Cryptocurrency finally outputs something beyond imagination: stablecoins

Last year, three major events helped push stablecoins into the mainstream:

1. Tether, the issuer of the world’s largest stablecoin USDT, earned nearly $13 billion in profits with less than 200 employees;

2. President Trump’s inauguration and the reversal of the U.S.’s adversarial regulatory stance toward digital assets;

3. Stripe acquired the stablecoin infrastructure company Bridge for US$1.1 billion to coordinate cross-border transactions.

As some make a killing in a thriving ecosystem, regulation is becoming clearer.

If you are issuing or leveraging stablecoins to grow your business, we hope this guide helps you understand how experienced operators view this space.

To provide multiple perspectives, we leverage our extensive network to draw unique insights from leading contributors on the front lines of the stablecoin revolution.

Let’s start learning!

Defining Stablecoins

Stablecoins are typically liabilities denominated in U.S. dollars and backed by assets of equal or greater market value.

There are two main types:

• Legal backing: fully collateralized by bank deposits, cash, or a less risky cash alternative such as Treasury bills

• Collateralized Debt Positions (CDPs): Overcollateralized primarily by crypto-native assets (e.g. ETH or BTC)

The fundamental determinant of a stablecoin’s utility is its “peg” to an underlying reference asset (the U.S. dollar). This peg is maintained through two mechanisms: primary redemption and a secondary market. First, can I immediately redeem my stablecoin liability for an equal amount of reserve backing? If not, is there a deep and persistent secondary market where market participants can buy or accept my stablecoin liability at the peg rate?

We also believe that primary redemption is a more durable peg mechanism due to the unpredictability of secondary markets. Additionally, it is worth noting that there are many attempts at low-collateral or algorithmic stablecoins that lack backing, which we will not cover in this guide.

Importantly, stablecoins do not appear out of thin air. When you hold a U.S. dollar deposit with Chase, Chase is responsible for keeping your dollars, ensuring your access, and allowing you to use your dollars to transact with others.

Stablecoins rely on blockchain to provide the same core functionality.

Defining blockchain

Blockchain is a global "bookkeeping system" that contains personal assets, transaction records, and transaction rules and terms.

For example, Circle's stablecoin USDC is issued based on the ERC-20 token standard, which specifies the following rules for a successful token transfer: a certain amount is deducted from the sender's account and the same amount is added to the receiver's account. These rules, combined with the blockchain's consensus mechanism, ensure that no user can transfer more USDC than they hold (commonly known as the double-spending problem). In short, a blockchain is like an append-only database or double-entry ledger that has an initial state and records every transaction that has ever occurred in its closed-loop network.

All assets on the blockchain, including USDC, are held in escrow by an Enchain account (EOA or wallet) or smart contract, which can receive and transfer assets when certain conditions are met. EOA ownership, the ability to trade assets from a public address, is enforced through the underlying blockchain's public-private key cryptographic scheme, which binds each public address to a private key one-to-one. If you have the private key, you effectively own the asset in the public address ("not your key, not your coin"). Smart contracts hold and trade stablecoins according to pre-programmed transparent logic, enabling on-chain organizations (such as DAOs or AI agents) to programmatically trade stablecoins without human intervention.

"Trust" in the accuracy of the system is derived from the execution and consensus mechanisms of the underlying blockchain (e.g., Ethereum Virtual Machine (EVM) and Proof of Stake). Accuracy can be proven through the initial state of the blockchain and the publicly auditable history of each subsequent transaction. Transaction settlement is managed 24/7 by a globally distributed network of node operators, which allows the settlement of stablecoins to be unconstrained by traditional banking hours. To compensate node operators for this service, a transaction fee (Gas) is charged when transactions are processed, which is usually denominated in the native currency of the underlying blockchain (e.g., ETH).

These definitions may be pedantic, even rebellious to some, but this concise and practical overview provides a suitable common ground for our readers. So, let's start with the more interesting part: How did we get here?

The history of stablecoins

12 years ago, stablecoins were just a fantasy. Now, Circle, which issued the world's second largest stablecoin USDC, is preparing for a sale or IPO. Circle's S-1 document provides first-hand information from USDC founder Jeremy Allaire, telling the story of USDC's creation. (Note: Circle has completed its IPO)

We invited our friends Phil Potter and Rune Christensen, the founders of the world’s largest stablecoin (USDT) and the third largest stablecoin (DAI), to share their entrepreneurial stories.

Tether: The birth of a king

Back in 2013, the cryptocurrency market was in its Wild West days, when the main places to access and trade cryptocurrencies were cryptocurrency exchanges like Mt.Gox and BitFinex. Given the early stages of cryptocurrencies, the regulatory environment was murkier than it is today: exchanges were advised to follow “best practices” by only accepting crypto deposits and performing crypto withdrawals (e.g., BTC deposits and BTC withdrawals). This meant that traders were forced to convert their dollars to cryptocurrencies on their own, a mandatory requirement that hindered widespread adoption of cryptocurrencies. Additionally, traders needed a place to escape the wild price fluctuations of cryptocurrencies without having to leave the “casino.”

Phil Potter entered the cryptocurrency space with a Wall Street background and a pragmatic eye, and he had a keen eye for market bottlenecks. His solution was simple: a "stablecoin" — a dollar of cryptocurrency liability backed by a dollar of reserves — that would allow traders to hedge against exchange and market volatility with dollar-denominated liabilities. In 2014, he brought the idea to BitFinex, one of the largest exchanges at the time. Ultimately, he partnered with BitFinex to create Tether, an independent institution with the necessary money transmission licenses to integrate with the broader financial network of banks, auditors, and regulators. These providers are critical for Tether to custody reserve assets and process complex fiat currency transactions in the background, while enabling BitFinex to maintain its "pure cryptocurrency" positioning.

The product is simple, but the structure is very radical: Tether issues USD-denominated liabilities (USDT), and only certain KYC-certified trusted entities can directly mint or redeem USDT for its underlying reserve assets.

However, USDT runs on a permissionless blockchain, which means that any holder can freely transfer USDT and exchange it for other assets in the open secondary market.

For two full years, the concept seemed stillborn.

It wasn’t until 2017 that Phil noticed that USDT adoption was growing in regions like Southeast Asia. After investigating, he found that export businesses began to see USDT as a faster and cheaper alternative to regional dollar payment networks. Eventually, these businesses began to use USDT as collateral for imports and exports. Around the same time, cryptocurrency natives began to notice USDT’s growing liquidity and began using USDT as margin for cross-exchange arbitrage. At this point, Phil realized that Tether had built a faster, simpler, and 24/7 parallel dollar network.

Once the flywheel starts spinning, it never slows down. With issuance and redemption always taking place within a regulated context, and tokens circulating freely on blockchains like TRON and Ethereum, USDT has reached escape velocity. Every new user, merchant, or exchange that accepts USDT only strengthens its network effect and increases its utility as a store of value and payment method.

Today, there is nearly $150 billion worth of USDT in circulation, far exceeding USDC's $61 billion in circulation, and many people call Tether the company with the highest per capita profit in the world.

Phil Potter is a prominent figure in the cryptocurrency space with a rather unique philosophy.

Yet, it’s impossible to call him an “outsider” in the world of traditional finance; he’s the kind of person you’d expect to create the world’s largest stablecoin. This is not the case with Rune Christensen.

DAI: The First Decentralized Stablecoin

Rune discovered cryptocurrency in its infancy and quickly dubbed himself “Bitcoin Man.” He was the quintessential crypto adopter, seeing BTC and blockchain as a ticket out of an unfair and exclusionary financial order. With BTC opening at around $13 in 2013 (time machine anyone?) and topping $700 by the end of the year, early adopters had every reason to believe that cryptocurrency could truly replace our financial system.

However, the subsequent recession forced Rune to accept that the ultimate utility of cryptocurrencies depended on managing this volatility. “Stability is good for business,” Rune concluded, and a new idea was born.

In 2015, after witnessing the failure of BitShares’ “first” stablecoin, Rune teamed up with Nikolai Mushegian to design and build a stablecoin denominated in U.S. dollars. However, unlike Phil, he lacked both the connections to execute a Tether-like strategy and the desire to build a solution that relied on the traditional financial system. The emergence of Ethereum, a programmable alternative to Bitcoin that allows anyone to encode logic onto the network through smart contracts, provided Rune with a platform to create. Could he use the native asset ETH to issue a stablecoin based on it? If the underlying reserve asset ETH is as volatile as BTC, how can the system remain solvent?

Rune and Nikolai’s solution is the MakerDAO protocol, which is based on Ethereum and went live in December 2017. MakerDAO allows any user to deposit $100 in ETH and receive a fixed amount of DAI (e.g., $50), creating an overcollateralized stablecoin liability backed by ETH reserves. To ensure the solvency of the system, the smart contract sets a liquidation threshold (e.g., ETH price of $70), which once broken, allows third-party liquidators to sell their underlying ETH assets, thereby exempting them from the DAI debt. Over time, new modules have emerged to streamline the auction process, set interest rates to regulate the issuance of DAI, and further incentivize third-party liquidators who are motivated by profit.

This ingenious solution is now known in the cryptocurrency world as a “collateralized debt position (CDP)” stablecoin, and the original concept has spawned dozens of imitators. The key to the system being able to operate without centralized gatekeepers is Ethereum’s programmability and the transparency provided by the public blockchain: all reserve assets, liabilities, liquidation parameters and logic are known to every participant in the market. In Rune’s words, this enables “decentralized dispute resolution,” ensuring that every participant understands the rules that keep the system solvent.

With DAI (and its sister project USDS) in circulation exceeding $7 billion, Rune’s creation has grown into a systemically important pillar in decentralized finance (DeFi). However, ideological demands to escape a broken system have become increasingly difficult to manage in a rapidly changing competitive landscape; CDPs’ capital inefficiencies and lack of an efficient and direct redemption mechanism stifle scalability. Recognizing this reality, MakerDAO began a major transition to traditional reserve assets such as USDC in 2021 and to BlackRock’s Tokenized Money Market Fund (BUIDL) in 2025. During this transition, MakerDAO (now Sky) established itself as the most critical liquidity provider for tokenized assets through the Tokenized Grand Prix, the $1bn Tokenized Money Market Fund (MMF) RFP managed by Steakhouse Financial, and BlockTower Credit’s $220 million private credit fund in partnership with Centrifuge to issue blockchain-native securities.

Stablecoins: Today’s Products

The fundamental promise of stablecoins is that any holder should be able to redeem one stablecoin for one dollar at any time, without any discount and with minimal transaction friction. The cornerstones of achieving this equivalent promise are sound asset management, reserve transparency, operational excellence, liquidity, custody integration, developer accessibility, and hard-earned regulatory clearance. Tether, Circle, and Maker were born in the greenfield era, which enabled them to succeed as they grew; for example, it is difficult to imagine a new entrant reaching the scale of Tether while investing its reserves in high-yield Chinese commercial paper.

Given the huge success of early stablecoin issuers, today’s market is even more competitive. There are at least 200 stablecoins today, and there will likely be thousands more in the future. This onslaught can fragment liquidity, degrade user experience, and evaporate venture capital dollars chasing the next big thing. Effectively competing with incumbents and newcomers requires new strategies and cohesive products from the outset. For fiat-backed stablecoins, the foundational elements for success include, but are not limited to, the following:

• Professional reserve management:

“Unless you are willing to staff a professional trading team,” said Austin Campbell (former CRO of Paxos), “don’t manage the underlying reserves yourself.” Maintaining the peg depends on solvency, and professional management is a minimum requirement for large fiat-backed stablecoins. Smaller issuers may prefer to start with existing tokenized money market funds (MMFs) and eventually scale up from the relatively high fee burden to cheaper solutions.

• Hosting coverage:

While consumers can hold stablecoins in browser wallets like Metam Ask, institutions hold digital assets in custody with providers such as Coinbase, BitGo, Fireblocks, Copper, and Anchorage. Some institutions may charge listing fees to asset issuers, which require technical and operational audits, compliance reviews, and approval from risk committees. Listing fees can sometimes be as high as six or seven figures (usually for crypto tokens, not stablecoins), and usually require maximum institutional support from service providers such as market makers.

• Standardize cross-chain deployment:

In the early 2020s, stablecoins may exist primarily on one chain and rely on trust-minimized bridges or wrapped copies on other chains. The subsequent era of bridge vulnerabilities — Ronin, Wormhole, Nomad — has spawned a new generation of cross-chain deployments, such as Circle’s Cross-Chain Transfer Protocol (CCTP) and Tether’s newer USDTO standard, both of which are built on LayerZero’s full-chain messaging protocol. As blockchains proliferate and interoperability improves, native deployment on multiple chains will become a necessity for a smooth user experience, and potential issuers must pay attention to this development direction.

Infrastructure providers like Paxos, which provides white label stablecoin services to high-profile clients like Paypal, and emerging stablecoin-as-a-service providers like Brale and MO, offer many core features out of the box. While these providers may change the “buy vs. build” tradeoff, the responsibility to design a useful product and market it effectively still lies with the issuer. What makes a stablecoin a good product, beyond stability and frictionless redemption at par? The issuer’s ability to create utility for its stablecoin and the products surrounding it.

Stablecoin utility function

USD stablecoins were originally created as a savings tool, allowing users to store value and protect against the volatility of crypto assets or their native currencies. However, fiat currencies give users more functionality than just savings. Anything a user does with a stablecoin—trading, earning yield, or paying—increases its utility as a product. The higher the utility, the higher the retention rate and the higher the floating yield.

Different users — be they businesses or consumers, traders or others — measure utility differently, and product-market fit requires that the feature set of a stablecoin aligns with customer expectations. While some feel the design space is infinitely broad, while others feel it is extremely narrow, recent successes and failures offer some interesting insights into today’s market landscape.

Different users — be they businesses or consumers, traders or others — measure utility differently, and product-market fit requires that the feature set of a stablecoin aligns with customer expectations. While some feel the design space is infinitely broad, while others feel it is extremely narrow, recent successes and failures offer some interesting insights into today’s market landscape.

Trade: Conquering Centralized Exchanges (CEX)

Tether’s creation story and the close collaboration between Circle, Coinbase, and now Binance are no accident: the essence of cryptocurrencies is speculation, and centralized exchanges remain the first choice for most crypto user journeys (~$19 trillion in trading volume in 2024).

Inside exchanges, stablecoins that can be used as margin collateral or form the base currency pair (such as BTC/USDC on Coinbase) have greater utility for traders seeking seamless entry and exit from the market. Acquiring these customers is not easy; for example, Circle formed a distribution partnership with Binance, paying $60 million in fees and sharing the float of idle USDC deposits on the exchange. For new issuers, the lesson is clear: if you can’t outspend Tether and Circle in customer acquisition, then you must differentiate on a whole new dimension to overcome the switching costs of your users.

Aside from the major incumbent players, the most successful centralized exchange (CEX) revolution has been Ethena and its (not quite) stablecoin USDe.

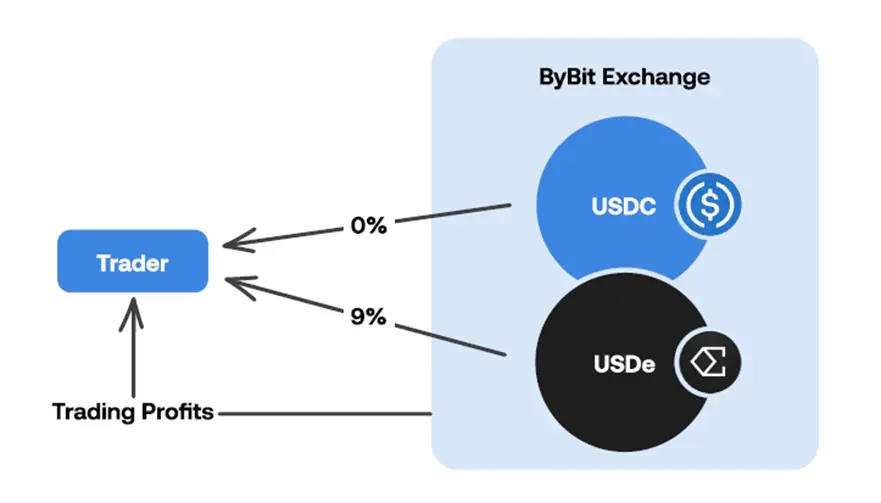

Traders are opportunistic and seek any avenues to improve capital efficiency, and staking USDC on CEXs means they earn little to no yield on their margin collateral. Ethena smelled an opportunity and struck a win-win deal between traders, centralized exchanges, and Ethena itself.

The general strategy is as follows:

1. Tokenize a high-yield, delta-neutral strategy into synthetic USD (USDe). The strategy they chose is a popular spot carry trade that has enabled USDe holders to earn annualized returns of up to 25% at times.

2. In order to obtain higher returns, Ethena approached centralized exchanges such as Bybit and proposed the following plan: If you allow the use of USDe as margin collateral, we will share part of the basic income with you (Bybit).

3. In order to compete for market share, Bybit has an incentive to transfer the earnings of the underlying USDe to traders to appease its traders. As of March 2025, Bybit traders using USDe as margin collateral have earned an annualized return of 9% (compared to 0% for USDC).

USDe’s obvious advantages as margin collateral, combined with frictionless distribution through centralized exchanges (CEXs), have driven USDe’s circulation to $5 billion today. This reality reflects traders’ preference for capital efficiency, even when the credit risk of the underlying asset is much higher than that of fiat-backed stablecoins (although we note that USDe has shifted to a more conservative stance over time). Ethena’s path is particularly courageous, and in some jurisdictions, new regulations may close the door to this particular strategy. That said, Ethena’s rapid growth is an example of the leverage that can be achieved with a successful centralized exchange integration.

Profit: Decentralized Finance (DeFi) Integration

From an economic perspective, branding can be defined as the ability of a company or product to generate higher profits than its commoditized competitors; the classic example that Warren Buffett cites is Coca-Cola's position in the soda market. Currently, USDC and USDT have unquestionable brand value, even if it is not impeccable. Due to first-mover advantage and network effects, USDT (and to a lesser extent USDC) are able to generate higher floating returns than new competitors that lack brand recognition. In this context, fully-reserve fiat-backed stablecoins (such as MO and Agora) have made a significant shift to sharing underlying revenue directly with users or B2B distribution partners.

However, with short-term interest rates widely expected to fall, revenue sharing is unlikely to be a differentiating factor to overcome user switching costs. To address this challenge, forward-thinking issuers are looking to increase the utility of their stablecoins by integrating their products into DeFi. One of the core integrations is listing on the cryptocurrency on-chain money markets popularized by DeFi protocols such as AAVE and Morpho.

These protocols coordinate borrowers and lenders into overcollateralized repo transactions similar to the Maker CDP structure; the main difference is that users are able to borrow almost any asset (e.g. USDC, USDT, etc.) and with more flexible parameters (e.g. up to 86% for cbBTC), with a wide variety of collateral assets such as BTC, ETH, and long-tail tokens.

On-chain money markets enable holders to leverage their assets, which they may be reluctant to sell for tax reasons or because they believe the collateral asset will appreciate. The demand for leverage (which can sometimes be very high) drives borrowing demand, and stablecoin holders meet this demand by borrowing, thereby earning a yield. The yield they earn depends on the market's willingness to borrow the asset.

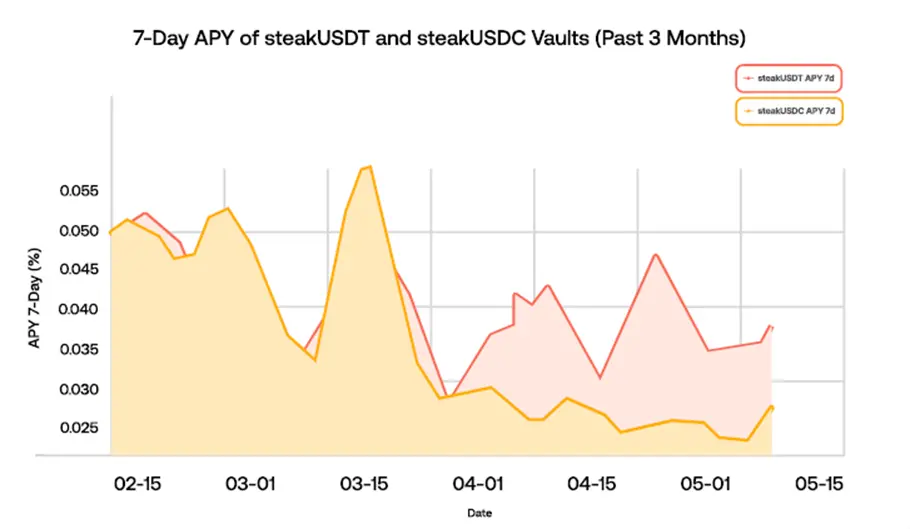

This chart shows the 7-day trailing annual interest rate for borrowing USDT (steakUSDT) or USDC (steakUSDC) into Steakhouse Financial’s Morpho market. Borrowing USDC offers a higher interest rate than USDT — which is commensurate with USDC’s dominant market share in the DeFi space.

• This is a strong indication of how DeFi users view the relative utility between the two assets.

This reality also extends to new stablecoins with lower native lending demand, prompting well-funded issuers to develop incentive plans to increase the actual returns received by borrowers. PayPal used this strategy to increase the circulation of PYUSD on Solana from $0 to $665 million in just 4 months in 2024, investing millions of dollars.

Incentivizing PYUSD markets in Kamino, a DeFi protocol on Solana. While PYUSD issuance on Solana has subsequently fallen to around $150 million, deep-pocketed issuers like Ripple continue to use this strategy, while more resource-constrained issuers incentivize markets with tokens (like Ethena’s $ENA) rather than cash. Either way, issuers must remain objective, or they risk confusing product-market fit with mercenary users who only see “free money.”

Once again, retention depends on the perceived utility of any particular stablecoin. To this end, permissionless blockchains are both a driver of growth and a potential limiter to market share dominance. Increasingly, new issuers are creating permissionless decentralized exchange (DEX) markets between their products and USDC, increasing the utility of their stablecoins by offering fungibility with on-chain USDC (Maker’s pegged stablecoin module being the most successful example). However, this emerging integration is severely challenged by the potential capital inefficiencies of on-chain USDC and the high IRR thresholds (>35%) charged by crypto-native market makers to create and manage these pools; unless providers with lower capital costs participate in the on-chain stablecoin market, true large-scale fungibility will not exist.

Payment: Bootstrapped Allocation

If cryptocurrencies are casinos and stablecoins are chips, then players will eventually need to cash out. After all, you can’t pay for dinner with chips. Cashing out those chips, however, is economically harmful to stablecoin issuers that primarily monetize floating capital. To counter this, stablecoins must become practical, not just speculative; Circle’s payment network is a prime example of Circle’s attempt to create additional functionality around USDC to monetize liquidity. However, the dream of stablecoins and blockchains themselves becoming payment networks faces strong resistance from the network effects that incumbents have carefully cultivated for decades. In the meantime, entrepreneurs have increasingly grafted stablecoins into existing credit card networks, allowing users to use chips seamlessly.

Crypto-based debit cards allow users to spend stablecoins like USDC at any of the millions of merchants around the world that carry a Visa or Mastercard sticker. The main difference between crypto debit cards and bank-issued debit cards is the “underwriting” process; while bank-issued debit cards require the bank to confirm that there are sufficient funds in the user’s account, crypto debit card issuers like Rain automatically authorize transactions if the user deposits enough USDC in a specific smart contract on the chain. Best practices for operational security (including multi-signature wallets and code audits) and limited basis risk between USDC and fiat currencies reduce risk for Visa and Rain, which are ultimately responsible for payment finality.

For users, the psychological barrier to holding stablecoins will gradually weaken as some stablecoins feel like cash. By working directly with crypto debit card issuers or card networks, issuers that leverage existing network effects are more likely to receive higher floating returns.

While early crypto debit cards were centered around USDC, future crypto debit cards will attempt to authorize payments using a wider range of crypto assets as collateral. For example, MetaMask is preparing to authorize transactions using assets such as ETH and other yield-bearing stablecoins, combining on-chain earnings with off-chain spending. In the long run, the card integration layer may completely abstract the underlying choice of stablecoins, reducing the importance of branding and creating a new attack vector against existing players.

In summary, there is a growing expectation that stablecoins can be launched with core fundamentals while maximizing user utility in terms of trading-yield-payments. Major initiatives like the alliance-backed stablecoin USDG acknowledge this reality; the alliance consists of leading exchanges such as Robinhood and Kraken, infrastructure providers such as Paxos, and custodians such as Anchorage. While it remains to be seen whether USDG can succeed, it is clear that the bar is only getting higher.

However, today stablecoin products have reached sufficient maturity to be adopted by a growing number of global payment channels. As this trend continues, stablecoins will increasingly be incorporated into the regulatory system that supports traditional financial services. For fiat-backed stablecoin issuers seeking maximum adoption, navigating this sea change will be critical to gaining and maintaining market dominance.

The changing regulatory landscape

Imagine spending years building a moat around your stablecoin, only to have it forcibly delisted by regulators. This is not a far-fetched story: USDT was delisted from major centralized exchanges across the continent when the European Union’s Market for Crypto-Assets (MiCA) came into effect on December 30, 2024. While Tether’s scale makes it uniquely capable of addressing these challenges, complying with global regulations is becoming increasingly important to enter key markets and win key distribution partners. As the guidelines become clearer, the restrictions they impose change the opportunity set and GTM strategies of new and existing issuers.

In this section, we seek to cover generally accepted fundamental concepts of compliance, best practices, and an overview of how these elements work together globally.

While many regulations may have unintended consequences, this section does not attempt to make a moral argument or judgement on the effectiveness of any particular regulation. For the avoidance of doubt, the following does not constitute legal, regulatory or compliance advice and is heavily biased towards the views of the operators.

Basic constraints

Beyond that, there are usually two non-negotiable conditions for gaining global regulatory approval:

KYC/AML: The goal of Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, such as the Bank Secrecy Act (BSA) in the United States, is to reduce the ability of bad actors to cause harm. The idea is simple: requiring customers to self-identify when entering the financial system makes it easier to catch criminals and more difficult to commit large-scale crimes.

Best Practice: Partners who control or strictly monitor nodes that control the flow of fiat money in and out of stablecoins. For example, minting USDC requires joining Circle, or for most retail users, minting or purchasing USDC through regulated centralized exchanges such as Coinbase. In the latter case, Coinbase will conduct KYC audits on users during the account opening process (Coinbase is a regulated money service company subject to the Bank Secrecy Act).

Regulators believe this would create an ideal system where:

1. All initial entry points (i.e., the entry points for exchanging fiat currency for stablecoins) are monitored;

2. All exit points require similar verification.

This process is similar to cash regulation; cash can be used and exchanged freely by anyone, but accessing the banking system or making large purchases requires self-identification and compliance with KYC/AML regulations.

Similarly, anyone can buy USDC or USDT in DeFi, but actual use may require registration at a regulated on-ramp or off-ramp.

Monitoring and Sanction Screening: Once participants enter the ecosystem, issuers must implement effective monitoring of these participants to detect participants with good behavior who turn bad, or identify bad actors who enter through DeFi.

In some cases, bad behavior is clear—for example, an entity or address is listed on an OFAC sanctions list—and failure to detect it in real time can result in significant fines or other regulatory consequences.

Best practice: Document and automate relevant policies.

Our common guiding principles are as follows:

• Conduct a baseline screening of all identifiable holders every six months (or when the sanctions list is updated)

• Adjust screening frequency based on risk profile, with more frequent screening for high-risk areas (e.g., geographic location)

• Implement automated compliance tools such as Chainalysis and TRM Labs to monitor suspicious blockchain activity

• Participate in financial intelligence networks, such as FinCEN's 3i4(b) information sharing program

• Implement formal agreements to freeze or seize assets where required by law, particularly in support of law enforcement investigations into money laundering and terrorist financing

Emerging options: blacklist vs. whitelist

The world’s largest fiat stablecoin has adopted a blacklist model, a pragmatic choice that maximizes distribution by minimizing friction. The blacklist model means that any wallet can receive, hold, or transfer stablecoins unless the wallet is flagged for sanctions, fraud, or other illegal activity. Compliance is achieved through: (i) screening at fiat on- and off-ramps; (ii) continuous monitoring of on-chain fund flows; and (iii) the power to freeze or destroy tokens in blacklisted addresses.

The opposite approach is the whitelist model, which flips the default model on its head and only allows pre-approved wallets to hold and trade stablecoins. Historically, this approach has reduced the utility of stablecoins, thereby inhibiting their growth, as the utility of stablecoins relies on widespread acceptance. That said, the model resembles the securities regulatory approach and provides maximum counterparty certainty, which may be attractive to banks, broker-dealers, or payment networks that must meet the most stringent anti-money laundering, counter-terrorist financing, and prudential standards.

The choice between a blacklist or whitelist model depends on the target user group of the stablecoin. Historically, blacklist models have seen higher adoption rates because consumers can use stablecoins for daily spending like cash; we expect the blacklist model to continue to grow significantly faster than the whitelist model.

However, as the regulatory environment changes, so too will the user base. If the user base shifts significantly toward institutions, we may see the whitelist model become the norm for certain use cases, such as securities settlement or intra-company transfers. While this is purely speculation, some implementations of the whitelist model could change the unit economics of stablecoins. For example, Fnality is seeking approval from the Federal Reserve for its master account this year, which would effectively eliminate the custody and reserve management infrastructure that supports today's fiat-backed stablecoins while allowing seamless access to traditional fiat payment channels. The impact of CBDC-like coin offerings on the broader stablecoin industry is unclear, but it is worth keeping an eye on.

The Layer Cake of Global Regulation

Stablecoins operate at the intersection of transnational aspirations and a complex web of national and local legal frameworks. This presents predictable challenges: a lack of clear rules and a lack of consistency across jurisdictions and regulatory regimes. For operators, we have attempted to succinctly distill insights and experiences from major markets. Please note that this section is highly general and U.S.-centric: Issuing compliant stablecoins requires case-by-case assessment and ongoing consultation with counsel, compliance professionals, and regulators.

America: Getting out of the maze

Historically, the United States has mainly guided stablecoin issuers to apply for money transmission licenses (MTLs), a system that is not designed for the innovative nature of stablecoins on public chains.

For example, in the past, money transmission institutions were often required to post margin because these businesses were primarily undercapitalized in their early stages; today, most fiat-backed stablecoin issuers hold sufficient reserves or even overcollateralize, and do not engage in lending or staking. In the meantime, U.S. issuers must deal with money transmission licenses (MTLs), money service businesses (MSBs), Bitcoin licenses, banking partnerships, and federal trust charters, while also dealing with scrutiny from the U.S. Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC), the Office of the Comptroller of the Currency (OCC), or the Financial Crimes Enforcement Network (FinCEN). However, with the passage of the General Data Protection Act (GENIUS Act) by the U.S. Senate, the U.S. may eventually move beyond regulating stablecoins simply by analogy with existing financial products.

The General Data Protection Regulation represents the best attempt yet by the United States to provide regulatory clarity.

The bill focuses on “payment stablecoins,” which are defined as stablecoins used as a means of payment or settlement, where the issuer “represents or creates a reasonable expectation” that the stablecoin is pegged to the U.S. dollar. As such, the issuer is obligated to redeem, redeem, or repurchase the stablecoin for a fixed monetary value (e.g., $1). Importantly, the GENIUS Act does not explicitly cover algorithmic stablecoins (e.g., DAI/USDS) or yield-generating stablecoins, which either fall under the bill’s 2-year algorithmic stablecoin moratorium or may be regulated under existing securities laws.

Alex Thorn of Galaxy has been producing some of the best research in the cryptocurrency space; his insights into the key terms of the GENIUS Act are a must-read for any practitioner looking to understand the new regime.

For practitioners, the most relevant guidance includes:

1. Treat stablecoin issuers as a distinct category of financial services providers, while limiting issuance to issuers that meet federal and state qualifications, with the Office of the Comptroller of the Currency (OCC), the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the National Credit Union Administration (NCUA) as the primary federal regulators.

2. Make it clear that payment stablecoins are not securities or commodities, and that permitted payment stablecoin issuers are not investment companies.

3. Allow foreign issuers from jurisdictions with similar regimes that are also required to register with the Comptroller General, comply with U.S. legal orders, and hold U.S.-custodial reserves for U.S. users.

4. Clarify guidelines for the composition of reserve assets, require 1:1 collateralization, restrict collateralization, and limit acceptable collateral to demand and insured U.S. dollar deposits, Treasury bills with a remaining maturity of 93 days or less, repo and reverse repo backed by Treasury bills, money market funds that invest in these assets, and any other similar government-issued assets approved by regulators.

5. Strengthen reporting requirements, including monthly disclosure of their reserves on their websites and annual audits for stablecoin issuers with a combined outstanding issuance amount exceeding $50 billion.

6. Marketing and consumer protection measures to limit issuers from misrepresenting stablecoins as legal tender or insured currencies.

7. Bankruptcy isolation and bankruptcy protection measures to establish the priority claim rights of stablecoin holders to reserve assets and funds in transit.

Importantly, the GENIUS Act provides a 12-month learning period for non-payment (i.e., yield-based) and algorithmic stablecoins, placing these assets in limbo but currently allowing them to circulate in the U.S. This moratorium provides a brief window for issuers to distribute yields directly to stablecoin holders, which could continue the wave of yield-based stablecoins that seek to replace existing stablecoins.

Global Integration

For a more in-depth theoretical and practical overview of global regulatory convergence, see Chris Brummer’s generous contribution, “Stablecoin Interoperability: A Theoretical Assessment and Practical Overview.”

Here is a brief overview of regulatory approaches outside the United States:

With MiCA, the EU has taken a comprehensive approach, creating clear legal categories: asset-referenced tokens (ARTs) refer to crypto-assets that reference multiple currencies, while electronic money tokens (EMTs) refer to crypto-assets that reference a single currency.

MiCA formally establishes a single pan-European compliant stablecoin market, while requiring non-EU issuers to comply with the regulations or be excluded.

Compliance requirements include full reserve backing, transparent reporting and clear regulatory approvals.

As of March 2025, 10 companies have been approved to issue 15 MICA-compliant stablecoins, including euro-pegged options such as EURC and EURCV, and dollar-pegged options such as USDC and USD1.

In Asia, three distinct regulatory models have emerged.

For example, Japan restricts the issuance of stablecoins to licensed banks and trust companies. Singapore and Hong Kong allow the issuance of stablecoins through strict regulatory channels, emphasizing financial robustness. China and India ban or severely restrict private stablecoins in favor of state-controlled digital currencies.

Both in the United States and globally, the situation remains dynamic and will continue to evolve.

However, as the regulatory environment becomes clearer, issuers have the opportunity to start a potential new game in the field. Regulatory arbitrage has historically defined the cryptocurrency industry and the financial services industry broadly; however, mainstream adoption depends on certainty. As payment stablecoins usher in a new era in the United States and other regions, pioneers have begun to shift the battlefield from stablecoin issuance to stablecoin infrastructure.

Stablecoins: The infrastructure of the future

One of the great appeals of cryptocurrency is the commercialization of cutting-edge technology: the inextricable link between BTC (the asset) and Bitcoin (the network) has spawned a multibillion-dollar industry that has emerged from the academic backwaters of cryptography, distributed ledgers, and zero-knowledge proofs.

Unfortunately, pitching cutting-edge technology to traditional financial institutions is often met with pushback.

It is extremely difficult for our industry to navigate this paradox.

Even with luminaries like Larry Fink publicly declaring that “tokenization is the next generation of financial markets,” the reality is that adoption of blockchain technology remains painfully slow and superficial for institutions demanding regulatory clarity and consumers seeking a seamless experience. This is nothing to be ashamed of: finance is one of the most heavily regulated industries in the world, commensurate with the importance of consumer protection and the industry’s role as a global commerce connector.

So, how do we drive change?

One approach is to start at the edge and go straight to the core. For example, Stripe first used its technology advantage to abstract the complexity of processing global payments into a simple developer-centric API. This meant it could serve startups that were technically savvy but too small and different for traditional institutions to serve.

History always rhymes. Stablecoins are the Trojan horse for blockchain infrastructure to enter global commerce, and this application has already begun at the edge of our financial system.

Value chain collaboration

“Hi, I’m from [Startup X] and my clients want to send money from the US to their parents in India. Can you help me?”

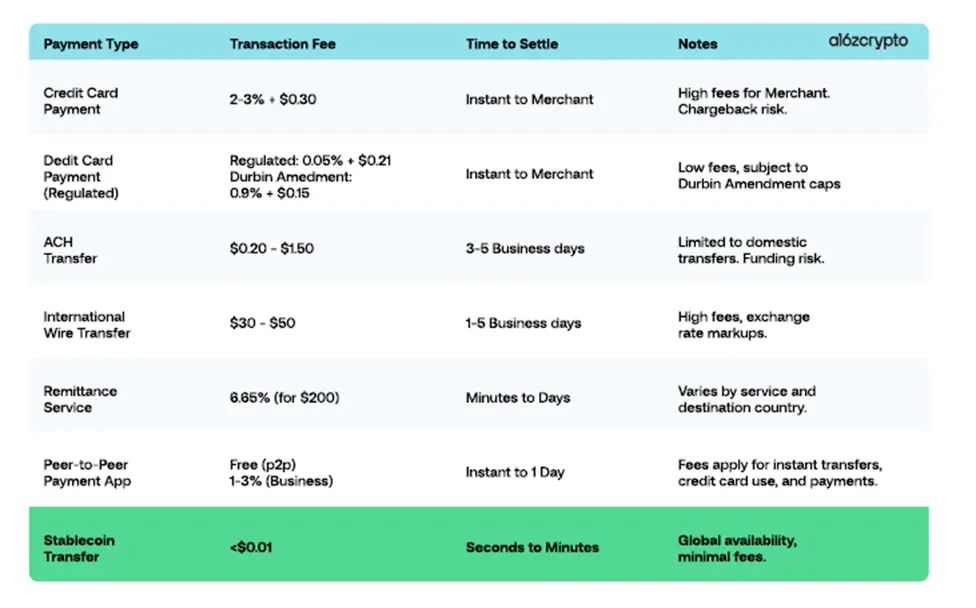

Moving money compliantly is a core function of payments orchestration. No, this won’t be another deep dive into cross-border payments opportunities. If you want to learn more, I recommend this great article from stablecoin infrastructure company Merge. If you don’t, just take a look at the following chart made by Sam Broner and the awesome team at ai6z crypto:

Cross-border payments are complex, time-consuming, error-prone, and costly; stablecoins and blockchain ledgers offer a globally accessible, cheap, and nearly instant alternative to traditional cross-border payment rails. Even if the above chart is a bit crude—as any intrepid consumer who has ever paid 350bps for a cup of coffee can attest—the world is gradually moving beyond a model that cobbles together local payment networks with an outdated messaging protocol (SWIFT) and a network of correspondent banks. Frankly, this is one of the clearest “your margin is my opportunity” situations we’ve ever seen in finance.

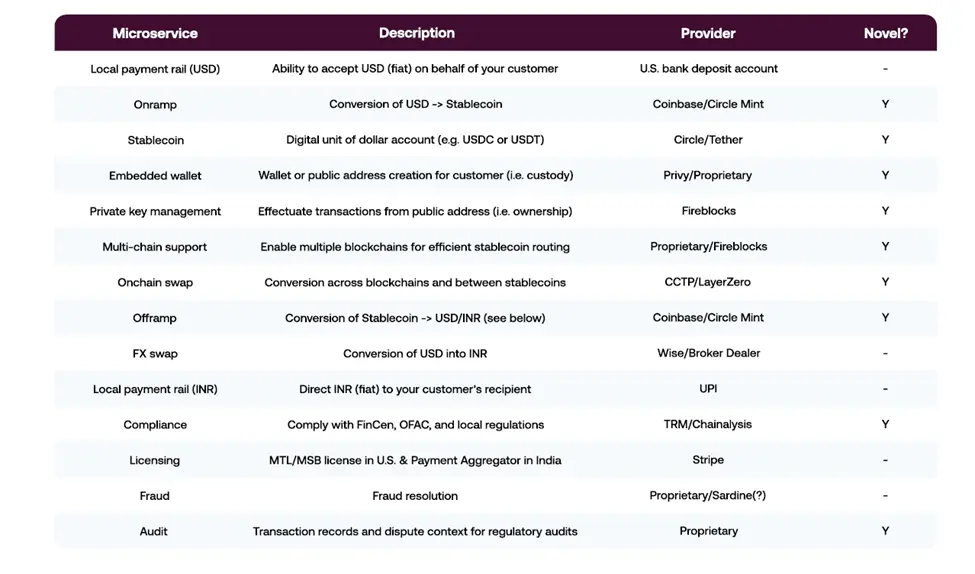

Back to the example above: you are [Startup X] and you need to accept USD payments on behalf of your clients and send INR to their parents in India. You have decided you want to meet your clients where they are — accept USD and send INR payments in fiat currency — but you want the efficiency of stablecoins routing cross-border payments and to comply with the law. Your lawyers tell you it will take 18 months to get a Multi-Account License (MTL), Multi-Account Business (MSB), and Bitcoin license, but you think the opportunity is there and decide to use a service like Bridge. How does Bridge restructure the payment orchestration value chain to enable you to provide this service?

Bridge - Value Chain Description

Note: The above list is not exhaustive, omitting the supporting elements of each microservice (e.g., node infrastructure and blockchain data indexing), as well as the reality that some underlying providers bundle multiple microservices together. However, what is more important to you is that Bridge is able to abstract this complexity through a developer-friendly API while retaining two key features:

1. Maximize accessibility and availability: acquire new partners and build redundancy into the underlying microservices (e.g., multiple partner banks in the United States);

2. Manage a unified real-time global ledger: equivalent to a bank core,

Managing transaction processing and internal accounting across multiple databases (blockchain or otherwise). We will explain this in more detail later.

Big Reorganization

Ben Thompson, in his book Keeping Attractive Profits, provides a practical framework for understanding technological disruption. He writes:

“Any company that can successfully integrate the different components of the value chain will gain a dominant position in the value chain, while the rest of the value chain will modularize and enter commodity competition.”

In the 1970s, IBM dominated the computer industry by vertically integrating hardware and software. The emergence of open architecture PCs such as the Apple II in 1978 opened the door for Intel to focus on CPUs and Microsoft to focus on the Windows operating system. As the value of CPUs and operating systems accumulated, the PC business itself became commoditized, and at the same time, new opportunities emerged for specialized companies (such as Nvidia and its GPUs) or repackaging (such as Apple's M4 CPU and macOS).

The same strategy is playing out in the context of stablecoins and blockchain-based financial services.

Stablecoins commoditize the ability to store value in a fully-reserved (i.e., solvent) dollar-denominated manner. Blockchain commoditizes the ability to distribute and transfer value in an open, global, and increasingly scalable manner. Prior to these innovations, both of these capabilities were monopolized by tightly controlled banks and payment networks, respectively.

“[Bridge] defines great products by mastering the fundamentals — managing reconciliation, regulatory compliance, and growing merchant and payment method acceptance — while enabling our customers to launch new products with ease.”

— Yelena Reznikova, Bridge Partner (a Stripe company) [Startup X’s] customers will come to expect more from your product over time: Yes, I’d love to send money from the US to India, but since I trust this app to do the transfer, it would be great if I could also spend it seamlessly. In fact, it would be awesome if this app could help me store my money, and, wait, I could earn money by keeping it there.

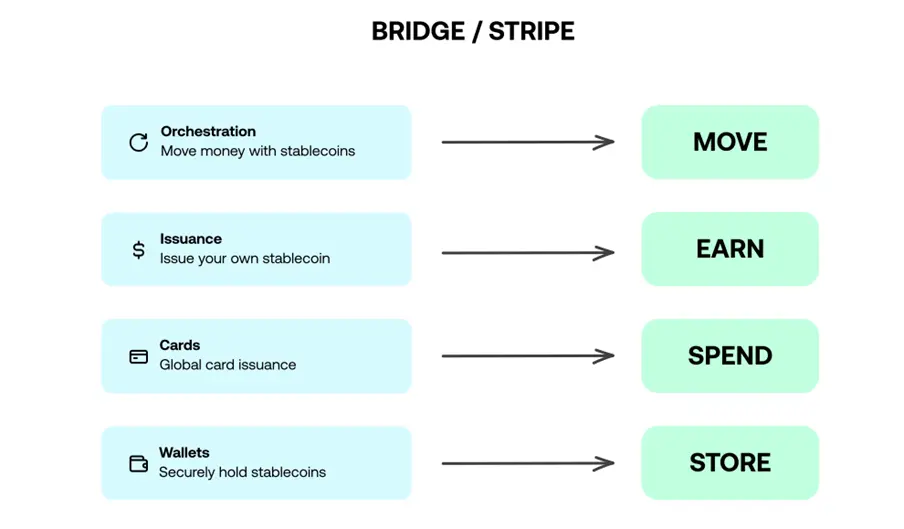

Bridge bundles all of these capabilities into a unified product suite:

Bridge has built a technology, operations, and compliance stack for its core business processes, and each product is a relatively simple extension of these stacks. For example, to allow customers to "mint" their own stablecoins (USDB), they need to add an asset reserve manager (Blackrock) and a securities custodian. Issuing cards requires extending the core to the card network, which they have already achieved through Stripe's partnership with Visa, and equipped with physical card printers. The wallet infrastructure is in place to manage their own on-chain stablecoin operations - it is almost free to have it as a product for sale.

How does this benefit [Startup X]? If I attract deposits into a stablecoin like USDC, Circle will monetize the float; if I issue my own stablecoin, XUSD, Bridge will share the float with me. Given that XUSD and USDC have the same underlying credit risk (e.g., backed by Blackrock Money Market Reserves), Visa should accept XUSD as collateral to execute payments on the Visa network, thereby increasing XUSD’s payment utility. If my users want to bridge USDC to a more practical use case (e.g., DeFi), Bridge can make XUSD fungible with USDC by enabling zero-fee swaps between XUSD and USDC, with Bridge subsidizing the cost of the swap infrastructure.

All of these products have been released in the past two months, culminating in Stripe’s “Stablecoin Finance Account,” which has launched in 101 countries and supports a full stack of USD-denominated banking and payment services. Monetizing the same core through multiple products creates operating leverage, allowing Stripe/Bridge to shift revenue toward commoditization of other layers. One pressure point may be single offline/online businesses that charge fees when converting fiat to stablecoins and vice versa; Brale’s IO product is a recent attempt to commoditize this layer. If your business only does this one business, then you must charge a fee (we have observed fees of around 10 basis points per transaction), which is effectively a tax on [Startup X] for moving money between the digital world and the fiat world. It is critical for business operators to avoid this tax, or to spread the cost across vendors that provide other necessary functions.

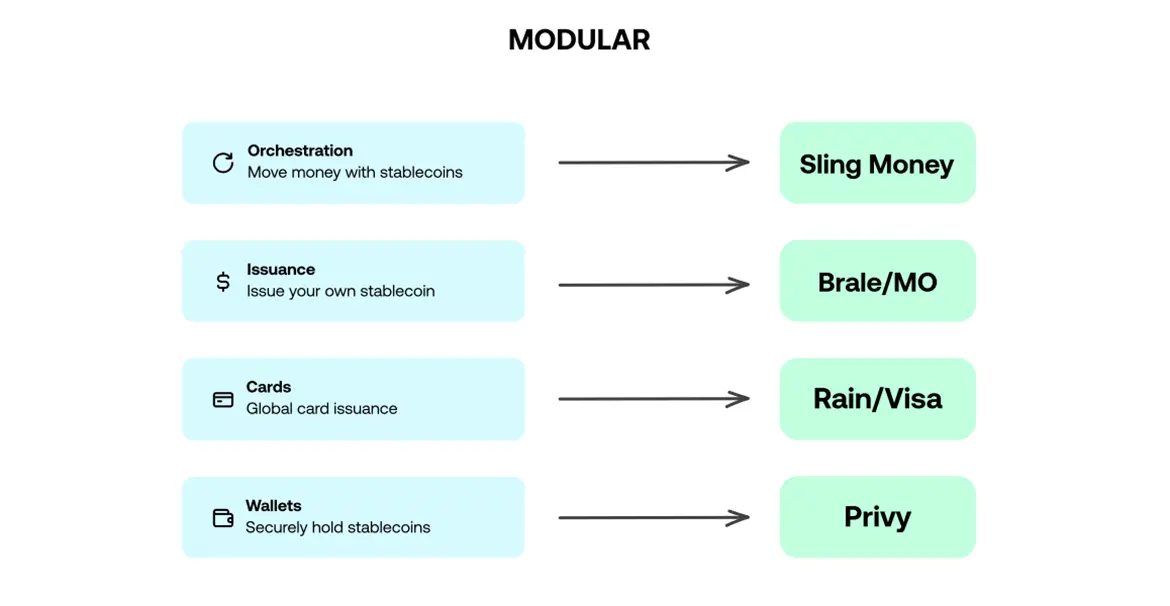

Ultimately, trillions of dollars of value depend on figuring out where value will accrue next. Will profits flow to specialists in the value chain? For example, [Startup X] could be created in different ways:

Today, a single vendor may be cheaper, but it also creates concentration risk and increases switching costs. Satya Nadella recently said in an interview with Dwarkesh Podcast: "Enterprise markets are trending towards oligopoly, not monopoly." If you are a Fortune 500 company, you will not entrust your critical infrastructure (such as cloud computing) to a single vendor. Either build redundant architecture with multiple cloud vendors, or new companies, such as multi-cloud infrastructure vendors, will emerge to meet your needs.

Will Mastercard or JPMorgan leverage their existing advantages — distribution and balance sheet — to create more attractive bundles? Or will specialized wallet providers, which serve as gateways for consumers into the blockchain ecosystem, become super-apps and realign the profit structure in their favor? The battle has only just begun.

Arc of Reason

In the long run, finance is highly rational.

From the Venice Clearing House to the Depository Trust Company (DTCC), the long trajectory of financial innovation has historically been toward greater efficiency. The closer we get to a situation where all nodes in a financial network reference a single, global, self-coordinating system of record (like the internet), the closer we get to terminal efficiency. Even if blockchain isn’t the final form, it’s clearly a superior technological alternative to the patchwork system we have today.

All financial services businesses are built on a proprietary core ledger that manages accounts, balances, transactions, and context.

These systems are notoriously difficult to scale, and can be disastrous if not managed well. Alvaro Duran, author of the phenomenal Substack Payments Engineer’s Handbook, summarizes the problem in his article “A Tale of Two Ledgers.” While the entire article is worth reading, Alvaro argues that the difficulty lies in the brutal tradeoff between availability (i.e. maximizing transaction approval rates) and consistency (i.e. ensuring that transactions are approved based on accurate information).

Holding or moving funds requires each bank, custodian, or payment service provider to communicate through a network that grows exponentially in complexity with each isolated node.

On the other hand, finance relies on accurate information, and this sprawling infrastructure makes reconciliation extremely challenging, especially when juggling speed and scale requirements. This thorny issue is driving the top builders of financial services to turn to infrastructure that is (i) consistent, transparent, and global, and (ii) capable of managing state and transaction processing on their behalf. Here’s what the builders are saying:

Blockchain unlocks global consistency, building a “second layer” on top of our existing financial system.

“Stablecoins are the first universal ‘file format’ for money, eliminating the inconsistent local currency system that has traditionally kept dollars, euros, Mexican pesos, and every other fiat currency in its own separate place. When all currencies are in the same format, our customers can build a wallet that can hold and redeem them instantly, enabling our customers to launch products in dozens of markets without having to deal with foreign bank accounts or payment networks. In other words, stablecoins break the link between geography and access to money — allowing people to hold dollars without going through a U.S. bank — which will have profound implications as adoption scales.”

— Zach Abrams, Founder and CEO, Bridge (a Stripe company)

Blockchain abstracts reconciliation, just like AWS abstracts IT infrastructure.

Having spent most of my career contributing to ledger systems and banking core systems, it is undeniable that reconciling massive amounts of data often means large teams, expensive infrastructure, and constant effort to keep things in sync with banks’ systems of record. Brale takes a blockchain-first approach to building its core systems. Every transaction is final and published to a shared global blockchain, either succeeding or failing. Reconciliation is built into the system. This allows us to move faster, support higher volumes with fewer people, and launch stablecoins at unprecedented speeds while maintaining interoperability with any bank. This speed and finality would not be possible without the thousands of engineers around the world working on blockchain technology.

- Ben Milne, Founder and CEO of Brale.xyz

No, blockchain is not a panacea. It cannot and will never solve all the problems of global finance.

Yes, there are tradeoffs — anyone who has experienced a failed transaction on Ethereum or Solana knows that public chains must continue to improve usability. No, the core elements that unlock new use cases and consumer adoption — identity and privacy — are not yet widely available.

Yes, consumers still have to pay high fees for consumer-facing cryptocurrency on-ramps — often 350 basis points or more.

Just like Stripe Link, MoonPay, etc.

Yet, despite these headwinds and the unfavorable regulatory environment, the technology continues to improve, with total stablecoin circulation organically growing to nearly $250 billion today. If one further compares this to incumbents that measure progress in a century-long timeframe, smart bettors would bet on David, not Goliath. These global record systems provide a consistent back-end experience and eliminate middle and back-office workflows, and each new node that integrates with these systems will enable

It’s becoming increasingly unreasonable to build on any other system. If you don’t believe us, believe the big players who are betting billions on the future that these efficiency gains and the new capabilities they unlock will flow to the early adopters of this new paradigm.

What's next?

During the time of writing, a game-changing industry announcement is released every week. This onslaught has caused predictable panic and fear among entrepreneurs and established businesses. Where is the market going? What should I be concerned about? Am I too late?

The sea change has only just begun. Likewise, as the battlefield shifts to “banking-as-a-service” stablecoin infrastructure, today’s level of competition requires firms to have a unified product, go-to-market strategy, and the ability to adapt. In this rapidly changing environment, we hope that the Practitioner’s Guide will provide timely and timeless insights into the current state and future of stablecoin issuance and infrastructure development.

What’s next? With regulatory clarity looming in the US, regulation is likely to coalesce around global standards, much like Basel standards have in banking. We will also see network effects compound in unpredictable ways, and expect blockchains to become increasingly differentiated when coordinating transactions between more parties, not just in closed-loop proofs of concept. With the repeal of SAB 121, we expect banks to gradually introduce structurally lower capital costs to the broader crypto ecosystem over time, significantly changing today’s on-chain market structure characterized by volatile and high costs of capital. Finally, we expect the landscape to change dramatically when fiat-backed stablecoins grow beyond the reasonable supply of Treasury bills: if stablecoins continue to grow, some form of fractional reserve stablecoins may need to emerge.

We present to you some thought-provoking reflections from our wonderful partners. Without them, we wouldn’t be able to create an article that we hope is worthy of your attention.

The atomicity, programmability, and openness of blockchains enable frictionless flows between currently siloed instruments. This is already opening new possibilities for the combination of tokenized money market funds and stablecoins, enabling unprecedented liquidity and interoperability. As tokenization grows, we are likely to see these new capabilities expand to more asset classes and more applications.

This future of seamless transitions between previously incompatible states will drive the growth and adoption of stablecoins, creating the potential for a more interconnected and efficient financial ecosystem.

- Robert Mitchnick, Head of Digital Assets, BlackRock

“If [regulatory] interoperability does emerge, it is unlikely to emerge from a single legislative breakthrough or multilateral agreement. Rather, it will be layered, piecemeal, and evolutionary — an ecosystem of technical standards, regulatory cooperation, mutual recognition mechanisms, and adaptive compliance protocols. Achieving this goal will require more than just institutional coordination; it will require a shift in philosophy. Regulators must begin to view stablecoins not just as objects of national control but as infrastructure for cross-border economic coordination.”

In this sense, interoperability is more than a technical or legal goal – it is a governance imperative in the digital financial age.”

- Chris Brummer, Founder of Bluprynt and Professor at Georgetown Law School

“The core function of the banking system is to channel excess savings into productive investments in businesses and the broader economy. While stablecoins offer significant efficiency benefits to savers, these benefits do not necessarily translate into improvements in the overall economy. If stablecoins grow substantially but remain restricted to investment in government bonds, they will siphon critical investment capital away from private business, harming economic growth. The Fed made the same argument when it refused to approve “narrow banks” in 2019. Now, regulators face a critical choice: either allow stablecoins to develop into Bank 2.0 — supporting both savers and businesses — or restrict their growth outright.”

— Hasu, Head of Strategy at Flashbots and Strategic Advisor at Lido & Steakhouse Financial

“What do I worry about? We understand that every 3 months or even less, we find some new use case that seems to be bigger than all the previous ones.

We think that will continue. If banks come in, it will open up a whole new market, and the capabilities that those customers need will change.” I’m not worried about new entrants competing directly with Bridge today; I’m worried about competitors that don’t exist yet and serve markets that we’re missing out on.

— Zach Abrams, Founder of Bridge (a Stripe company)

“I hate the state of the stablecoin discussion and the lack of imagination in the industry to turn such a powerful tool into something tawdry, as if it were just a network to move money between systems that don’t communicate with each other.

This goes against the original purpose of cryptocurrency. Don’t underestimate the power of open source, decentralized finance applications, and other blockchain-native technologies to lower barriers to entry, create new use cases, and improve lives.

——Luca Prosperi, Founder of MO

In many ways, Luca is right. Cryptocurrency is no longer the industry some of us entered all those years ago; it has moved far beyond the constraints of ideology to become a canvas on which each of us can paint a different future. Stablecoins, as a critical link between the world we live in and the future, will only become more important over time. We can’t wait to see what develops next.

Thanks