Now it's not easy to be a leek in the crypto!

Last night, BTC did a deep squat, dropping to 98,000 and then bouncing back to 106,500, exactly hitting the starting point of the big drop on June 20th. From the pattern, there's still some upside space, possibly touching the top of the descending channel at 108,500.

Communication+Q: 3806326575

Note that the month-end is approaching. Although the short-term pullback is fierce, the volume hasn't significantly followed.

Looking at ETH, although it continues to surge, the bullish momentum seems to be weakening. 2475 is a critical level, and in the short term, it may encounter resistance and fall back, entering a consolidation phase.

If it cannot break through 2475 during the day, the trend will likely oscillate within the range. Support is at 2414. If it breaks through 2475 with volume, consider following the trend. In the past few days, some altcoins have had a chance to bounce, with many directly surging 20%-30% in the last 48 hours.

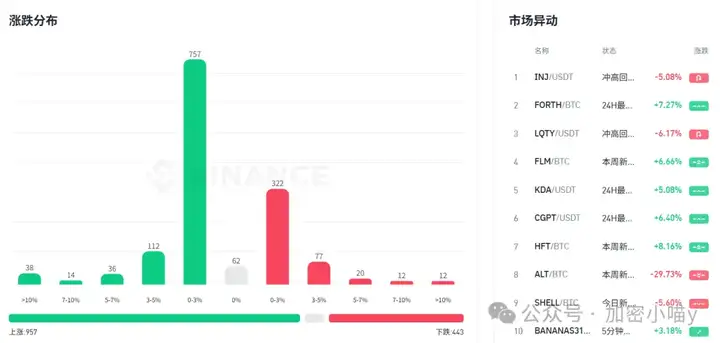

1. Meme Tribe: #WIF, Bananas31, #TUT are the most aggressive low-narrative coins, hold them or watch them fly.

2. Serious DeFi line: #UNI, #ETHFI also gave a significant rebound.

These days, while mainstream coins are consolidating, many small coins want to jump again - but remember not to be greedy, with high volatility, taking profits is the real strategy.

Today's Market Highlights:

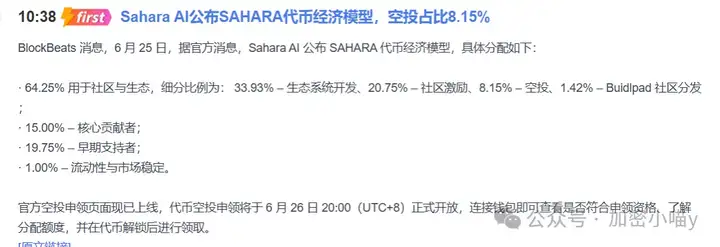

1. Sahara on BN: A domestic team's AI data base, with attractive narrative and liquidity buffs.

2. $SEI & APT Leading: Both carrying stablecoin narratives, with funds moving ahead. (Shared SEI's trend last week)

3. #NEWT Surging: Listed on Korean exchange, small market cap new listing effect, directly igniting.

I saw many people saying #Solami took off, and I realized I haven't touched SOL for a long time. Searching group messages, the earliest mention of this coin was at 6.9m. Feels like it's not the project's issue, but our crypto circle has been a bit slack recently.

On the SOL side, it's not just $Solami that's hot. $rfc has been causing a stir, saying they'll launch a new coin, not sure if it's riding the wave or has a real plan.

In fact, BSC has been getting more attention recently:

- $EGL1 seems to have a big brother vibe, now with a market cap of 77m, momentum is good;

- $U remains steady around 6m, not rising but the community is still passionate;

- $Uptop is my personal painful baghold, rushed in at opening and got completely trapped...

I tried to ride two new coin waves last night, currently at a loss, feeling like the skill of riding waves has been failing recently...

Okay, let's continue discussing the overall market situation

Overall, this wave of conflict has temporarily come to an end. BTC has had a large oscillation this week but is still holding around 106,000, with a trend similar to US stocks. The altcoins are miserable, with many coins dropping back to their original state without support. Because altcoins without liquidity mean no future, this rebound shows which projects are positive and worth watching, indicating the market and funds still remember them. Those that hit new lows every time should be abandoned early.

The market focus will return to tariff negotiations and rate cut expectations.

With only two weeks left before the final tariff negotiation, most haven't taken a stance, seemingly planning to make a move at the last moment. I expect mainstream countries won't make significant concessions. So next month might see another "Liberation Day Panic 2.0". However, the crypto market's resilience is increasing, and BTC is developing some safe-haven attributes.

On the other hand, the Federal Reserve is almost being cursed out by Trump. He's been calling out Powell daily. The Fed's internal divisions are growing, with Bowman and Goolsbee voicing support for a July rate cut. So if CPI and PCE don't rebound, a rate cut is likely, and once announced, the rate cut bull market will start.

Although the crypto market has rebounded recently, the overall crypto and stock performance is average. #sbet and #srm have returned to around $9, with Circle racing ahead to new highs, even exceeding USDC's market cap. This shows the "reserve coin" concept's hype cycle is shortening, and only those with strong fundamentals can truly break through. Circle has no corresponding coin, so funds are piling into stocks. Projects like OKB and BNB trying the reserve concept haven't seen much movement after news, indicating the positive effect is weakening.

However, long-term, projects supported by coin stocks or ETFs are much stronger in terms of funding channels and compliance, worth focusing on.

That's it for the article! If you're lost in the crypto world, consider joining my community to layout and harvest from market makers! Can join the group with WeChat+Q: 3806326575 or V: Mixm5688