The market, project, currency, and other information, opinions, and judgments mentioned in this report are for reference only and do not constitute any investment advice.

Written by 0xBrooker

The crypto market's structural forces, industry prospects, policies, US economic employment data (including the Federal Reserve's interest rate decision), capital supply, macroeconomic financial trends, and geopolitical conflicts collectively influence investor sentiment and determine BTC's short-term, medium-term, and long-term price trends. Among these, capital supply and geopolitical conflicts primarily impact short-term prices.

This week's BTC price trend is a typical game between internal structural forces and geopolitical conflicts.

Against the backdrop of neutral US economic and employment data, internal structural forces combined with continuous capital inflow pushed BTC to break through $110,000 again at the beginning of the week. The sudden escalation of the Israel-Iran conflict on June 13th heightened global risk-averse sentiment, causing a sudden drop in global stocks and BTC prices. Ultimately, BTC fell slightly by 0.18% for the week, with a volatility of 7.47%, closing with a doji candle on reduced volume.

Currently, the "soft landing" of the US economy and "inflation below expectations, rate cut in September" have been fully priced in. BTC prices have returned to the framework of "geopolitical conflicts intensify - risk-averse sentiment rises - risk asset prices decline".

BTC's short-term trend depends on the progress of "geopolitical conflicts". If conflicts escalate, risk assets, including BTC, will remain volatile or continue to decline; if conflicts ease, equity assets may gradually recover their losses.

Policies, Macroeconomic and Economic Data

Media reports suggest that Iran's nuclear technology is at a breakthrough point, potentially able to produce nuclear weapons in a short time if successful.

On June 12th, the UN Nuclear Technology Committee passed a resolution criticizing Iran for repeatedly failing to fulfill nuclear non-proliferation obligations since 2019, including lack of cooperation with IAEA and undeclared nuclear materials and activities.

On June 13th, Israel launched a large-scale airstrike on Iran, targeting nuclear facilities and military leadership, resulting in significant damage to Iranian nuclear facilities and the death of over 20 military leaders and 6 nuclear scientists.

On the evening of June 13th and morning of 14th, Iran launched a retaliatory action, firing approximately 150-200ballistic missiles in four waves targeting Israeli military targets, including the Kirya military headquarters in Tel Aviv.

Currently, the US has not directly participated in the conflict. On the 15th, the US and Russian presidents exchanged views via phone conference and believed the conflict should end. However, the conflict is expected to continue for several weeks.

The escalation of the Israel-Iran conflict caused a significant rise in oil prices, with Brent crude rising from $63 to a high of $76.26 per barrel, now retreating to $73.58. Simultaneously, gold prices rapidly approached historical highs.

The sharp increase in oil prices raised market concerns about potential delays in US interest rate cuts due to inflation, directly pushing US stocks lower.

In fact, apart from the Israel-Iran conflict, the important US economic and employment data released this week were slightly positive, sufficient to support a modest rise in US stocks.

On Wednesday, the US CPI data showed an unadjusted annual CPI rate of 2.4% in May, lower than the expected 2.5%. On Thursday, initial jobless claims for the week of June 7th were 248,000, slightly higher than the expected 240,000, with a PPI annual rate of 2.6%, meeting expectations. These data strengthened rate cut expectations. The one-year inflation rate expectation initial value on Friday was 5.1%, significantly lower than the expected 6.4%; the University of Michigan's consumer confidence index initial value was 60.5, far higher than the expected 53.5.

Due to relatively full pricing, these data only slightly pushed up the US dollar index, while the Israel-Iran conflict became the main market trading point.

After the conflict broke out, oil and gold prices surged, US stock indexes gave up their gains, and BTC fell sharply from $11,000 to around $10,000. Subsequently, with continuous inflows through the BTC Spot ETF channel, it rebounded to around $105,000 over the weekend, showing strong resilience.

BTC's short-term trend basically depends on the development of "geopolitical conflicts". The medium and long-term risks are relatively small.

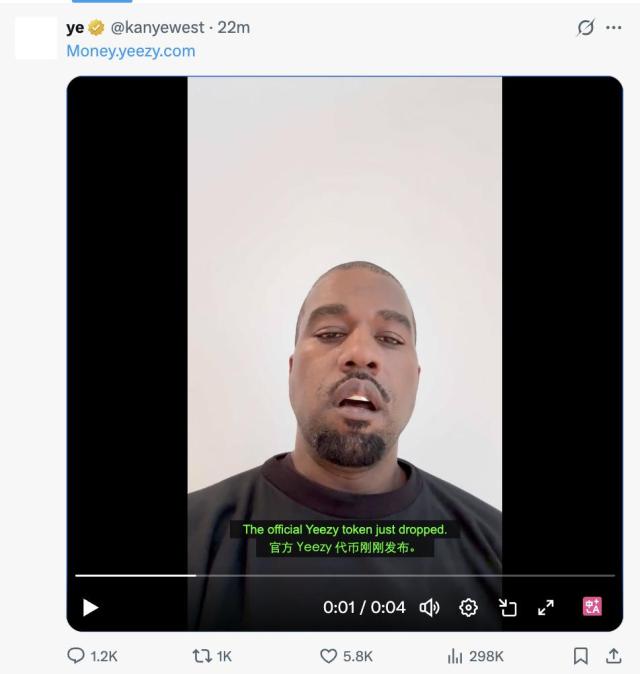

Crypto Market

This week, BTC opened at $105,784.41, closed at $105,599.25, with a slight weekly decline of -0.18% and a volatility of 7.47%, with reduced trading volume.

On Monday, BTC surged 4.27% to attack the $110,000 mark again, then hovered around this level for two days. As the Israel-Iran conflict suddenly escalated, it fell to a low of $102,746.01 on Friday before rebounding to around $105,000 and narrowly oscillating.

From a technical indicator perspective, BTC is still operating within the "Trump bottom", and on Friday, it again explored the support of the "first bull market uptrend line". Trading volume continued to shrink.

Contract open interest continued to decline, falling below $6.9 billion, with lending rates converging, indicating insufficient confidence among trading parties at historical highs and an increasing number of participants temporarily withdrawing due to geopolitical conflicts.

During this low trading period, more US companies are joining the game of accumulating BTC and other crypto assets. The famous MEME stock GME announced pricing for its private zero-coupon convertible preferred notes, increasing the fundraising scale from $1.75 billion to $2.25 billion. SharpLink Gaming announced on Friday the purchase of 176,270.69 ETH ($463 million), becoming the second-largest known holder after the Ethereum Foundation. However, both stocks experienced significant declines after the announcements.

Additionally, retail companies like Walmart and Amazon are considering launching USD-backed stablecoins to reduce payment friction, accelerate settlement speed, and lower costs associated with traditional financial channels.

Next week, the US Senate will conduct the final vote on the GENIUS Act (stablecoin bill).

Selling Pressure and Sales

The long and short holding structure is the basic support for internal structural forces in the crypto market. Since the market's major adjustment in March, long-term holders have again started accumulating, continuing this trend this week with approximately 32,000 BTC entering long-term holdings.

While long-term holders accumulate, short-term holders again became the source of sales during geopolitical conflicts, selling a total of 13,708 BTC this week. Overall, BTC transfers to exchanges continue to decline, indicating that the current holding structure is more inclined to collect and long-term hold, while the emotionally volatile short-term group remains at a low profit level (8%), not under significant pressure.

The crypto market's structural forces remain stable and strong, becoming the fundamental force supporting BTC's price and trend.

Capital Inflow and Outflow

Besides internal structural forces, capital inflow is also an external reason for BTC maintaining relative strength this week.

Stablecoin, BTC Spot ETF, and ETH Spot ETF Inflow Statistics (Weekly)

According to eMerge Engine data, the crypto market saw a total inflow of $3.227 billion this week, including $1.314 billion in stablecoins, $1.384 billion in BTC Spot ETF, and $530 million in ETH Spot ETF.

The BTC Spot ETF channel ended a two-week trend of minimal outflows, while the ETH Spot ETF channel saw its largest single-week inflow this year.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is 0.625, indicating an upward phase.

EMC Labs was established in April 2023 by crypto asset investors and data scientists. Focusing on blockchain industry research and crypto secondary market investment, with industrial foresight, insights, and data mining as core competencies, committed to participating in the booming blockchain industry through research and investment, and promoting blockchain and crypto assets for the benefit of humanity.

For more information, please visit: https://www.emc.fund