Written by: imToken

Stablecoins, the product form closest to RWA in crypto finance, are facing an unprecedented regulatory transformation.

On June 18, 2025, at dawn, the US Senate passed the "GENIUS Act" (Giving Every Nation a United Stablecoin) with 68 votes in favor and 30 against, which is considered a milestone in crypto payment legislation. This is the first time the United States has established a clear compliance path for stablecoins at the federal level, marking a key turning point for crypto assets moving from technical experimentation to institutionalization.

Simultaneously, Hong Kong has also made forward-looking arrangements through the Stablecoin Regulation and future license applications, and will officially begin accepting stablecoin issuance license applications on August 1, becoming the world's first financial center to implement a local stablecoin licensing mechanism.

As stated in "Comprehensive View of Traditional Institutions Entering: Holdings, Stablecoins, and Legislation Advancing Together, Are Giants Reshaping Web3?", the compliant new cycle represented by the United States and Hong Kong may profoundly reshape the position of stablecoins in the global financial system, and the undercurrent behind all these variables is accelerating to the forefront.

01 United States: Firing the First Shot of Stablecoin Compliance

Over the past 5 years, what has been the most successful crypto financial product globally?

The answer is not difficult to guess. It's neither the on-chain financial innovations like Uniswap that ignited DeFi Summer, nor the digital artworks like CryptoPunks that sparked the Non-Fungible Token craze, but rather the stablecoins that everyone has long been accustomed to.

Indeed, beyond DeFi, Non-Fungible Tokens, and other games with whale attributes, stablecoins have become one of the use cases widely accepted by crypto and non-crypto users, gradually becoming an important bridge in on-chain payments, cross-border settlements, financial transactions, and even Web2 scenarios, greatly expanding and deepening the user base of the crypto economy.

Objectively speaking, its widespread application has always been in a gray area - lacking unified regulation, opaque reserve mechanisms, and blurry legal attributes, becoming key issues hindering institutional entry and mainstream adoption.

As a bellwether for global financial rules, the US "GENIUS Act" is undoubtedly a milestone. For the first time at the federal level, it comprehensively stipulates stablecoin definition, issuance qualifications, reserve mechanisms, and user rights. Key points include mandatory 1:1 reserve support, with all issuers required to maintain fiat currency reserves equal to the issued stablecoins, and users able to redeem their stablecoins at 1:1 at any time.

Issuance qualifications are limited to banks, licensed non-bank financial institutions, and compliant audited enterprises, with a broad applicable scope including corporate settlement stablecoins and consumer payment stablecoins. This means that stablecoin businesses that have long operated in the gray area will finally enter a "rule-based" institutional track, with particularly profound implications for enterprises like Circle, PayPal, and JPMorgan that are promoting stablecoin businesses.

As such, Circle, the only stablecoin issuer currently listed on US stocks, has been rising since its IPO on June 5, soaring from the issue price of $31 to a high of $263.45, an increase of over 100%, joining heavyweight players like Coinbase and Robinhood.

More notably, Circle's market value once approached $60 billion, equivalent to the total circulating market value of its issued USDC, undoubtedly marking the market's re-evaluation of the compliant stablecoin logic.

This also indicates that the imagination of "stablecoin compliance" is no longer limited to Web3 but is beginning to project into mainstream financial narratives. Regardless of its subsequent actual direction, this is a turning point for crypto assets to further enter the mainstream view and obtain a legal and compliant framework.

02 Hong Kong: Leading the Way with Licensing

Since publishing the "Policy Declaration on Hong Kong's Virtual Asset Development" on October 31, 2022, Hong Kong has been at the forefront of crypto regulation among major global jurisdictions.

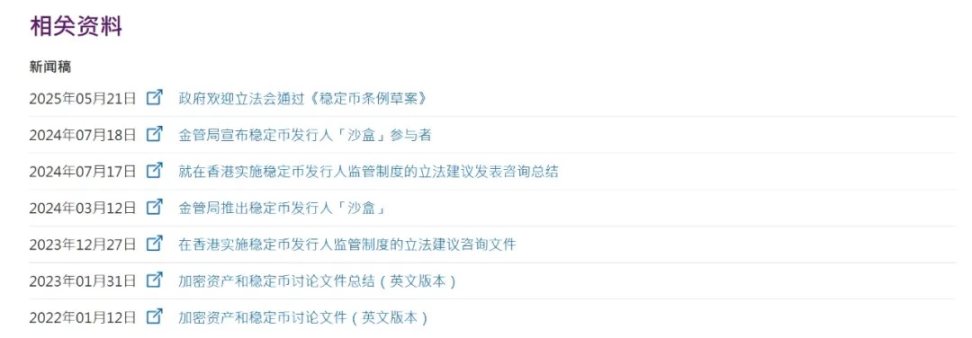

As early as January 2022, the Hong Kong Monetary Authority (HKMA) issued a discussion paper on crypto assets and stablecoins and invited stakeholder feedback. Early last year, it launched a stablecoin issuer "sandbox" to understand the business models of institutions planning to issue fiat stablecoins in Hong Kong.

The latest Hong Kong Stablecoin Regulation will take effect on August 1, when the HKMA will begin accepting license applications. Currently, the HKMA has initiated market consultation on specific guidelines for implementing the Stablecoin Regulation.

Source: Hong Kong Monetary Authority

Based on currently disclosed information, the key institutional design adheres to the principle of "same activity, same risk, same regulation", including requirements for issuers to apply for stablecoin issuance licenses from the HKMA, maintain a local registered entity, ensure assets are fully pegged to the total issuance, and reserve assets should be high-liquidity fiat or short-term government bonds.

It can be said that the regulatory dimensions and mechanisms are largely similar to those of the United States. Notably, the Hong Kong regulatory system applies to stablecoins pegged to major currencies like USD and HKD, with the policy's core aim being to provide a stable clearing and settlement medium for Web3 finance while attracting more institutions to establish stablecoin businesses in the city.

As an international financial center, Hong Kong has always been actively exploring paths of financial innovation, and the stablecoin market is somewhat within Hong Kong's comfort zone - encompassing rich financial service formats, with years of accumulation and experience, mature risk control systems, comprehensive trading infrastructure, and a massive customer base.

This makes Hong Kong more focused on flexible implementation and international alignment, attracting more institutions to use Hong Kong as a springboard to explore stablecoin clearing and issuance paths in the Asian market. Currently, local heavyweight players like HashKey and OSL are reportedly preparing or planning for stablecoin licensing, becoming an important entry point for observing Hong Kong's crypto compliance and financial infrastructure integration.

03 Multi-Point Blossoming in EU, South Korea, and Others

Additionally, the EU's Markets in Crypto-Assets (MiCA) Regulation, effective in 2024, comprehensively covers crypto asset compliance, providing detailed classification of stablecoins, including Electronic Money Tokens (EMT) and Asset Reference Tokens (ART).

The former refers to stablecoins pegged to a single fiat currency, like Circle's EURC, while the latter refers to stablecoins pegged to a basket of assets, like the failed Libra type. EMT stablecoins require authorization from EU electronic money institutions, are subject to central bank supervision, must disclose reserve composition and operational mechanisms, and ensure user redemption rights. Circle's EURC is among the first products to benefit from MiCA implementation.

In South Korea, with significant Crypto influence, the ruling party of the new president Lee Jae-myung has proposed the "Digital Asset Basic Law", stipulating that Korean companies with at least 500 million won (about $370,000) in capital and ensuring refund guarantees through reserve funds can issue stablecoins.

Source: Cointelegraph

According to the Bank of Korea's data, stablecoin trading volume has surged, with the first quarter's trading volume of major US stablecoins at five major domestic exchanges (Upbit, Bithumb, Korbit, Coinone, and Gopax) reaching 57 trillion won (about $42 billion).

Recently, the Bank of Korea's senior deputy governor Ryu Sang-don also stated that introducing won-denominated stablecoins should be gradual, starting with the most strictly regulated commercial banks issuing won stablecoins before gradually opening to non-bank institutions.

Moreover, multiple major financial centers have historically issued local stablecoin frameworks or pilot projects:

The Monetary Authority of Singapore (MAS) proposed a stablecoin regulatory draft in 2023, emphasizing 1:1 reserves, transparent disclosure, and local operation requirements;

Abu Dhabi Global Market (ADGM) launched a stablecoin settlement pilot, attracting cross-border businesses such as PayPal and USDC;

Japan passed a new law allowing banks and trust companies to issue stablecoins;

Overall, European regulation focuses on protecting user rights and financial stability, while South Korea tends to explore in collaboration with local financial and technology giants. This signifies that the global stablecoin regulatory system is gradually moving towards unified standards and indicates that stablecoins are no longer in a gray area but are being viewed as a formal component of financial innovation, with their regulatory testing ground becoming an important capital policy tool for attracting Web3 projects.

Dialectically speaking, starting from 2025, whether it's crypto asset ETFs or stablecoins, a completely new regulatory cycle has become a clear watershed for Web3 and crypto industry development. Especially when compliance becomes the main theme of the next stage of stablecoin development, each country's exploration at the institutional level not only influences market patterns but also profoundly shapes the future infrastructure of Web3 finance.

It can be said that globally, stablecoins are experiencing a dramatic transformation from "wild expansion" to "institution-led", and the landscape reconstruction under this massive change is comprehensively unfolding with the implementation of regulations from various countries.