Chain-based data analysis platform Arkham pointed out last night (28th) on X that BlackRock's Bitcoin spot ETF "IBIT" has already generated returns that exceed all other ETFs in the company's portfolio, even surpassing the S&P 500 ETF "IVV" with 10 times the asset size, attracting market attention.

Bitcoin Spot ETF Sees Continuous Net Inflows for Three Weeks

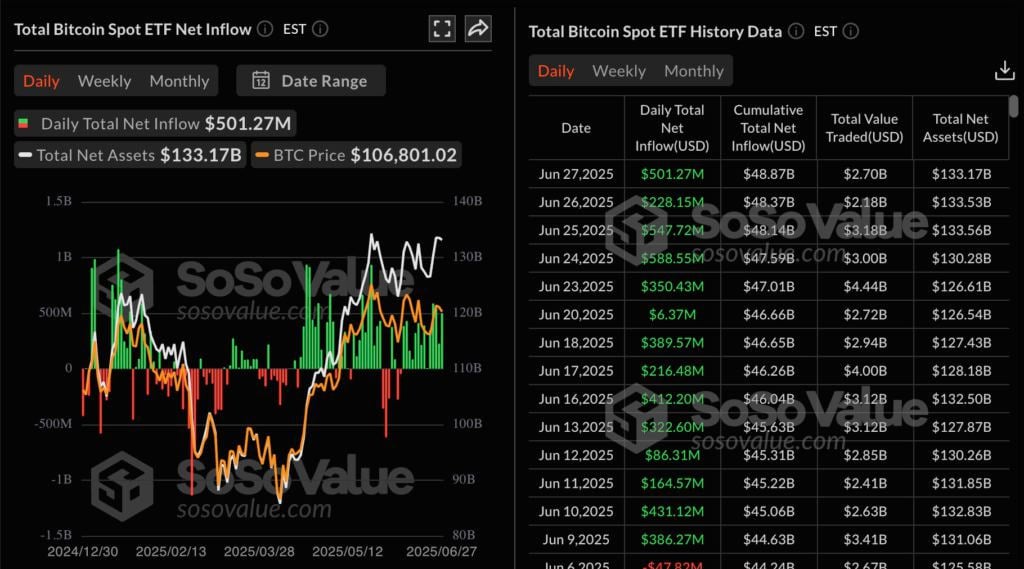

According to Sosovalue data, the combined performance of 12 Bitcoin ETFs has seen net inflows for three consecutive weeks (starting from June 9), nearly breaking a new historical record.

With Bitcoin's strong price performance, the largest US cryptocurrency exchange Coinbase (COIN) became the best-performing stock in the S&P 500 index in June 2025, with a monthly increase of about 43%.

BlackRock's Subsequent Developments Attract Attention

The market is currently focused on how BlackRock will next layout cryptocurrency and related ETF products. Due to IBIT's outstanding performance, the market expects BlackRock may further launch more digital asset products or strengthen existing product lines to capture the rapidly growing crypto market.