Market sentiment is gradually warming up, with Bitcoin regaining its position above $107,000, breaking free from the earlier decline below $100,000 this week. There is a high probability of reaching $150,000 by the end of the year, and Ethereum is also expected to benefit from the upward trend.

VX: TZ7971

The net capital inflow of Bitcoin spot ETFs has accumulated to $46 billion, continuing to provide solid structural support for the market.

Although short-term volatility persists, Bitcoin is expected to attack $110,000 to $120,000 in the third quarter of this year, with the potential to challenge $150,000 before the end of the year.

Ethereum is also expected to explore $2,600 to $2,800 in the short term, with long-term potential to soar to $5,000.

Behind this rebound, it also reflects a shift in global investment sentiment. US futures continued to rise on Wednesday, maintaining the momentum of the Nasdaq 100 index reaching a historical high, with Asian stocks rebounding for the second consecutive day; US bond prices rose, and the US dollar remained stable.

Old Bao stated that "monetary policy has multiple possible directions," with the market re-betting on the possibility of interest rate cuts within the year, especially against the backdrop of continued weakness in recent US consumer confidence data.

Bitcoin's rapid rebound has also simultaneously triggered market discussions about its safe-haven asset status.

Bitcoin's status as a safe-haven asset is still taking shape. However, after a sharp drop to the $90,000 range, it V-shaped rebounded within 48 hours, rising above $105,000, indicating that Bitcoin's liquidity and mainstream asset status are gradually stabilizing.

Although geopolitical conflicts usually trigger capital outflows, recent trends show that institutional buying is playing a stabilizing role in the market, not only helping to alleviate the decline but even accelerating the rebound.

Institutional Cash Flow Supports Bitcoin Price

Over the past week, crypto investment product fund flows have been strong. According to CoinShares' June 20 report, crypto ETP net inflows were $1.24 billion, with $1.1 billion flowing into Bitcoin funds.

BlackRock's Bitcoin spot ETF (IBIT) led this growth, pushing total inflows year-to-date to over $15.1 billion.

Despite Bitcoin's price being close to historical highs, continued bullish fund flows indicate ongoing institutional investor interest.

As Bitcoin ETF assets under management steadily grow, and with over 126 listed companies now holding BTC, the long-term demand foundation appears robust.

Despite weekend selling, the Bitcoin derivatives market showed resilience. CoinGlass data shows that total futures open interest (OI) remains around $68 billion, with only $193 million in long positions liquidated, less than 0.3% of total positions.

The options market on Deribit also shows bullish sentiment, with open interest concentrated near the upcoming expiration prices of $110,000 and $120,000.

According to Santiment, retail investor sentiment has dropped to its most negative level since April, while glassnode's on-chain indicators show large Bitcoin holders are engaging in accumulation activities.

The combination of negative retail investor sentiment and whale buying activities is often a precursor to a bullish reversal, helping to support Bitcoin's price recovery.

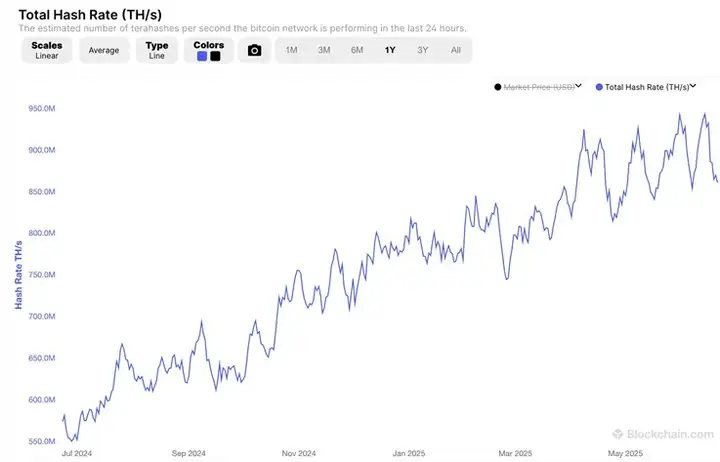

Over the past week, Bitcoin mining hash rate dropped 8%, from 943 million terahashes per second to 865 million terahashes per second.

The drop in computing power is temporary, caused by power outages, and not a systemic issue. Meanwhile, the amount of Bitcoin withdrawn from exchanges is increasing, indicating more holders are choosing to hold rather than panic sell.

glassnode's cost basis data further strengthens the positive fundamentals. At the time of writing, Bitcoin's trading price is already above the short-term holder's cost basis ($105,200).

Long-term indicators show that most holders are still profitable, thereby reducing the risk of forced selling.

The $110,000 resistance zone is psychologically and technically significant.

If successfully broken through, the price may enter a new strong upward trend. Conversely, if unable to break this level, the market will continue to consolidate.