Since the "crypto art" breakthrough in 2021, Non-Fungible Tokens (NFTs) as unique digital assets on the blockchain have rapidly swept through the global market. In just four years, over 2 billion NFTs have been issued on mainstream blockchain networks, with the global market capitalization reaching billions of dollars.

However, the narrative of NFTs is quietly changing - it is transforming from a single digital collectible to a core asset with practical functions and widespread application scenarios. In this evolutionary path, the potential of NFTs continues to be explored, redefining the decentralized digital future.

Collectibles and Market Frenzy

The starting point of NFTs was a revolution in digital asset ownership. In the traditional internet era, digital content could be infinitely copied, but NFTs use blockchain technology to give digital works a unique identity authentication, making them scarce and ownership-based. This characteristic quickly ignited the passion of art, collection, and cultural creative markets.

More importantly, this stage began to nurture a new bottom-up IP shaping model. Traditional IP creation often relies on large media institutions and brand capital, while PFP projects gradually form globally influential digital IPs through decentralized community governance and consensus accumulation.

CryptoPunks in 2017 were among the first on-chain verifiable digital collectibles, followed by CryptoKitties, which sparked the market. By 2020, with the DeFi explosion bringing the cryptocurrency market to a new peak, NFTs also rapidly rose in this wave. The emergence of Bored Ape Yacht Club marked the craze of PFP-type NFTs, with trading volumes surging, and the market's pursuit of scarcity and uniqueness made NFTs a new financial star.

The prosperity of this stage mainly relied on market sentiment, consensus, and liquidity, with NFTs experiencing extremely high price volatility.

Rise of Functional NFTs

As the market gradually matures, the NFT narrative begins to move from single digital collectibles to functional applications, demonstrating richer value. First, ENS domains truly achieved large-scale implementation and scenario expansion. By mapping complex on-chain addresses to concise domain names, it realized decentralized identity authentication, promoting the popularization and standardization of on-chain identities.

Meanwhile, NFTs experienced a breakthrough in the gaming field. Stepn's in-game NFT props allowed players to truly own on-chain assets, and Axie Infinity's "play-to-earn" model further promoted the GameFi trend, enabling players to create economic benefits in the game, greatly driving NFT liquidity and value consensus.

The functional exploration of NFTs has also extended to offline scenarios, with ticket NFTs and membership systems achieving anti-counterfeiting traceability and rights transfer through on-chain verification mechanisms. Brand membership cards have also emerged in Web3 communities, giving holders unique social and rights experiences.

At the same time, PFP applications are no longer limited to avatar displays. They have gradually evolved into community identities and social symbols, supporting airdrops, community verification, and decentralized governance, with community-driven IP shaping beginning to show strong vitality.

More notably, the functionality of NFTs is no longer limited to the Ethereum network. The Ordinals protocol brought NFTs to the Bitcoin chain, achieving data storage through "inscriptions", bringing a new decentralized digital asset model to the Bitcoin ecosystem.

RWA and Real-World Asset Mapping

As the market continues to develop, the NFT narrative gradually shifts from digital collectibles to real-world asset mapping and ownership confirmation. The concept of RWA (Real World Assets) emerged, using NFT technology to map physical assets like real estate, luxury goods, and tickets to the chain, achieving decentralized ownership and trading. This transformation not only expands the application boundaries of NFTs but also promotes the deep integration of digital assets with the real world.

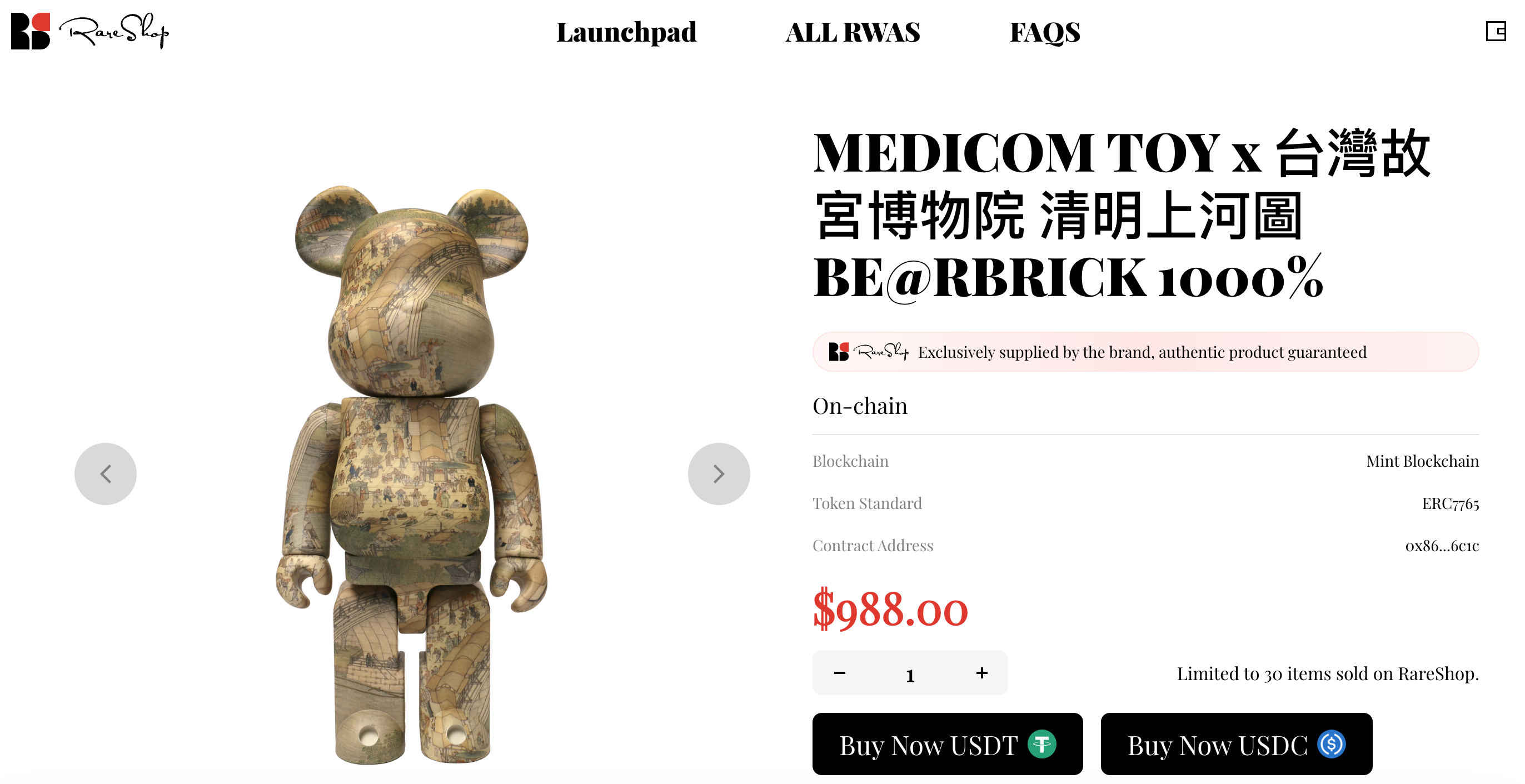

Traditional NFTs were mainly focused on digital art, collectibles, and virtual worlds, while the rise of RWA represents a new application mode: digitization of real-world assets. More and more projects are exploring how to use NFTs to register and trade physical products on-chain, breaking down traditional asset management barriers.

RareShop is the world's first RWA NFT commodity sales platform for consumers, promoting large-scale RWA NFT implementation through the innovative ERC-7765 asset protocol standard. RareShop not only supports on-chain ownership and trading but also provides rich interactive scenarios, including crypto payments, privacy protection, commodity pre-sales, gift giving, and physical delivery. Supported by the Mint Blockchain underlying technology, RareShop provides a one-stop Web3 digital solution for global brands and enterprises, accelerating the Web3 transformation of the physical economy.

The ERC-7765 asset protocol, proposed by the Mint Blockchain team to the Ethereum community, aims to establish industry standards, making RWA issuance and circulation more transparent and efficient. The protocol allows NFT holders to perform specific operations on-chain, such as exchanging real-world goods and services through on-chain credentials, achieving direct linking of on-chain assets with real-world assets.

New NFT Narrative and Future Development

The NFT narrative is undergoing profound transformation - evolving from static digital assets to decentralized smart assets. Meanwhile, cross-platform and cross-chain interoperability is becoming a key breakthrough point. Future NFTs will not just be static on-chain assets, but intelligent entities with self-interaction capabilities and cross-ecosystem liquidity.

Decentralized smart assets will become the main theme of the new stage, with the combination of AI Agent + NFT giving on-chain assets the ability to self-interact and execute smart contracts. For example, AI based on on-chain data can automatically adjust NFT value assessment, liquidity management, and even execute on-chain trading strategies, achieving truly intelligent asset management.

At the same time, cross-platform interoperability is rapidly advancing, breaking existing on-chain silos and achieving seamless circulation between multiple platforms and chains. In the future, NFT equipment in games will be able to be shared across different games, asset interconnection between trading markets will be more convenient, and asset liquidity and value capture capabilities will significantly improve. On-chain assets will no longer be limited to a single platform but will be able to freely move between various ecosystems.

NFTs are continuously evolving in a diversified direction, and future related applications will become increasingly rich. As underlying technology, NFTs will gradually become hidden in our daily experiences, becoming one of the infrastructures of the digital world. What will drive innovation and development is the actual value and application scenarios realized through technology.

Mint: NFT+Everything

Mint Blockchain is committed to expanding the diversified application scenarios of NFTs, building a comprehensive ecosystem covering digital life, constructing a multi-dimensional ecosystem centered on NFTs, and deeply integrating NFTs into various fields of life and digital innovation. The application scenarios of NFTs will no longer be limited to digital collections but will broadly penetrate payment, identity, social interaction, gaming, asset management, and other fields, demonstrating its infinite possibilities.

Mint Blockchain's vision and mission: Use NFTs to connect global users and AI Agents, allowing every individual in human society to freely own NFT assets, and develop NFTs into the most free value carrier in the crypto world!

This narrative about NFTs has only just begun.