US stocks approach previous highs, will Bitcoin follow with a "false breakout"?

Currently, the S&P and Nasdaq are both standing at the doorstep of previous highs, and whether they will break through or retreat will likely be revealed soon, with potential significant market volatility. Bitcoin is even more "aggressive" - continuously attacking upwards, without even giving a proper pullback, making it difficult to find an opportunity to buy the dips. Considering the current strength of US stocks, my most likely scenario is: Bitcoin will have a false breakout, create extreme long bait, and then immediately dump.

Such trends are not uncommon in the crypto market, and veteran investors have stepped into these traps before.

The current strategy is simple: only short when the false breakout fails and the price falls back to key levels, do not move if it doesn't fall back, and must see a downward signal. If it doesn't even break through, it indicates a direct weakening, so we'll wait for it to fall to the target level and prepare to build positions in batches in August. There's a potential ETF approval window in October, so keep some ammunition - we might catch the next major upward wave.

Speaking of ETF speculation, let's look at these altcoin expectations!

XRP, SOL, DOGE, ADA have spot ETF approval probabilities over 90%; the results could be known as early as mid-October. If approved, historical experience suggests a reference increase of 30-40%, which is not exaggerated.

Especially #SOL and #XRP, which passed CME futures earlier this year, have an almost 95% chance of spot ETF approval. XRP might be the most crazy one, with many remembering last year's wave. Honestly, I personally still don't understand its logic and have never used it, nor do people around me, so I might just buy a symbolic amount.

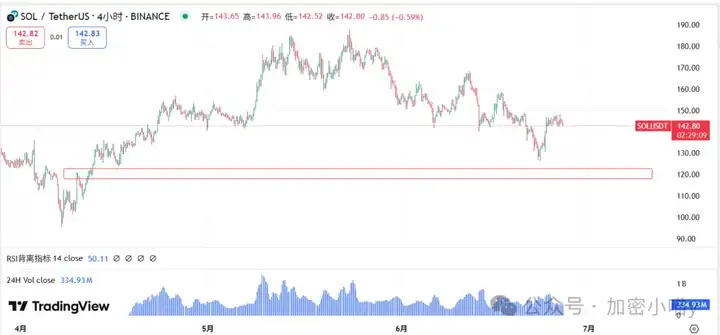

My main focus is #Solana, expecting to buy the dips around $120, the lower the better, and will complete position building by the end of August. Many retail investors are unaware of these timing and rhythms - follow me for pure valuable information.

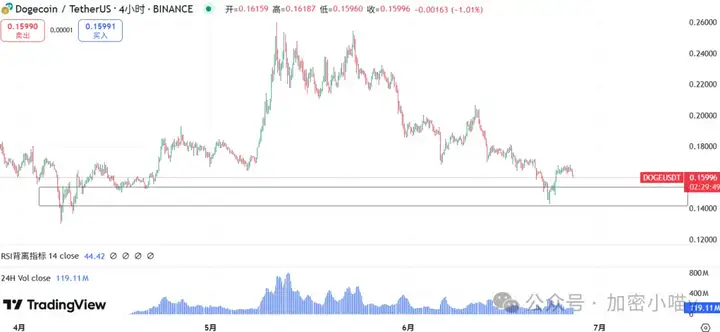

For #DOGE, I'll consider entering around 0.14, and I'm also very optimistic about Pepe and SUI, waiting for a pullback opportunity.

Before the October market starts, Bitcoin will most likely have a significant pullback, which will be an excellent buying opportunity - we'll discuss this logic next.

Bitcoin ETF has been net inflows for over ten consecutive days, with retail investors buying enthusiastically, yet the price remains stagnant around $100,000.

The daily MACD shows a clear divergence - new price highs with decreasing momentum, similar to the pattern before major drops in January this year and March last year; if not for continuous US stock buying, the market would have already fallen.

My approach: wait for a "false breakout". If the price briefly exceeds the previous high and quickly falls back, I'll short with cross margin, targeting $93,000, with a stop loss above the previous high, offering a good risk-reward ratio. The Nasdaq is also near its historical top, with less than a 30% chance of continued bullish attack, and a higher probability of pullback.

Rhythm planning: July-August bottom exploration → September 18 Fed rate cut ignites new market → October mainstream crypto ETF approvals boost sentiment. Exit when the market is most FOMO, just like clearing positions at the high in mid-May for PEPE, SOL and successfully shorting TRUMP, ZK, ZRO. Stay tuned for daily updates if interested.

The next key market influencing point is July 8th after Trump's tariff exemption expires. If Bitcoin is still at low levels, betting on tariff benefits might be understandable, but now having rebounded over 50% from the low point, gambling on uncertainty seems unwise. This week, Fed officials have started hinting that a rate cut on September 18th is highly probable (70% chance), coupled with potential October mainstream crypto ETF approvals! Recommendation: build positions opportunistically by the end of August, waiting to act when market sentiment is extremely panicked.

That's it for the article! If you're feeling lost in the crypto market, consider joining me in layout and harvesting from market makers! You can join the community via WeChat+QQ group for market analysis, individual coin recommendations, and positive news... Contact+QQ: 3806326575 or WeChat: Fupi22497