In contrast, Ethereum, despite being second, has not achieved the same degree of mainstream integration, with most retail and institutional investors not using Ethereum ETF as a core allocation.

Altcoin ETFs need to provide differentiated value to avoid repeating the Ethereum ETF's mistakes.

But this also reflects how the crypto industry is drifting away from its original intent. When meme coins have ETF applications, when 72 products compete for attention, when fee compression is like a commodity business, this industry has become thoroughly mainstream.

The question is: does this create real value, or is it merely speculation dressed in regulatory approval? The answer may depend on perspective. Asset management companies see a new revenue source in a crowded market, while investors can easily gain crypto exposure through familiar products.

The market will render its judgment.