Focus

SharpLink Gaming (SBET), a listed company focusing on online game and sports betting marketing, after announcing the purchase of 176,271 ETH for $463 million on June 14, issued another announcement yesterday (24th), stating that between June 16 and 20, it bought an additional 12,207 ETH at an average price of $2,513, spending $30.67 million.

SharpLink Gaming's Ethereum Holdings Reach 188,478

After this additional purchase, SharpLink Gaming's total Ethereum holdings have reached 188,478 ETH, making it the listed company with the most Ethereum holdings.

Additionally, the funds for this purchase mainly came from selling 2,547,180 common stocks through an ATM mechanism, generating $27.7 million. Currently, the company has staked all its ETH in proof of stake, earning 120 ETH in rewards since June 2, attempting to strengthen cash flow through staking income.

SharpLink Gaming Stock Slightly Rebounds

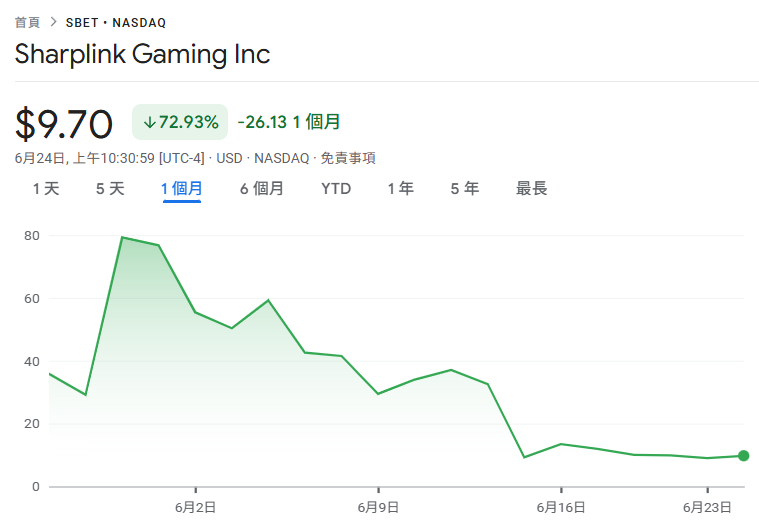

According to Google Finance data, SharpLink Gaming's stock (SBET) rose 8.77% after the US market opened on the evening of June 24, temporarily reporting at $9.8, with a market value of approximately $594 million.

However, it is worth noting that after announcing the establishment of a large Ethereum strategic reserve, the company faced market doubts about its feasibility, with the stock price plummeting from $80 to $9.21. The current stock price is still far from returning to its previous high.

Can SharpLink Gaming's Stock Return to Its Previous High?

The main reasons for SharpLink Gaming's significant stock price drop include:

- Market Misunderstanding and Panic: S-3 document registration of 58.7 million shares for potential resale led investors to mistakenly believe insiders were about to sell stocks, causing panic selling. Although company leadership clarified this as a standard procedure with no actual stock sale, market confidence is difficult to restore in the short term.

- Ethereum Price Volatility: SharpLink Gaming has tied its company value to Ethereum, which is more volatile than Bitcoin. The current weak overall sentiment towards cryptocurrencies affects investor confidence in the company's strategy.

However, some analysts point out that SharpLink Gaming's stock price may still see a significant rebound for the following reasons:

- Long-term Bullish Ethereum Expectations: SharpLink Gaming's Ethereum holdings and staking are expected to generate stable income. Analysts predict Ethereum prices could recover to $4,000-$5,000 in 2025, which would significantly increase the company's asset value and drive stock price up.

- Gradual Dissipation of Market Misunderstanding: The panic caused by the S-3 document is a short-term emotional reaction. Company leadership has actively clarified, and there is no evidence of large-scale stock selling. As the market gradually digests this information, investor confidence may stabilize, driving a stock price rebound.

- Similarity to MicroStrategy's Success: SharpLink Gaming's Ethereum reserve strategy is similar to Strategy's Bitcoin strategy, which saw stock prices repeatedly hit new highs after long-term holding. If Ethereum market sentiment improves, SharpLink Gaming might replicate a similar path, attracting institutional investors.